Unknown tax increases and unknown list of projects in House transportation proposal 24 hours prior to hearing

Washington House Transportation Committee Chairman Jake Fey (Democrat, 27th District), has introduced a “title only” bill for a possible increase in the gas tax, car registration fees, and more. It was introduced on March 28 and is scheduled for a public hearing at 9 a.m. on Thursday (April 1).

This essentially blank bill is sponsored by seven Democratic members of the House Transportation Committee. Based on the limited text, it appears to many observers that this bill will eventually transform into a major transportation tax increase proposal.

The Washington Policy Center (WPC) shared information on the title-only bill, reminding citizens and the legislature that bipartisan bills were introduced this session to prohibit title-only bills. Neither received a public hearing.

The WPC shared: “While we wait to see the real text of HB 1564, lawmakers may want to remember what happened the last time they used a Title Only bill to increase taxes. That 2019 bank tax proposal was ruled unconstitutional by trial court and is set to receive oral arguments before the state Supreme Court on May 25, 2021.”

Citizens might wonder how they can offer comments to the legislature, one way or another, on a bill where there are no specific details 24 hours prior to the hearing?

“This is a transportation revenue package that has been discussed since before the session began,” said Rep. Andrew Barkis (Republican, 2nd District), who sits on the House Transportation Committee. “We’ve been waiting to find out what it is, what the costs are going to be; everything about it. And it shows up as a title-only bill with no specifics.”

“My concern is we’re going to try to do this with only four weeks left in session,” said Barkis.

Barkis reported that, normally, there is a great deal of discussion about a transportation package over several years. What needs to be done and how to raise the revenues are the focus of the extended dialogue. That hasn’t happened this time.

The state hasn’t finished spending the funds raised and allocated from the 2015 Connecting Washington gas tax increase. It was a 16-year, $16 billion transportation package. At the time it was the largest in state history. All the funds raised in that package have not yet been expended.

Last week, the house and senate released their budget proposals on transportation, allocating between $9 billion and $11.7 billion of existing tax revenues.

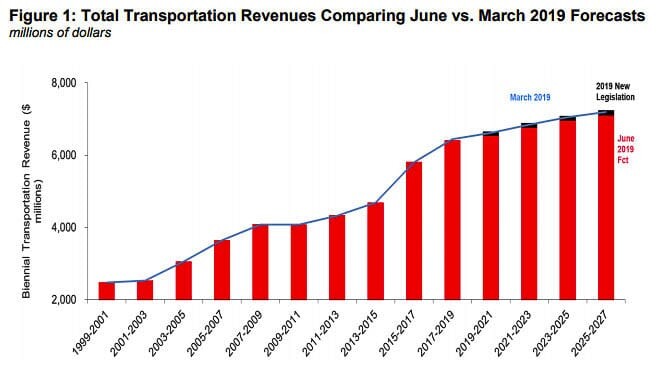

“Last year, transportation was in a terrible fiscal position due to revenue losses from the COVID pandemic, the pending I-976 case, and the need to fund fish passages,” said Rep. Fey. “We are in a much better position today after the state Supreme Court rejected I-976 and the federal stimulus provided $800 million in transportation funding.”

Shortly after the legislature began its current session, there was talk of a $26 billion transportation package. The 16 year proposal included an 18 cent per gallon gas tax with an automatic inflation adjustment. That proposal included carbon taxes and other tax increases including vehicle weight fees and car tab fees.

Included in the list of projects at the time, was funding for a replacement Interstate Bridge.

Rep. Ed Orcutt (Republican, 20th District) had said he was unable to support the January proposal.

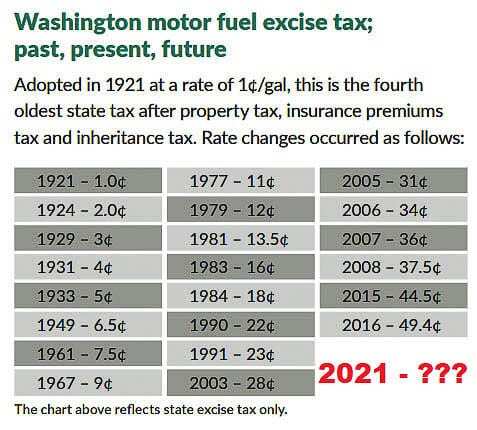

“There are many things with which I am concerned regarding the proposal,’’ Orcutt said. “To begin with, it includes an 18-cent-per-gallon increase in the gas tax – then would automatically inflate by the provision indexing it to inflation. Since 2003, the gas tax has already more than doubled from 23 cents to 49.4 cents per gallon. This 18-cent-per-gallon increase alone is almost as much as the entire federal gas tax!”

The Washington Farm Bureau came out in opposition to the January proposal. “Can you afford to spend $1.00 per gallon in TAXES at the pump? House Democrats have proposed a $26 Billion transportation package that includes 28 individual fees! This will be detrimental to agriculture, leaving farmers pockets empty and their communities hungry. Please explain to us how this is a #OneWashington approach? It’s not.”

Barkis reminded citizens that the state received a first round of federal money in 2020. It not only contained funding specific to fighting the virus and for the healthcare system, but there was also money for schools and businesses and to help transit.

The second round of federal funds is different according to Barkis. He says the legislature must appropriate it, as it has restrictions and conditions. The federal transportation funds are a backstop against revenue shortfalls caused by COVID. Those include lower gas tax revenues, lower tolls, and lower fares on the state ferry system.

Many legislators have suggested using the latest round of federal funds for much-needed, one time fixes to projects like repairing roads and bridges, and addressing the fish culvert issue mandated by the state Supreme Court.

“The operating budget has plenty of money,” said Barkis. “There is so much money flowing into the state, we don’t need to be talking about more (tax) money.”

Clark County Today reached out to Rep. Sharon Wylie (Democrat, 49th District) and one of the bill’s sponsors. She did not respond to questions seeking details of what might be included in the title-only bill or how citizens were expected to offer input on a title-only bill.

The text of the bill reads.

AN ACT Relating to transportation spending; and creating a new section.

BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF WASHINGTON:

NEW SECTION. Sec. 1. Additive transportation funding is hereby adopted and, subject to the provisions set forth, the several amounts specified, or as much thereof as may be necessary to accomplish the purposes designated, are hereby appropriated from the several accounts and funds named to the designated state agencies and offices for employee compensation and other expenses, for capital projects, and for other specified purposes for the period ending June 30, 2023.