Vancouver lawmaker offered her about the so-called ‘wealth tax’ proposed today by Democrats in the Senate and House of Representatives

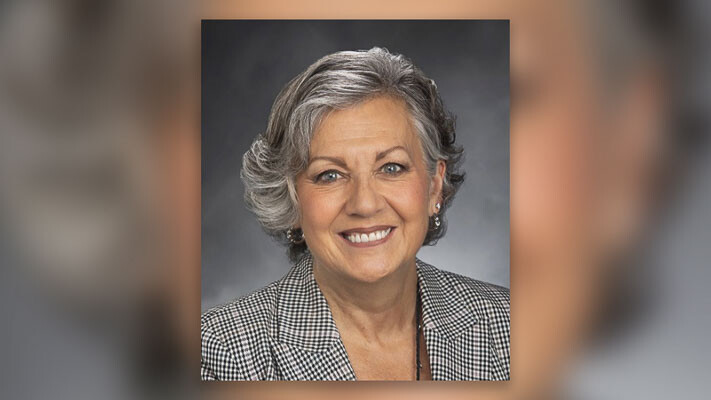

OLYMPIA – The budget leader for the state’s Senate Republicans isn’t buying the idea that Washington needs to slap another tax on residents who are financially successful. Sen. Lynda Wilson, R-Vancouver, offered these remarks about the so-called “wealth tax” proposed today by Democrats in the Senate and House of Representatives:

“On the surface this may have a Robin Hood kind of appeal, but that’s just not enough to make it a good idea. The sponsors know this is constitutionally questionable but are charging ahead anyway. It’s how the state income tax was adopted: push the tax through and cross your fingers that the judicial branch will ultimately come to your rescue. We need less legislating from the bench and more listening to the people.

“The ‘wealth tax’ didn’t make the list of tax options recently recommended to the Legislature by the bipartisan Tax Structure Work Group. You wonder why the Democratic chair of that work group decided to introduce the Senate version of this bill, even though her colleagues on the work group decided the idea wasn’t worth further consideration.

“State government has 6 billion dollars in reserve. Maintaining the programs and services in the current budget will cost 1.5 billion. A lot of good can be done with even a portion of what’s left. The Robin Hood angle falls apart completely when you see the revenue from this tax is aimed at growing government, with no promise of any real tax relief. And why talk about new taxes when the focus should be on using the existing revenue wisely?

“These bills repeat the Democrats’ myth that Washington has the most regressive tax system in the nation. Let’s keep in mind these Democrats just last year refused to join with Republicans on two pieces of progressive tax reform – one to lower the state sales tax, the second being my bill to offer a property-tax exemption that would have benefited owners of lower-value property more. At the same time they have created new laws that increase costs related to driving and energy, both of which hit lower-income people harder. If the Democrats truly want to help people at lower income levels, they should stop supporting regressive taxes and fees, and lower or eliminate the ones they’ve created. A ‘wealth tax’ doesn’t do any of that.”

Also read:

- Opinion: Interstate Bridge replacement – the forever projectJoe Cortright argues the Interstate Bridge Replacement Project could bring tolling and traffic disruptions on I-5 through the mid-2040s.

- 2026 Columbia River spring Chinook seasons announcedWashington and Oregon fishery managers approved 2026 Columbia River spring Chinook seasons, with a forecast of 147,300 upriver fish and specific fishing windows from March through early May.

- Opinion: Make your voice heard about the majority party’s state income tax proposalRep. John Ley outlines his opposition to Senate Bill 6346 and urges residents to participate in the February 24 public hearing before the House Finance Committee.

- A late starter in her sports, Clark College athlete is excelling in basketball and track and fieldClark College’s Emily Peabody, a late starter in basketball and track, now leads the NWAC in scoring and is a conference champion sprinter.

- Letter: County Council resolution ‘strong on rhetoric, weak on results’Peter Bracchi calls on the Clark County Council to withdraw its ICE-related resolution and replace it with a measurable public-safety plan.

- Trump vows new tariffs, criticizes Supreme Court justices after rulingPresident Donald Trump said he will pursue new tariffs under different authorities after the Supreme Court ruled he exceeded his power under IEEPA.

- Opinion: A loss at the Supreme CourtLars Larson reacts to a Supreme Court decision limiting President Trump’s tariff authority and outlines his view of its economic impact.