Economist Joe Cortright provides his last analysis of cost estimates for the I-5 Bridge replacement project by the Interstate Bridge Replacement Program

Joe Cortright

The City Observatory

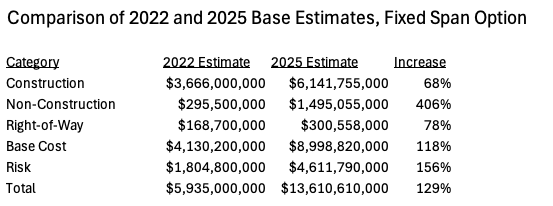

The cost of the proposed I-5 Bridge replacement project has ballooned from a maximum of $5.9 billion (2022) to a total of $13.6 billion, according to estimates obtained via public records request.

The Interstate Bridge Replacement Program (IBR) asserts that these increases are simply the result of inflation.

Unexpected inflation (that is higher inflation between 2022 and 2025 than was already built into the IBR cost estimate) accounts for only $1 billion (less than one-seventh) of the increased cost estimate for the project.

IBR estimates already had inflation built in, but assumed that costs would increase by about 2.0 percent per year.

In fact, according to data reported by IBR in 2025, annual inflation averaged about 6.98 percent per year between 2020 and 2025 (this is a composite of construction costs, engineering costs, and right-of-way costs weighted by IBR budget categories). In the aggregate, prices increased about 22 percent between the 2022 and 2025 estimates. At 2 percent per year, slightly more than a 6 percent three-year increase was already built into the IBR cost estimate.

Consequently the “excess inflation” – or inflationary increase beyond that already built into the IBR budget – was just 16 percent over the three years between the 2022 and 2025 forecasts.

On a budget of $5.9 billion, this excess inflation should have led to an increase in costs of a total of about $1 billion. But the cost estimate increased seven times faster – by more about $7.7 billion. This means that other factors, not higher than expected inflation since 2022, are responsible for the big increase.

IBR officials blame inflation

A favorite response of IBR officials has been to attribute the huge increase in IBR costs to a nationwide trend of increased highway construction costs. For example, at the January 22, 2026 Oregon Transportation Commission meeting, IBR Administrator Carley Francis testified:

“What folks have been reacting to very naturally is the change in costs over time that everyone has been experiencing across the country, and this program is not immune to that. So transportation projects nationwide have been experiencing that inflation construction to bids have been going higher.”

In short, IBR wants everyone to think that they are innocent victims of a nationwide trend. Conspicuously absent from these explanations is any mention of actual inflation rates. A close look at IBR’s own internal documents shows heightened construction cost inflation over the past three years alone accounts for only a small fraction of the project’s increased cost.

IBR estimates already included an allowance for inflation

In January of 2021, the IBR team described the methodology they used to construct their estimates and predicted construction cost inflation of 2.2 percent to 2.3 percent per year after 2020:

“As with the construction cost inflation factor, the program team used WSDOT’s Capital Development and Management (CPDM) historical and forecast cost indices for Preliminary Engineering (PE), Right-ofWay (RW) acquisition, and Construction activities (CN), using third-party data sources and statewide experience. The values used to escalate fiscal year (FY) 2012 dollars to FY 2020 are based on these indices by the three expenditure types, which include historical data through FY 2019. The overall effect of the three historical cost indices that were used to inflate from FY 2012 to FY 2020 equates to an average annual inflation rate from 2.0% to 2.2%, depending on which capital cost option is selected. Projected inflation rates by year beyond FY 2020 vary, averaging between 2.2% and 2.3% when applied to the expenditure schedules for the capital cost options.”

Actual inflation has been slightly higher that predicted

City Observatory obtained previously unreleased IBR analyses of construction cost inflation from a public records request. These data show that inflation over the past five years has been higher than IBR had predicted. The actual data use three different sub-indices: construction costs, preliminary engineering costs, and right-of-way costs. IBR reports the annual rate of increase of these costs from FY 2020 through FY 2025 as follows:

| Actual Rate of Change Between FY 2020 and 2025 | |||

| Annual | 2022-25 Change | Share | |

| Construction | 6.98% | 1.22 | 88.8% |

| Preliminary Engineering | 3.21% | 1.10 | 7.2% |

| Right-of-Way | 8.02% | 1.26 | 4.1% |

| Weighted Composite | 6.75% | 1.22 | |

| Inflation Predicted in 2022 Estimate (@2%) | |||

| Construction | 2.00% | 1.06 | 88.8% |

| Preliminary Engineering | 2.00% | 1.06 | 7.2% |

| Right-of-Way | 2.00% | 1.06 | 4.1% |

| Weighted Composite | 2.00% | 1.06 | |

| Difference | 4.75% | 0.16 | |

We have constructed a composite priced index by weighting each of the three cost sub-indices by the share of expenditures in each category. About 88 percent of IBR budget consists of construction costs, with the remainder divided between preliminary engineering and right-of-way costs.

The weighted composite rate of annual cost increases for the IBR project between Fiscal Years 2020 and 2025 was 6.75 percent. That means prices increased about 4.75 percent faster than IBR predicted (6.75 percent – 2.00 percent). Over the period 2022 to 2025 (i.e. between the earlier estimate and the current estimate), total costs increased by about 22 percent (three years at 6.98 percent), as opposed to the implied forecast of increased costs of about 6 percent (three years at 2.0 percent). Based on the increased inflation (i.e. higher costs increases than already built into the project’s budget forecast), the 2025 cost estimate should be about 16 percent (22 percent minus 6 percent) higher than the 2022 cost estimate.

IBR’s vastly higher cost estimate is not explained by inflation

In fact, the cost estimate is vastly higher than can be explained by the excess inflation over that forecast in 2022. IBR’s new 2025 cost estimate is $13.6 billion, which is $7.7 billion higher (129 percent higher) than its 2022 estimate of $5.9 billion. If these cost increases were solely due to the unexpectedly higher inflation rate observed from 2022 through 2025, the total cost should be approximately $6.9 billion ($5.9 billion plus 16 percent). This analysis shows that only about $1 billion of the $7.7 billion increase in prices is due to unexpectedly high inflation between 2022 and 2025. Instead of being just 16 percent higher than the 2022 estimate, the 2025 estimate is actually 129 percent higher.

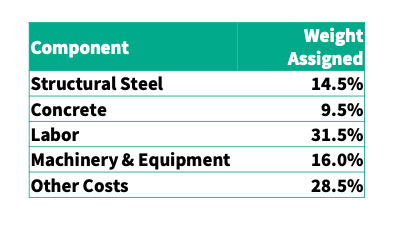

Consultant & staff costs are driving a higher costs

According to the documents obtained by City Observatory, “non-construction costs” which is the official euphemism for the cost of staff and consultants are rising about six times faster than construction costs. Overall, the total cost of the fixed span design has more than doubled, from about $6 billion to about $13.6 billion. But estimated construction costs have increased more slowly than overall costs. Construction costs are predicted to rise by about 68 percent over the earlier estimate. “Non-construction” costs – which are chiefly the costs for engineering consultants and staff time – are predicted to increase six times faster than actual construction costs, by 406 percent, compared to just 68 percent for construction. Higher non-construction costs constitute a $1.2 billion increase in total project costs.

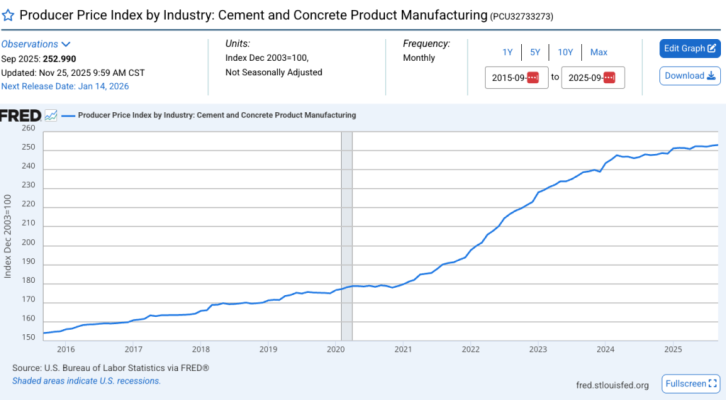

The cost of concrete and steel are stabilizing or actually declining

As we all know, the price of many construction materials rose sharply in the wake of the pandemic. But since then, markets have normalized. Material inflation in the construction sector did spike in the wake of the pandemic, but has eased (concrete) or reversed (steel). The cost of steel has fallen by about 20 percent since its peak in 2022.

The cost of concrete continues to rise and is up about 2 percent over the past 12 months.

Concrete and steel are the two most important non-labor commodities in the IBR budget, accounting for almost a quarter of direct project costs.

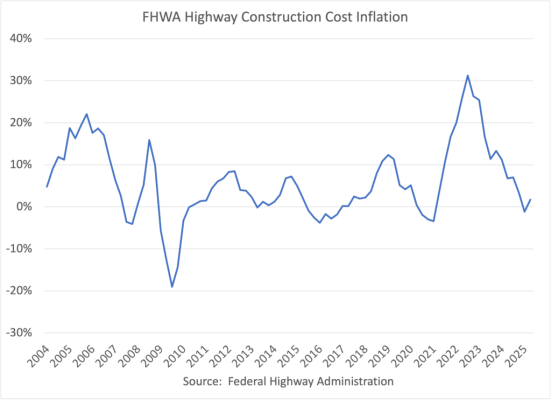

Construction cost inflation is ebbing

Data published by the Federal Highway Administration show that the rate of construction cost inflation which was heightened a few years ago, has subsided substantially. Construction cost inflation which peaked at nearly 30 percent per annum in 2022 has fallen sharply; the index is up just 1.7 percent over the last year (through the second quarter of 2025).

Author’s note: To simplify the exposition of this inflation analysis, we focus here on the mid-point of IBR’s cost estimates: $5.9 billion in 2022 and $13.6 billion in 2025. To be clear, the underlying estimates are actually ranges, which have changed from $5 to $7.5 billion (2022) to $12.2 to $17.7 billion (2025).

Also read:

- Expect delays on northbound I-205 in Vancouver for guardrail repairs March 4WSDOT will close the left lane of northbound I-205 in Vancouver from 10 a.m. to 2 p.m. March 4 for guardrail repairs between Exit 36 and the northbound I-5 on-ramp.

- Letter: IBR’s money pitBob Ortblad argues the Interstate Bridge Replacement Program is withholding a higher cost estimate while moving forward with limited funding and an unclear construction timeline.

- Full closure: I-5 southbound off-ramp to Exit 11 in north Clark County for maintenance March 3The southbound I-5 off-ramp to Exit 11 for SR 502/Battle Ground will close March 3 from 10 a.m. to 2 p.m. for maintenance work.

- Unnecessary, unaffordable add-ons likely to spell doom for the I-5 Bridge replacement projectThree Southwest Washington legislators argue the Interstate Bridge Replacement’s rising costs and added features threaten its viability.

- Opinion: A-pillars – The safety feature that increases crashesDoug Dahl explains how wider A-pillars designed to protect occupants in rollovers may also reduce visibility and increase crash risk for other road users.