Rep. Ed Orcutt: ‘This 18 cent per gallon increase alone is almost as much as the entire federal gas tax’

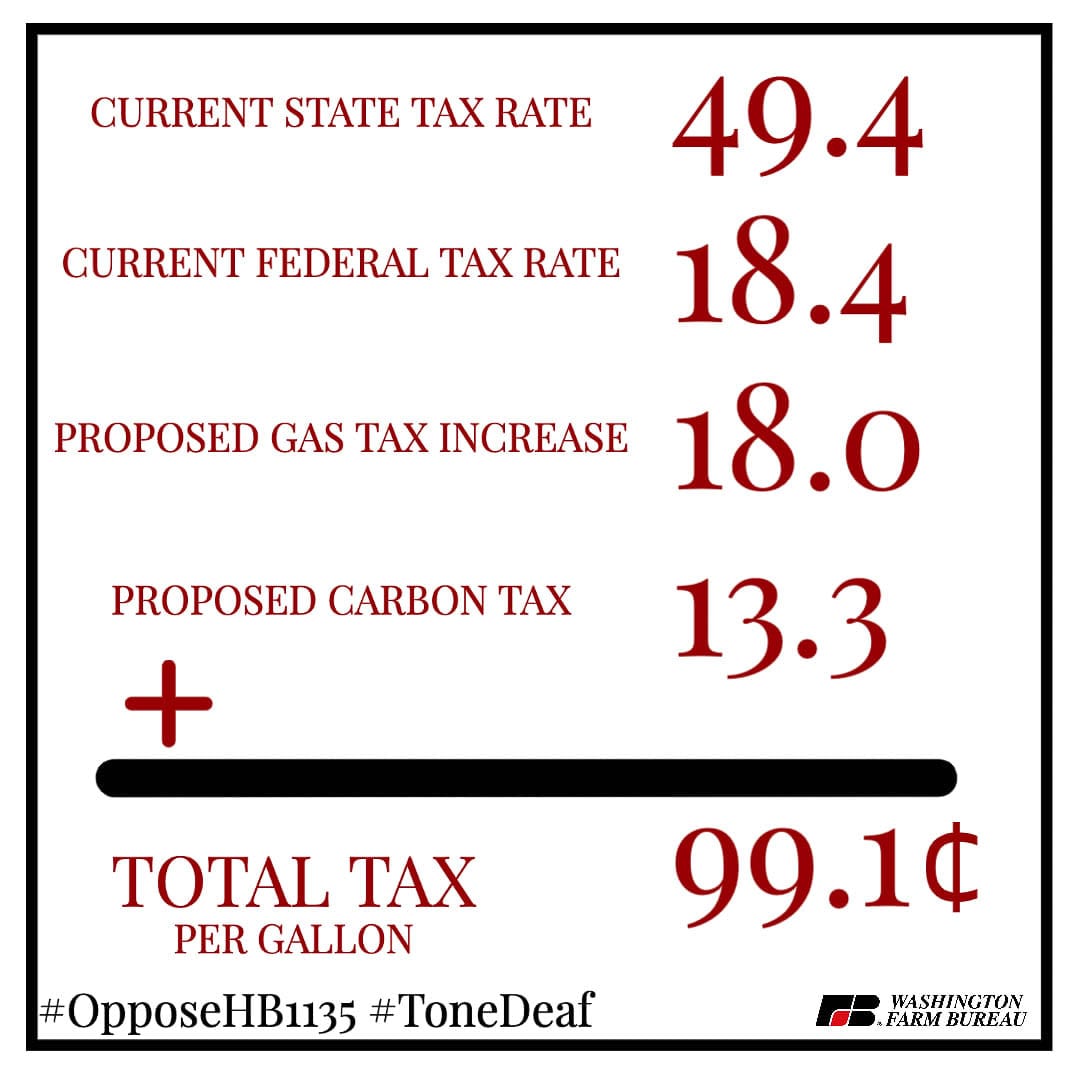

Washington state leaders in the House are proposing the largest increase in gas taxes in state history as part of a $26 billion transportation package. The 16-year package includes an automatic inflation adjustment, raising the gas tax to nearly $1 per gallon. The proposal includes carbon taxes and other tax increases including vehicle weight fees and car tab fees.

“Our proposal is much more substantial than any in state history because the needs and challenges are so much bigger,” said Transportation Chair Jake Fey (Democrat, 27th District). “Those needs include long-overdue investments in preserving and maintaining our current transportation system, help for frontline communities, and carbon reduction to fight climate change.”

The announced transportation package proposal drew immediate criticism from Republican lawmakers.

Sen. Ann Rivers (Republican, 18th District) responded to Clark County Today via email, stressing that the proposal was just the beginning of a conversation.

“I think that Representative Fey deserves credit for putting something out to get the conversation going but I am gravely concerned about both the project list and the funding mechanisms. As always, the introduction of a bill merely indicates the beginning of a conversation, in earnest … not the final outcome.”

Sen. Lynda Wilson (Republican, 17th District) also responded to a request for comment about the proposal. Wilson questioned whether Democrats had taken the time to gauge the thoughts of Washington residents before compiling the proposal.

“I was in office when the ‘Connecting Washington’ package of 2015 was assembled and refined and adopted. Although I was a no, it won a strong bipartisan vote, in part because it reflected a great deal of public input from all corners of the state. It’s not clear to me that the House Democrats behind this new proposal went to the same effort. Did they go into districts served by Republican legislators, to learn about their transportation needs?

“We do need to look at funding for maintenance and preservation, and the fish-passage issue, and the Interstate 5 bridge, but the gas tax is among the most regressive taxes in our state,” Sen. Wilson said. “I don’t know how my colleagues across the aisle can complain about how Washington’s tax system is so regressive then introduce a proposal that would make it even more regressive. Let’s also remember that families and employers are still trying to get through a pandemic, and the last thing they need is more financial pressure from tax increases of any kind.”

Rep. Vicki Kraft (Republican, 17th District) expressed strong opposition in her response to the proposed transportation package and its tax increases. “Any tax on the people, especially at a time like this where so many have experienced serious financial challenges over the past year, proves the Democrat majority in Olympia is completely out of touch with the realities Washingtonians are facing now. This tax will raise the price of gas to 85.4 cents per gallon and if carbon fees are added will cost $1 per gallon.

“It’s clear to me this bill will punish drivers who have vehicles using gasoline,’’ Kraft said. “Ultimately, this furthers the agenda of the Democrat majority in Olympia to get people out of their cars and depend instead on public transit or rail. Note, the recent Seattle Times article yesterday even quoted Rep. Wylie who said about the current Columbia River I-5 bridge replacement, “a new structure should be adaptable to rail use.” I would argue, the people do not need any new taxes, the people should be able to drive the vehicle of their choice, and we need to keep it affordable for them to do so.”

Like Kraft, Rep. Ed Orcutt (Republican, 20th District) said he is unable to support the proposal.

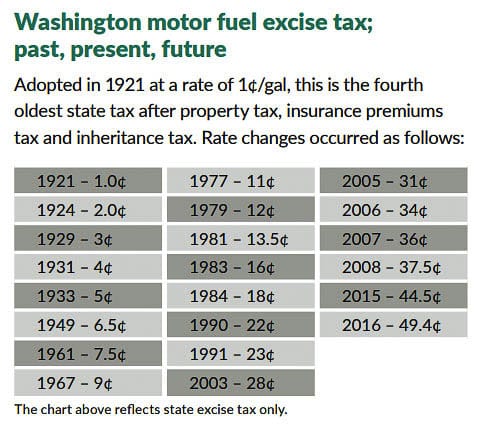

“There are many things with which I am concerned regarding the proposal,’’ Orcutt said. “To begin with, it includes an 18 cent per gallon increase in the gas tax – then would automatically inflate by the provision indexing it to inflation. Since 2003, the gas tax has already more than doubled from 23 cents to 49.4 cents per gallon. This 18 cent per gallon increase alone is almost as much as the entire federal gas tax!

“Another concern is that weight fees on passenger vehicles – first created in 2005, then increased in 2015, with another rise already scheduled for 2022 – will go up yet again,’’ Orcutt said. “A little over a year since voters demanded vehicle license fees drop to $30 from $60 or more, he is proposing to increase them rather than to follow the will of the voters and lower them.

“Next, diesel taxes and weight fees on trucks will rise as well. This will lead to higher costs of delivery of products — and inflate the purchase price of almost everything we buy. And, to add to it all, they intend to pass a carbon tax that will also drive up the underlying (pre-tax) cost of fuel. Higher direct taxes plus added hidden taxes both of which rise over time.

“The proposed gas tax increase alone is greater than the entirety of any single tax package in the past – then everything else is added on top of that,’’ Orcutt said. “It will devastate the budgets of those who drive low or moderate fuel efficiency vehicles – especially those who drive a lot of miles – but it also will add cost to all areas of family budgets, not just fuel. I am very concerned about this proposal and the impact it will have on families – and the economy. For the above reasons, I am unable to support the proposal.”

Of interest to Southwest Washington citizens is the proposed expenditure of $1 billion for the Interstate Bridge Replacement Project (IBRP). This was the only transportation project specifically mentioned in the press briefing distributed this week. Furthermore, there are no details on what a replacement bridge will look like, including the cost.

The IBRP team has only shared that if the prior proposal were built, it would cost roughly $2 billion more than the previous proposal. The Bi-State Legislative Committee was briefed in Nov. that there was a funding shortage of $1.8 to $2.3 billion. Fey is a member of the joint state legislative committee.

At the time, Oregon Sen. Lee Beyer (Democrat, 6th District) said: “We may not get a transportation package. But in order to inform people about what we might be looking for, or a state contribution for this project, it would be helpful to have that. If 450 (million) is no longer the right number … it would be helpful to me to know what that (higher number) is.”

Staff responded by restating it is a conceptual finance plan based on the old Columbia River Crossing (CRC). “The conceptual finance plan we have here indicates that each state would need to provide between $750 million to $1 billion of funds to construct a program unless other additional sources of funding are identified,” said Ray Maybe of the IBRP staff.

Several lawmakers participated in a press conference on Tuesday (Jan. 19), to talk about the details of the proposal, which is separate from the two-year transportation budget. They say priorities in the plan include maintenance and preservation, investing in frontline communities, supporting economic recovery, aggressive carbon reduction, and living up to commitments, including the restoration of fish passages.

”This is a high-water mark,” said Fey. “This is the direction the House wants to go.”

“We’re proposing $6.7 billion in new road-related investments, $1 billion for the Interstate Replacement Bridge connecting Washington and Oregon, and fully funding fish passages,” said Rep. Sharon Wylie (Democrat, 49th District). “There are also significant investments to reduce carbon. We do so using a wide range of strategies, including alternative fuels, the electrification of vehicle fleets, and increased spending for multi-modal services such as transit and special needs transportation along with bike and pedestrian projects.”

The Washington Farm Bureau came out in opposition to the bill. “Can you afford to spend $1.00 per gallon in TAXES at the pump? House Democrats have proposed a $26 Billion transportation package that includes 28 individual fees! This will be detrimental to agriculture, leaving farmers pockets empty and their communities hungry. Please explain to us how this is a #OneWashington approach? It’s not.”

The House proposal is unique in that it raises new revenue without new borrowing through bonds, saving billions of taxpayer dollars in interest costs. One aspect of this move is that it only requires a simple majority vote in the legislature, whereas bonding the proposal would require a supermajority, according to one report.

“We heard in our listening sessions that stakeholders wanted transparency and a clear connection to transportation investments,” said Rep. Vandana Slatter (Democrat, 48th District). “A good example is the carbon fee, with all of those revenues dedicated to multimodal transportation along with carbon reduction and electrification investments. This will give people more transportation choices while moving our state toward a green transportation future.”

Another connection between revenue and investments is how indexing the fuel tax to the Consumer Price Index will pay for the increased costs of preservation and maintenance according to the proposal.

The Washington Policy Center reports the proposed fee on carbon dioxide emissions of $15 per ton, passed on to consumers, would add another 15 cents per gallon. The fee would increase to $20 per a ton next biennium and $25 per ton in 2025-25, adding more to the consumer cost of gasoline.

According to the press release, the 18 cent gas tax increase, indexed to inflation, would raise $16.7 billion. The carbon tax would raise $7.5 billion. The increased passenger vehicle weight fee would raise $527 million, the 3 cent diesel tax increase $386 million, car registration fees $300 million, and driver’s license fees another $228 million.

On the spending side, $4.6 billion is allocated for maintenance and preservation, $3.5 billion for fish culverts, $6.7 billion for state and local projects, $1 billion for the state ferry system, $582 million for “crab preservation programs,” and $828 million for TIB (Transportation Improvement Board) programs.

Under the broad category of “carbon reduction initiatives,” the proposal allocates $8.2 billion. The largest of which is $2.5 billion for undefined “carbon reduction investments.” Included are $569 million for the state ferry system (plus the $1 billion above), $864 million for Amtrak Cascades, plus nearly $1.6 billion in various transit related projects. An additional $585 million is allocated for bike and pedestrian projects. A separate $960 million allocation is for special needs transit.

Overall, of the $25.8 billion in spending, transit appears to be the biggest beneficiary. $6.22 billion or 23 percent of the package appears to be spending on mass transit, bikes and pedestrian, state ferries, and rail. Fish culverts get 13.5 percent of the funding.

The House Transportation Committee’s top-ranking Republican member, Rep. Andrew Barkis (2nd District) said he opposes the gas tax increase. He said the state should stick to maintenance and finish the road projects approved during the last decade.

In 2015, the legislature passed a 16-year, $16 billion transportation package. At the time it was the largest in state history. All the funds raised in that package have not yet been expended. The current proposed package is more than 60 percent larger.

A bill number has not yet been assigned to the proposal. Senate Democrats are expected to release their own proposal as early as next week, according to the Washington Policy Center.

Interested citizens can watch the press conference here.

Clark County Today Editor Ken Vance contributed to this report.