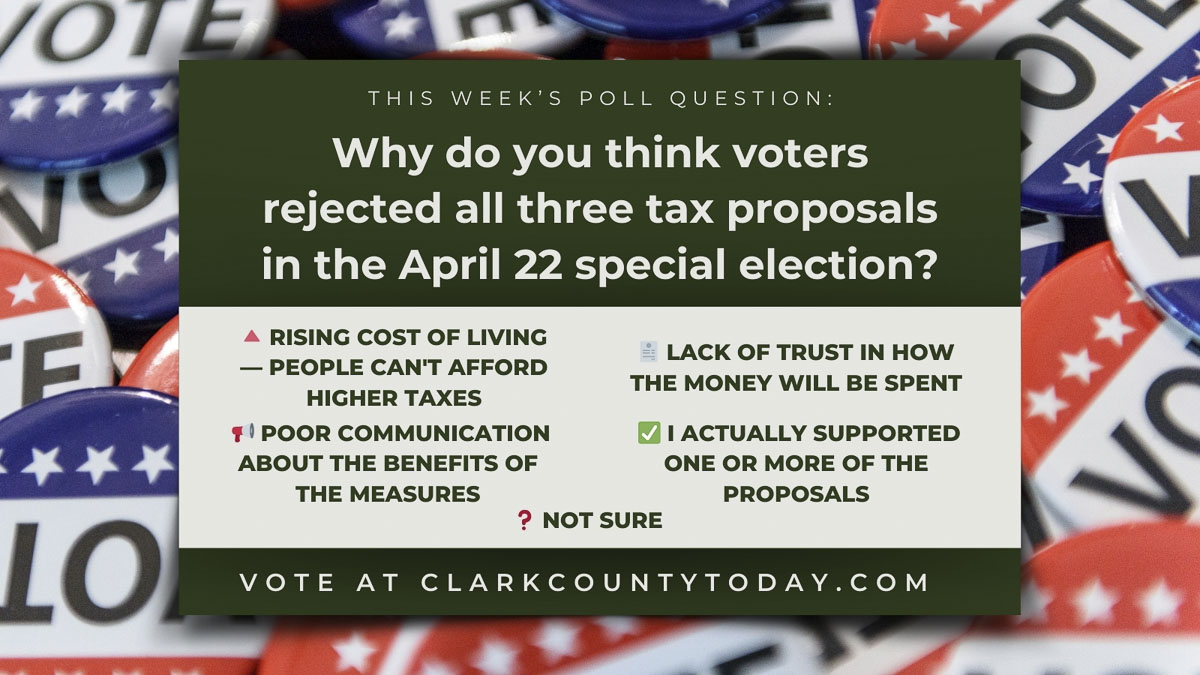

Clark County voters delivered a clear message in the April 22 special election, rejecting all three proposed tax measures. But what drove the outcome? From financial concerns to trust in government, we want to hear your perspective. Take this week’s poll and let us know what you believe was the biggest factor behind the no votes.

More info:

Voters reject tax proposals in April 22 special election

Clark County voters rejected all three tax measures on the April 22 special election ballot, including proposals in Camas, Washougal, Battle Ground, and Hockinson.

Read more

Also read:

- Opinion: ‘Seeking might over right destroys representative government’Retired judge Dave Larson argues that prioritizing political power over constitutional principles has undermined representative government and calls for renewed civic responsibility.

- Letter: ‘Immigration’ resolution scheduled for this Wednesday at Clark County Council MeetingRob Anderson urges residents to closely watch an upcoming Clark County Council meeting where an immigration-related resolution and proposed rule changes are expected to be discussed.

- Opinion: The 1700-square-foot solution to Washington’s housing crisisAn opinion column arguing that Washington’s energy code has driven up housing costs and outlining how HB 2486 aims to limit those impacts for smaller, more affordable homes.

- Letter: Public school visionClark County resident Larry Roe urges a deeper community discussion about public school priorities, levy funding, and the long-term affordability of education for local families.

- Opinion: House Bill 1834 would create a regulatory nightmare and restricts parental control on social mediaMark Harmsworth argues that House Bill 1834 would undermine parental authority and create sweeping regulatory and legal risks under the guise of protecting minors online.

Government never, ever has enough money. They always want more and will make any excuse to get it. Voters have to understand this and vote appropriately….

The schools keep doubling down on things people don’t want for their kids (DEI teachings, certain health & LGBTQ curriculum, boys in girls sports, etc..) so this is a way to finally say no more money. Keep it up, and we will keep voting no. And keep wondering why enrollment is down along with test scores. One day is might click

I see every single day how much waste is in our schools. Money is not helping our schools. Teachers need to teach not do all these extra paperwork. so, so much waste!!!!

I am tired of higher taxes…make a plan make it work.

http://www.meritstreetmedia.com › show › dr-phil-primetimeF Is For Failure – meritstreetmedia.com

State government raising taxes to unaffordable levels without voter approval. Can’t afford more local tax increases.

I agree.Locals may have rejected the levy but my property tax assessment still includes

the two state assessments for “Sate Schools 1” plus “State Schools 2”.

Since we cannot vote for or against the State school property taxes will they simply

impose their will on the property owners and voters?

State Schools 1 and State Schools 2 are both for K-12 education, the state funds basic education.Voters input on State school taxes is thru elected representatives and Senators.

Local levies for K-12 schools go to voters for Extra curricular activities and other spending. I think the Treasurer and Assessor should add the description K-12 for State schools part 1 &2 and also for local levies. Our property tax bill can and should include as much detail as possible.