Jeff Bezos plans to sell $5 billion worth of Amazon shares, avoiding a $343 million capital gains tax by ...

-

Jeff Bezos to save nearly $1B in capital gains taxes by not living in Washington

Jeff Bezos to save nearly $1B in capital gains taxes by not living in Washington

-

Opinion: Truth or Liias – Will an evil billionaire be the only one to benefit from I-2109?

Opinion: Truth or Liias – Will an evil billionaire be the only one to benefit from I-2109?

-

Battle begins over three revenue-cutting initiatives on the ballot this November

Battle begins over three revenue-cutting initiatives on the ballot this November

-

Jeff Bezos’ move to Miami looms large at WA revenue forecast presentation

Jeff Bezos’ move to Miami looms large at WA revenue forecast presentation

-

Jeff Bezos to save $600M selling stock in Florida, not Washington

Jeff Bezos to save $600M selling stock in Florida, not Washington

-

Opinion: Will Washington voters say no?

Opinion: Will Washington voters say no?

-

POLL: Do you believe things are likely to get much better or somewhat better for your household in 2024?

POLL: Do you believe things are likely to get much better or somewhat better for your household in 2024?

-

Poll: WA voters want both new spending and tax cuts

Poll: WA voters want both new spending and tax cuts

-

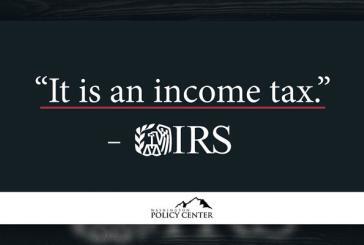

Opinion: United States Supreme Court to consider hearing Washington capital gains tax lawsuit during Friday conference

Opinion: United States Supreme Court to consider hearing Washington capital gains tax lawsuit during Friday conference

-

Let’s Go Washington submits 857K signatures to repeal capital gains tax, ban new income tax

Let’s Go Washington submits 857K signatures to repeal capital gains tax, ban new income tax