The Department of Revenue announced that it had made a series of errors in tallying the state’s new capital gains tax and the recent departure of the billionaire to live in another state

Carleen Johnson

The Center Square Washington

The executive director of the Washington State Economic and Revenue Forecast Council says the overall revenue picture for the state is “pretty good.”

But the elephants in the room as Dave Reich began his revenue forecast presentation Wednesday morning were the state Department of Revenue’s Tuesday announcement that it had made a series of errors in tallying the state’s new capital gains tax and the recent departure of a billionaire to live in another state.

The errors, he said came from “a double booking of about $50 million in tax receipts from the capital gains tax.”

The other error Reich said was a coding issue at DOR.

“So we’ve adjusted our forecast down,” he explained.

A Washington State Republican Party news release took DOR to task for the errors.

“The series of errors has caused an overstatement of approximately $150 million for the current budget cycle that now needs to be cut from budgets,” the news release said.

Republicans contend the miscalculations are more proof of how volatile the “capital gains income tax scheme is.”

The tax was forecast to impact about 700 of the wealthiest Washingtonians, but even before implementation, opponents said many of those super-wealthy residents would leave the state to escape the tax.

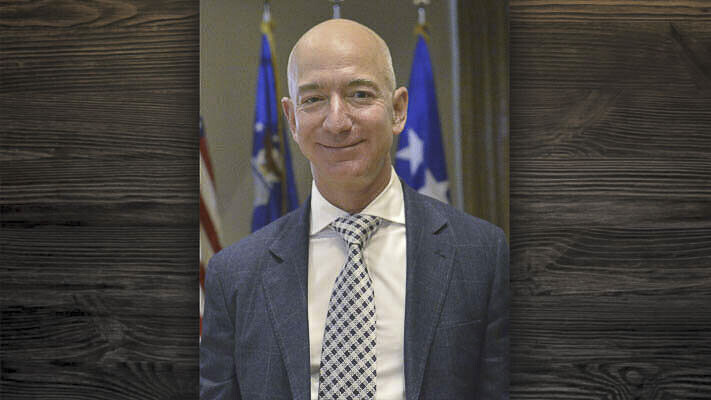

Amazon founder Jeff Bezos moved to Miami from Seattle last year, effectively escaping Washington state’s new capital gains tax of 7% on the sale or exchange of long-term capital assets such as stocks and bonds.

As reported by The Center Square, Bezos’ planned stock sale of some $2 billion worth of Amazon shares in 2024 would have cost him upwards of $610 million if he were still a Washington resident.

During Wednesday’s revenue update, The Center Square asked Reich about Bezos’s move and if the DOR is tracking how many of the roughly 700 people the capital gains tax applies to.

“A small number of taxpayers account for a significant share of the capital gains collections,” Reich responded.

He went on to say, “It’s very volatile, and there are a very small number of taxpayers who account for most of the revenue. We won’t talk about any individuals, though we assume there will be fluctuations because of the volatility of capital gains.”

Republican Sen. Lynda Wilson, R-Vancouver, who chairs the council, had a different take.

“We know that just the one individual who has left,” she said. “We would have received $600 million in capital gains if he sold the same amount of stock he sold every other year.”

The capital gains tax, she said, was likely a motivating factor.

“He didn’t last year because of capital gains,” Wilson said. “Now I’m assuming this right, but you put one and one together and you get two.”

Rep. April Berg, D-Mill Creek, also responded to the question about Bezos leaving.

“I’m going to push back here a bit,” she said. “Just assigning motive to why people are moving, sometimes one and one doesn’t make two.”

She referenced the controversy over whether the capital gains tax functions as income tax or an excise tax.

“I think a lot of people move for a variety of reasons, and we don’t have an income tax; we have an excise tax, and I don’t think that’s why anyone is leaving,” Berg said.

She went on to say, “Mr. Bezos does have family in Florida; he has businesses in Florida, and he has a new relationship, so I’m not sure our tax policy was as big of a factor as some people think it is. I think we’ll see a lot of changes and people moving, but it won’t be because of tax policy.”

Complicating matters is Initiative 2109 to the Legislature, which would repeal the capital gains tax. Enough signatures were gathered to qualify it for the ballot, and it has since been certified by the secretary of state.

Washington’s projected Near General Fund revenue collections for the 2023–25 state budget increased by $122 million to around $67 billion from the November 2023 projection, according to estimates by the Economic and Revenue Forecast Council on Wednesday.

This report was first published by The Center Square Washington.

Also read:

- WA House bill raids billions from pension plan while lawmakers also pass record tax hikesThe Washington State House passed House Bill 2034 to terminate LEOFF 1 and transfer $4.5 billion, drawing sharp opposition from House Republicans.

- Prairie High School presents ‘Roald Dahl’s Matilda the Musical’Prairie High School will stage Roald Dahl’s Matilda the Musical with performances scheduled from Feb. 27 through March 7.

- Clark County Joint Lobby closing March 9 to June for remodeling projectClark County’s Joint Lobby will close March 9 through June 2026 for remodeling, with property tax payments still due April 30.

- Opinion: Ecology’s war on private wellsNancy Churchill argues a Department of Ecology lawsuit and related legislation threaten long-held private well water rights across Washington state.

- VIDEO: Income tax bill passes WA Senate after hours of heated debateSenate Bill 6346, imposing a 9.9% tax on income over $1 million, passed the Washington Senate after hours of debate and multiple rejected amendments.

- Letter: After ignoring the students, Ridgefield School District outed themRob Anderson and a concerned Ridgefield parent allege Ridgefield School District repeatedly failed to redact student names in public records releases tied to a cheer coach investigation.

- ‘Absolutely good news’: WA financial outlook brightens as budget talks heat upA new forecast projects $827 million more in revenue for Washington’s current budget, offering relief as lawmakers finalize a supplemental spending plan.