Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes

David Boze

Washington Policy Center

Ten times since 1934, Washington voters have said no to any kind of income taxes, including those targeting the wealthiest among us. Will it soon be 11?

The effort to repeal the newly-instituted income tax on capital gains advanced today with the certification of more than enough signatures to make it to the ballot. The first stop though, is the state legislature where the legislative majority is expected to do nothing. That action (or inaction) will send it to the voters in the fall.

Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes.

But this time, they have an advantage.

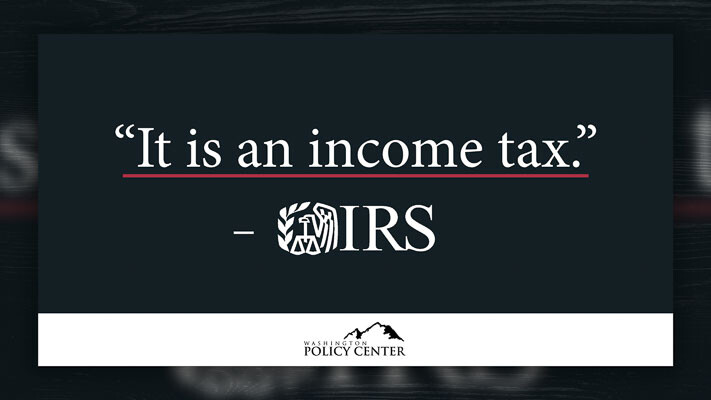

Despite the IRS confirming a capital gains tax is an income tax and despite every other state in the union and several other countries confirming they treat capital gains taxes as income taxes because … well, it’s the taxing of a form of income, the Washington State Supreme Court legitimized this political version of “Freaky Friday” and allowed Washington’s income tax on capital gains to become an “excise tax on capital gains.” This is an advantage unprecedented in the history of Washington’s income tax votes. Instead of being faced with truth in labeling, advocates will claim no “income tax” is on the line. I can imagine media sources “fact checking” opponents who call it an “income tax” and more.

Washington voters earned the right to decide — they also deserve an honest debate,

David Boze is the communications director at the Washington Policy Center.

Also read:

- Opinion: Democrats signal retreat on the death tax as exodus fears mountMark Harmsworth argues recent moves on estate and other tax policies reflect mounting concerns about high earners and businesses leaving Washington state.

- Letter: ‘As a lifetime resident of Clark County I am disturbed regarding what I witnessed’Sally Snyder describes lewd conduct, threatening language, and safety concerns she says she witnessed at the Feb. 11 Clark County Council meeting.

- Letter: ‘Are we being punked?’Anna Miller questions the Clark County Council’s authority to pass a resolution on ICE and urges members to focus on core county responsibilities.

- Letter: ‘People who have entered illegally must face the consequences of their actions’Vancouver resident Debra Kalz argues the County Council should not pass immigration-related resolutions and says laws must be followed or changed through proper channels.

- Opinion: IBR’s systematic disinformation campaign, its demiseNeighbors for a Better Crossing challenges IBR’s seismic claims and promotes a reuse-and-tunnel alternative they say would save billions at the I-5 crossing.