Councilors’ decision part of mid-biennium readoption of the 2017-2018 county budget

Brook Pell

For ClarkCountyToday.com

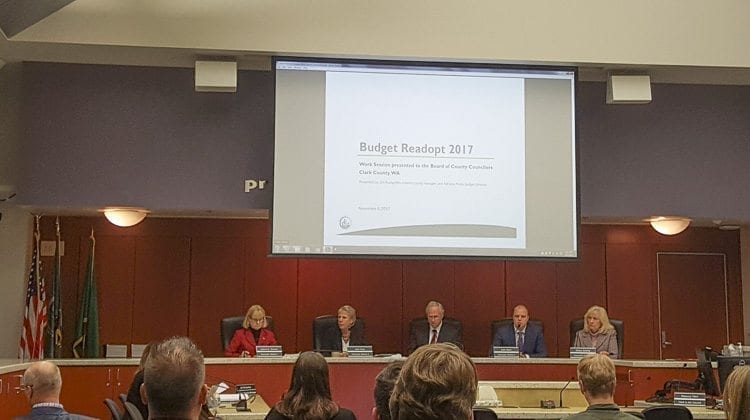

VANCOUVER — The Board of Clark County Councilors convened Tuesday for the mid-biennium readoption of the 2017-2018 county budget. Councilors were joined by interim County Manager Jim Rumpeltes and Adriana Prata, the county budget director, to present the recommended adjustments.

The 2017-2018 county budget, which totaled $946.9 million, was adopted in December 2016. Of those funds, $323.3 million is dedicated to the general fund and goes toward funding things such as county operations, services, and the Clark County Sheriff’s Office.

According to Prata, “the purpose of the readopt is to address critical funding needs and new requests, recognize budget neutral items such as grants, make technical adjustments and update revenue forecasts as needed.”

Rumpeltes felt the budget recommendations presented to the board was, “fiscally conservative” and highlighted that the county is “preserving reserves for the rainy day that may come.”

Offices from across the county submitted over 120 requests totaling $21.5 million in additional funding for the 2018 year. Of those requests, Rumpeltes recommended only $2.7 million be added to the budget. The $2.7 million would go toward replacing the county’s aging fleet as well as capital improvements across the county.

Prata noted, “the general fund faced a significant shortfall, it was 7 percent of expenses or $22.6 million.” She went on to list a few of the factors that caused this shortfall, some of the expenditures included rising personnel costs, which makes up two-thirds of the general fund, rising operation costs for services, replacing outdated technology and maintenance of the aging county facilities. Another significant loss of revenue will begin in 2018 due to the annexation of land just north of the Vancouver Mall that included both Home Depot and Costco. The total revenue lost will total $1.2 million per year in sales tax.

To help address the shortfall, “the biennium budget included a number of general fund interventions, approximately $8 million from savings from departmental expense reductions or existing revenue recovery proposals were put into place to balance the budget,” said Prata.

A key piece to this readoption session was the county property tax levies. Prata highlighted the three property tax levies, “the general fund — which includes subordinate levies: veterans, mental health, and developmental disabilities — the road fund, and conservation features.” She went on to outline the levy options for the 2018. The board could choose not to raise property taxes, they could choose to max out the property tax increase at 1 percent, or they could opt to raise taxes anywhere in between.

Councilor Julie Olson moved to “adopt the property tax resolution that includes a 1 percent for the general fund in 2018” and Councilor Jeanne Stewart seconded the motion.

County Chair Marc Boldt asked for conversation about the motion and Councilor Eileen Quiring took the opportunity to let her fellow councilors know she was “surprised” by the motion to increase the general fund levy by 1 percent and that “we should live within our means.’’

Quiring felt taxpayers were already going to feel an additional tax burden due to the McCleary Decision passed in the last state legislative session. Quiring stated, “We will still have a balance left in our general fund even if we go with the 0 percent increase.”

Boldt felt the need to counter Quiring’s comments saying, “You know I was there when we did Referendum 47, the property tax initiative and I watched when it was found unconstitutional. The senate and the house took it up and I watched the floor debate of it. I never heard one time in any of that two-and-a-half years that said that we should do 0 percent.”

Boldt went on to add that, “even Mr. Tim Eyman, I stood right next to him and he said counties need 1 percent.” Boldt felt the community was going to have to do a lot of “soul searching” even with the 1 percent increase to “figure this [referring to the budget] out.’’

Stewart added to the discussion, “I too am concerned about the overall impact of all the collective sum of taxes” but still felt the 1 percent increase was the responsible option.

Councilor John Blom weighed in by pointing out the Sheriff’s Office would benefit from the increase, helping to insure the county can remain competitive to, “keep that kind of talent here.”

Councilor Olson felt the increase was a “responsible decision.”

Quiring felt the conversation amongst the board made it seem the budget wasn’t balanced and wanted to be sure it was clear that in fact the budget would have been balanced with a vote for the 0 percent increase.

The meeting ended with a 4-1 vote in favor of the 1 percent increase to the general fund levy with, Quiring standing as the lone councilor against the hike.