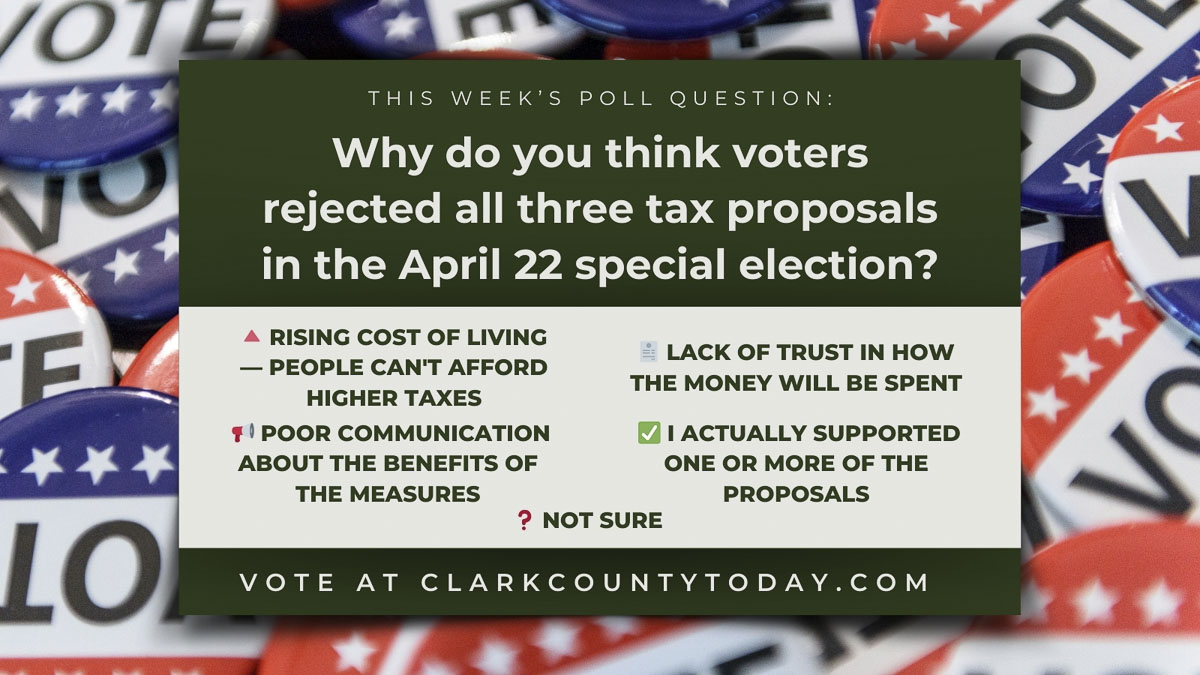

Clark County voters delivered a clear message in the April 22 special election, rejecting all three proposed tax measures. But what drove the outcome? From financial concerns to trust in government, we want to hear your perspective. Take this week’s poll and let us know what you believe was the biggest factor behind the no votes.

More info:

Voters reject tax proposals in April 22 special election

Clark County voters rejected all three tax measures on the April 22 special election ballot, including proposals in Camas, Washougal, Battle Ground, and Hockinson.

Read more

Also read:

- POLL: Should Fort Vancouver Regional Libraries prioritize stronger parental oversight for children’s access to materials?A packed meeting over changes to the Fort Vancouver Regional Libraries strategic plan has sparked debate over parental oversight and children’s access to materials.

- Letter: Brad Benton announces candidacy for County Council, District 5Brad Benton announces his candidacy for Clark County Council District 5, outlining positions on affordability, transportation, and public safety.

- Opinion: Oversized tires and the frequency illusionDoug Dahl explains why tires that extend beyond fenders are illegal and how frequency illusion shapes perceptions about traffic safety.

- Opinion: Senate shenanigans – Income tax debate, double-standardsElizabeth New writes that Senate Bill 6346 would impose a 9.9% tax on income above $1 million and is likely headed for a legal challenge if approved by the House.

- Letter: ‘The intent of the proposed County Council resolution appears to be a general condemnation of our federal immigration enforcement officers’Washougal resident Mike Johnson criticizes a proposed Clark County Council resolution regarding federal immigration enforcement in this letter to the editor.