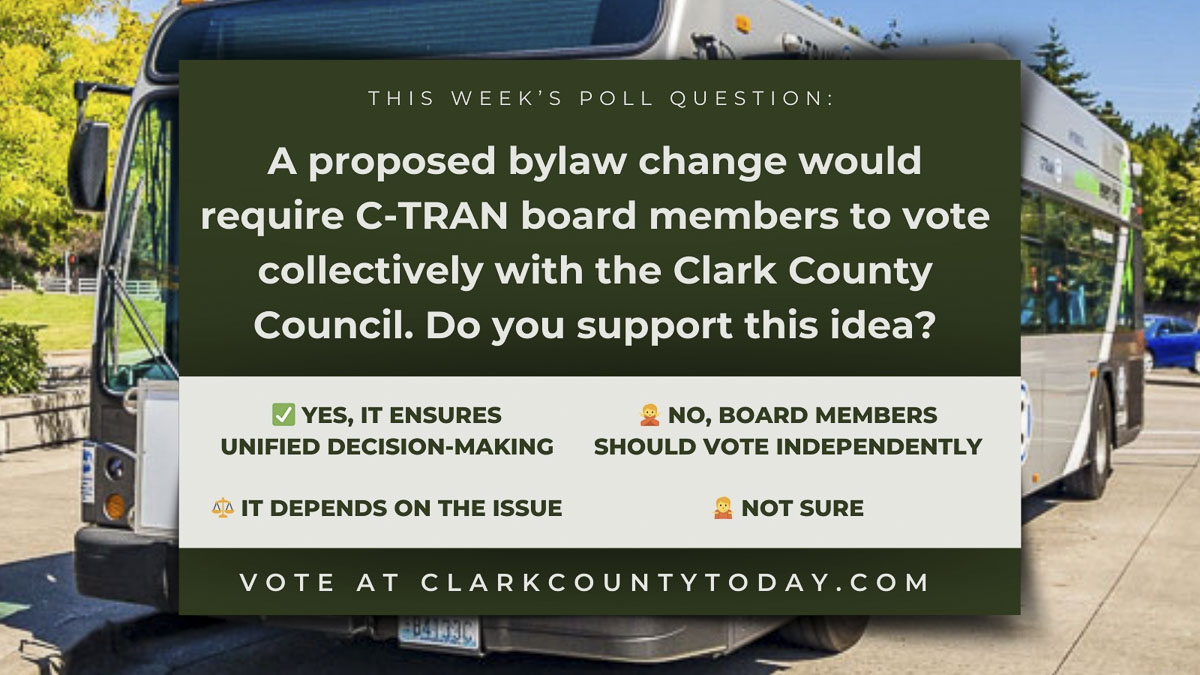

This week’s poll dives into a major debate surrounding the C-TRAN Board of Directors. Clark County Council recently removed Michelle Belkot from the board after she refused to align with the council’s stance on light rail funding. Now, a proposed bylaw change could require board members to vote collectively with the council, potentially limiting independent decision-making. Supporters argue that a unified vote ensures consistency and accountability, while critics say it strips board members of the ability to represent their constituents. What do you think? Should C-TRAN board members be required to vote as a bloc, or should they maintain their independence? Cast your vote and let us know your thoughts!

More info:

Michelle Belkot speaks out after Clark County Council kicks her off C-TRAN board

Clark County Council removed Michelle Belkot from the C-TRAN Board of Directors after she opposed funding light rail operations and maintenance.

Read more

Also read:

- Opinion: Many important decisions looming as the 2026 session nears the endRep. John Ley outlines budget concerns, energy policy debates and several tax proposals as the 2026 legislative session approaches its final days.

- Opinion: 106 striking workers already using unemployment insurance benefitsA Washington Policy Center analyst says the state’s new law allowing striking workers to collect unemployment benefits is already affecting the UI system.

- POLL: Who should have the primary say in decisions about a student’s gender identity at school?Clark County Today is asking readers who should have the primary role in decisions about a student’s gender identity at school.

- Opinion: Study shows 2025’s record tax increases reduce Washington’s GDP growth and worker payTodd Myers writes that a new economic analysis projects Washington’s 2025 tax increases will slow GDP growth and reduce wages over the next several years.

- Letter: Facts aren’t politicalBrian Kendall writes that disagreements about the LEOFF 1 pension debate should begin with accurate facts rather than misinformation.