The battle over Proposition 22 is a litmus test for similar legislation passed in Washington in 2022

Mark Harmsworth

Washington Policy Center

California has faced a public backlash over Assembly Bill 5 (AB5) that took effect January 1, 2020 classifying freelance workers as employees. AB5 effects job categories such as truck drivers, hairdressers, rideshare drivers and one of the most vocal groups, journalists. By changing the definition of a freelance worker, AB5 prevents an independent worker from working part-time or on a temporary contract basis. Under AB5, Journalists, as an example, can no longer write and submit work to different publishers; they must work for one exclusively.

In an attempt to overturn AB5, voters overwhelmingly supported Proposition 22 which passed 58-42 in November 2020.

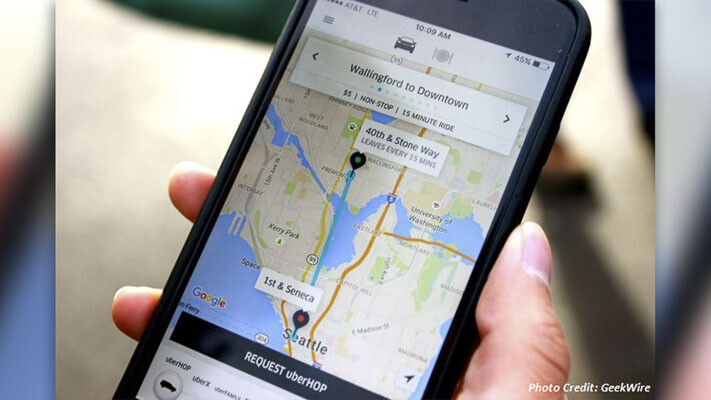

In 2021, a California judge ruled Proposition 22 was unconstitutional in response to a lawsuit filed by the labor union Services Employees International Union (SEIU). In the last few weeks, the First District Court of Appeals overruled the lower court allowing ride-sharing apps Uber and Lyft to treat drivers as contractors instead of full-time employees again.

The battle over Proposition 22 is a litmus test for similar legislation passed in Washington in 2022. House Bill 2076 (HB 2076) puts restrictions on Transportation Network Company (TNC) workers on when and how they work.

Proponents of the legislation say that it gives the temporary worker the same protections and rights as a full-time employee has today. However, that’s not how it turned out in California. Hundreds of thousands of jobs have been eliminated as a result of AB5 becoming law. Many workers don’t want or need full-time employment and the government should not be deciding what jobs they can and cannot accept.

The reinstatement of the voter approved Proposition 22 is an interesting turn of events and may have a positive effect on the TNC drivers and riders in Washington State should something similar pass here.

Mark Harmsworth is the director of the Small Business Center at the Washington Policy Center.

Also read:

- Opinion: Many important decisions looming as the 2026 session nears the endRep. John Ley outlines budget concerns, energy policy debates and several tax proposals as the 2026 legislative session approaches its final days.

- Opinion: 106 striking workers already using unemployment insurance benefitsA Washington Policy Center analyst says the state’s new law allowing striking workers to collect unemployment benefits is already affecting the UI system.

- POLL: Who should have the primary say in decisions about a student’s gender identity at school?Clark County Today is asking readers who should have the primary role in decisions about a student’s gender identity at school.

- Opinion: Study shows 2025’s record tax increases reduce Washington’s GDP growth and worker payTodd Myers writes that a new economic analysis projects Washington’s 2025 tax increases will slow GDP growth and reduce wages over the next several years.

- Letter: Facts aren’t politicalBrian Kendall writes that disagreements about the LEOFF 1 pension debate should begin with accurate facts rather than misinformation.