The Washington State Legislature did not provide funding for the group to continue

Chris Corry

Washington Policy Center

The Washington State Tax Structure Work Group officially ended on June 30th of this year. Although the group was slated to produce a final report by December 2024, the legislature did not provide funding for the group to continue. The final report was made public this month.

TSWG was established in 2017 to “identify options to make Washington’s tax code more equitable, fair, adequate, stable, and transparent.” The mission was expanded in 2019 to include analyzing and facilitating statewide public discussion about Washington’s tax structure. This included updating previous research on state tax structure changes, making legislative recommendations, and providing the previously mentioned final report.

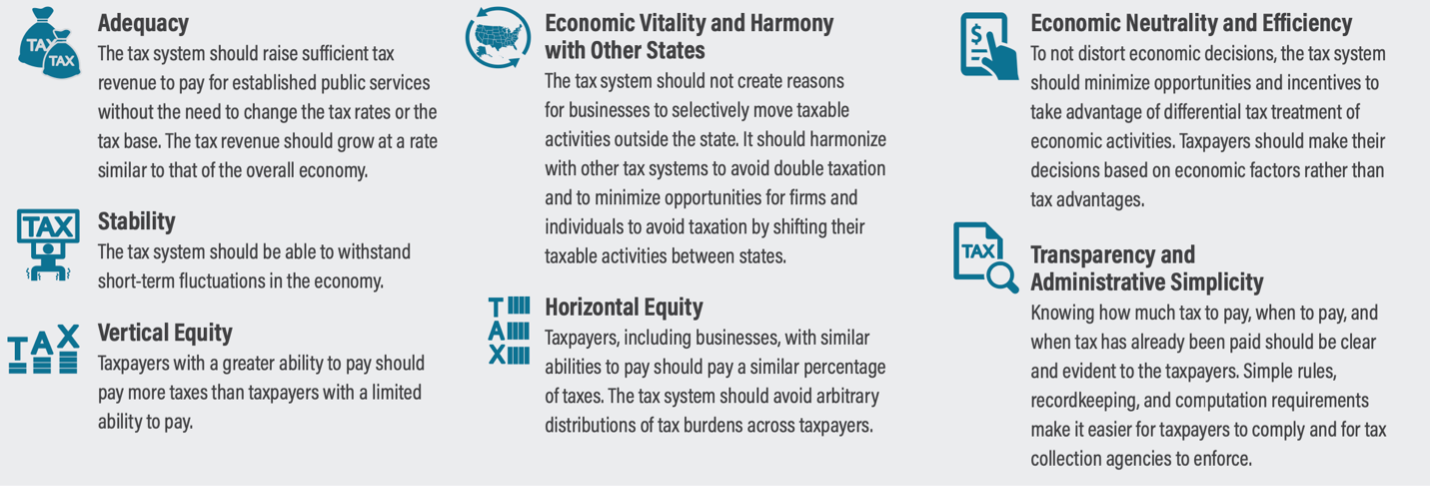

In 2019 legislative proviso directed the TSWG to examine tax principles in their modeling. They included several progressive tax principles, including vertical equity. This would mean creating tax rates based on the ability to pay rather than on a flat basis as codified in Washington State’s Constitution.

TSWG Tax Principles

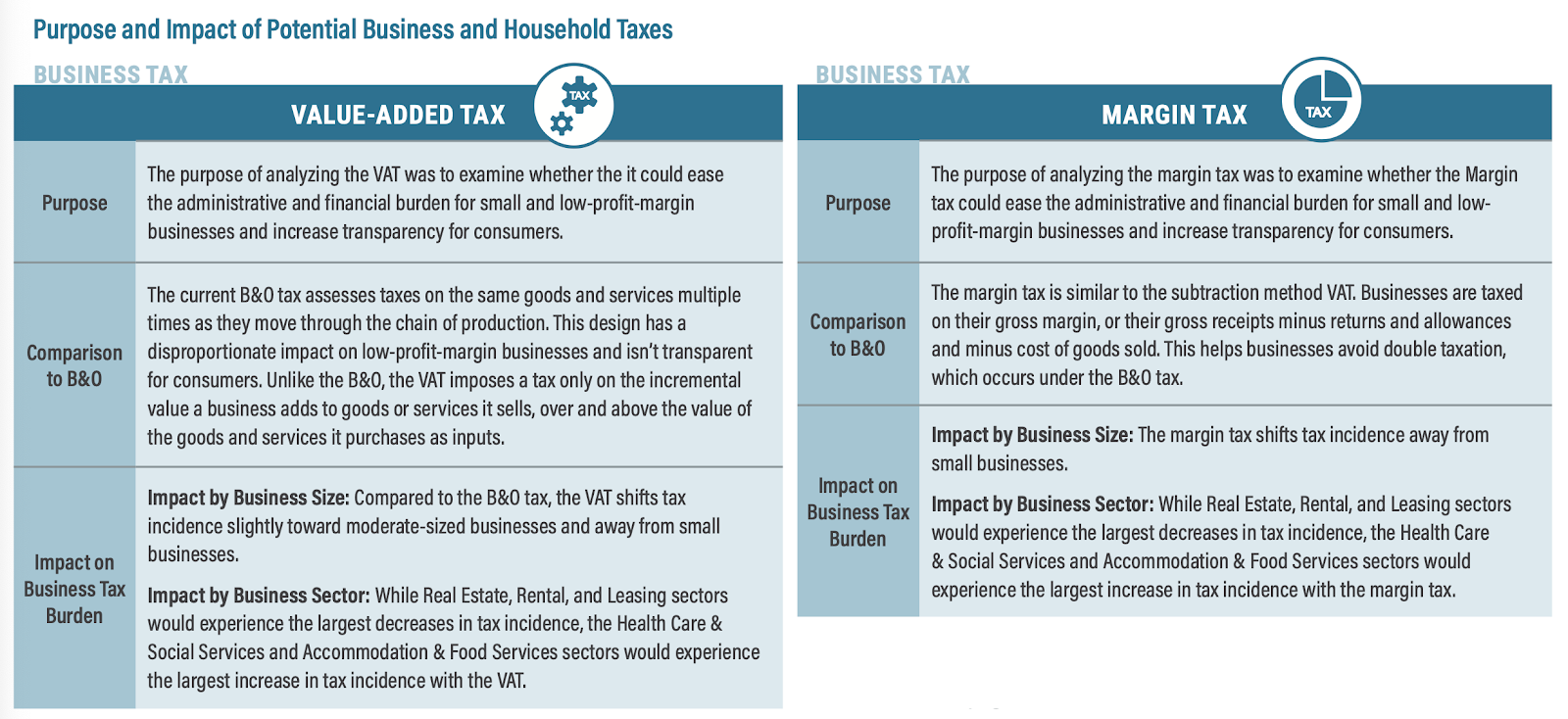

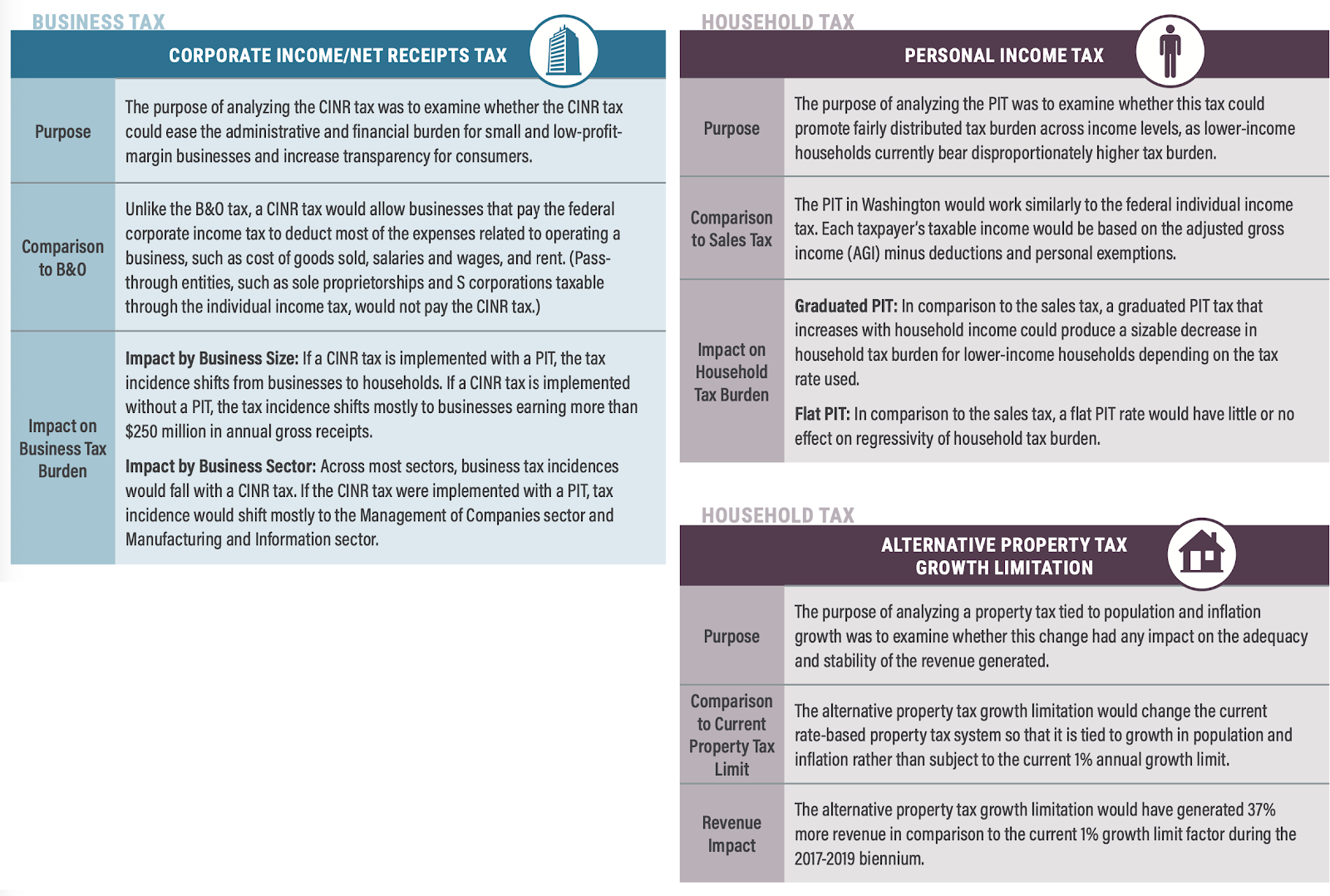

Under those tax principles, the group also examined tax modeling for alternative tax options for both business and personal taxes. The group reviewed a value-added tax, margin tax, and corporate income/net receipts tax for businesses. They also examined personal income tax and alternative property tax for households.

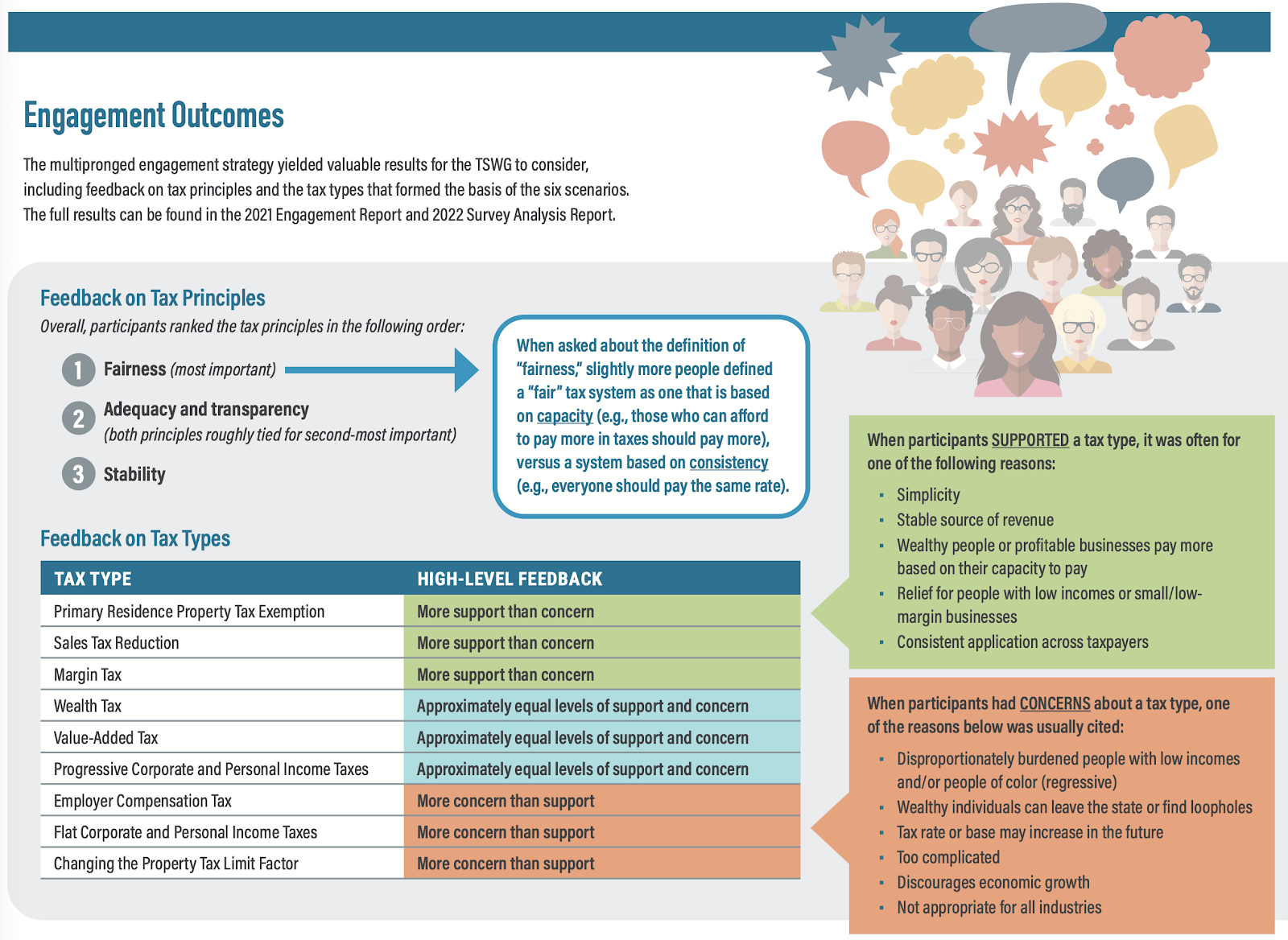

As mentioned, the TSWG was tasked with public engagement on these various potential changes. The group held virtual forums throughout the state. Feedback on changes to taxes provided an interesting insight into public sentiment on taxes. Two tax reduction options more supported than raised concerns, and the proposal for a flat income tax also solicited more opposition than support. Per the report:

The report’s conclusion reviews the tax concepts and proposed legislative ideas from the 2023 session, including the Margin Tax Bill SB 5482 and Property Tax Revenue Growth Limit SB 5618 and HB 1670. These bills did not pass in the 2023 session.

You can review all the Tax Structure Work Group archives here.

Chris Corry is the director of the Center for Government Reform at the Washington Policy Center. He is also a member of the Washington State House of Representatives.

Also read:

- Letter: ‘One year later, a withheld text message points to perjury’Clark County resident Rob Anderson argues a previously undisclosed text message tied to a C-TRAN board dispute raises questions about sworn statements and public meeting rules.

- Opinion: It’s not just the increased taxes that are driving businesses awayMark Harmsworth of the Washington Policy Center argues taxes, workforce challenges and economic uncertainty are driving businesses to relocate outside Washington.

- Opinion: There is no such thing as a ‘free’ lunch, and an income tax isn’t more palatable because it offers oneElizabeth New of the Washington Policy Center argues the proposed Washington income tax and universal school meals policy reflect a broader state spending problem

- Opinion: Democrat Party penalizes marriage in WashingtonLars Larson argues that Washington’s newly passed income tax unfairly targets married couples by creating what he describes as a financial penalty for filing jointly.

- Opinion: Gov. Ferguson has abandoned his own tax relief demandsRyan Frost of the Washington Policy Center argues that Gov. Bob Ferguson’s support for the state’s proposed income tax contradicts his earlier demands for broader taxpayer relief.