Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes

David Boze

Washington Policy Center

Ten times since 1934, Washington voters have said no to any kind of income taxes, including those targeting the wealthiest among us. Will it soon be 11?

The effort to repeal the newly-instituted income tax on capital gains advanced today with the certification of more than enough signatures to make it to the ballot. The first stop though, is the state legislature where the legislative majority is expected to do nothing. That action (or inaction) will send it to the voters in the fall.

Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes.

But this time, they have an advantage.

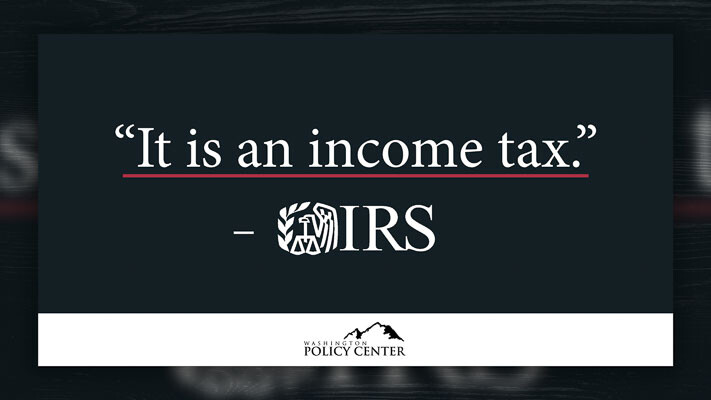

Despite the IRS confirming a capital gains tax is an income tax and despite every other state in the union and several other countries confirming they treat capital gains taxes as income taxes because … well, it’s the taxing of a form of income, the Washington State Supreme Court legitimized this political version of “Freaky Friday” and allowed Washington’s income tax on capital gains to become an “excise tax on capital gains.” This is an advantage unprecedented in the history of Washington’s income tax votes. Instead of being faced with truth in labeling, advocates will claim no “income tax” is on the line. I can imagine media sources “fact checking” opponents who call it an “income tax” and more.

Washington voters earned the right to decide — they also deserve an honest debate,

David Boze is the communications director at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?