Area resident and former County Councilor Dick Rylander attempts to help you better understand where your taxes are going and what the future impact of new taxes may be

Dick Rylander

for Clark County Today

When we see tax proposals come to the ballot those in support frequently refer to the “rate” rather than the total dollars to be collected. This “rate” is shown as an estimate of $$$ per $1000 of assessed value. Those writing the tax proposals usually show examples of the average or median home price and then do some math to show the impact.

For instance a tax may be $1/$1000. If the home value example used is say $400,000 then the actual amount of taxes would be $1 x 400 = $400. What is the median home value in Clark County. WA estimated to be currently? (Note: median means ½ of values are higher and ½ are lower). It appears that $550,000 is a reasonable estimate.

The higher the assessed value the higher the cost to the property owner. If, in this example, the assessed value was $1,000,000 then the tax owed would be $1 x 1000 = $1,000 or 2.25x more than the $400,000 example.

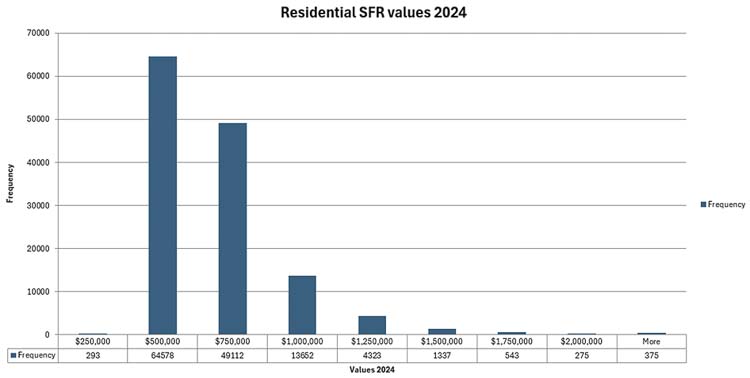

In today’s market what’s the distribution of assessed values as of 2024? Are there a lot of high value homes?

The Assessors Office did some research and were able to supply the following chart. Please accept that it is an estimate and a snapshot.

There are a total of 134,488 properties. Of those it appears that there are 20,505 of $1,000,00 or more which works out to about 15.2%.

What’s the value in knowing this distribution and knowing your own assessed value (and how the taxes are distributed) you can better understand where your taxes are going and what the future impact of new taxes may be.

Also read:

- Letter: Facts aren’t politicalBrian Kendall writes that disagreements about the LEOFF 1 pension debate should begin with accurate facts rather than misinformation.

- Opinion: Trails, roadways and crosswalksDoug Dahl explains how Washington law treats hiking trails that cross roadways and whether pedestrians automatically have the right-of-way.

- Opinion: Supreme Court’s ruling should end state’s bullying of the La Center School DistrictKen Vance argues a recent U.S. Supreme Court ruling on parental rights in education could influence the ongoing dispute between the La Center School District and Washington state officials over gender pronoun policies.

- Opinion: Neighbors for a Better Crossing urges Oregon Legislators to demand full audit of IBR project, echoing Washington’s HB 2669Gary Clark of Neighbors for a Better Crossing urges Oregon lawmakers to pursue an audit of the Interstate Bridge Replacement project similar to Washington’s HB 2669 proposal.

- Opinion: Climate Commitment Act – Washington’s hidden carbon tax hits hardOpinion, columns, Washington state, Climate Commitment Act, CCA Washington, Washington carbon tax debate, Washington gas prices, Nancy Churchill, Dangerous Rhetoric, Washington climate policy, Washington fuel costs, Travis Couture, Washington Department of Ecology, Washington Department of Commerce, Washington carbon credit auctions, Washington cap and trade program, Washington environmental policy