Elizabeth New (Hovde) says lawmakers should stop pretending the only option for fund solvency is to take more of workers’ paychecks

Elizabeth New (Hovde)

Washington Policy Center

Most people want their savings and investments to work for them. But majority lawmakers in Washington state want your savings and investments to work for other people — funding paid time off as they start families or address health needs — through the Paid Family and Medical Leave (PFML) program.

A tax rate cap is tied to this overly generous program that benefits many workers who are not in need of taxpayer dependency, while lowering the paychecks of other workers, including some who are in need of taxpayer dependency. But that protective cap of 1.2%, which we’re already close to, may not be in place much longer.

Sentate Bill 5292 makes me nervous — not because it openly raises the cap today, but because it changes the rules in a way that will build the case to raise the cap later. It could be voted on by senators as early as this week.

At first, I thought that as long as the bill didn’t openly attack the rate cap, it might be palatable. That happened last year.

In 2025, SB 5292 was sold as a reasonable, technical fix that would change how the PFML tax rate is calculated so it’s more forward-looking and less volatile. Then House lawmakers amended the bill to raise the cap to 2%. That’s $2 of every $100 in earnings taken from W-2 workers for a benefit they may never see. Full-time workers already pay hundreds to thousands to PFML already. (Calculate your 2026 PFML tax here.)

I worry this year’s strategy is subtler. SB 5292 could quietly rewire the system in a way that makes a future cap increase easier to justify when the fund is again unable to meet its obligations, as projections suggest.

PFML is not a safety net

PFML is funded by payroll premiums taken primarily from workers, with about a quarter paid by employers — money that could otherwise go to wages. The tax rate for 2026 is 1.13%, up from 0.4% in 2019. With a cap of 1.2%, we’re already right up against it.

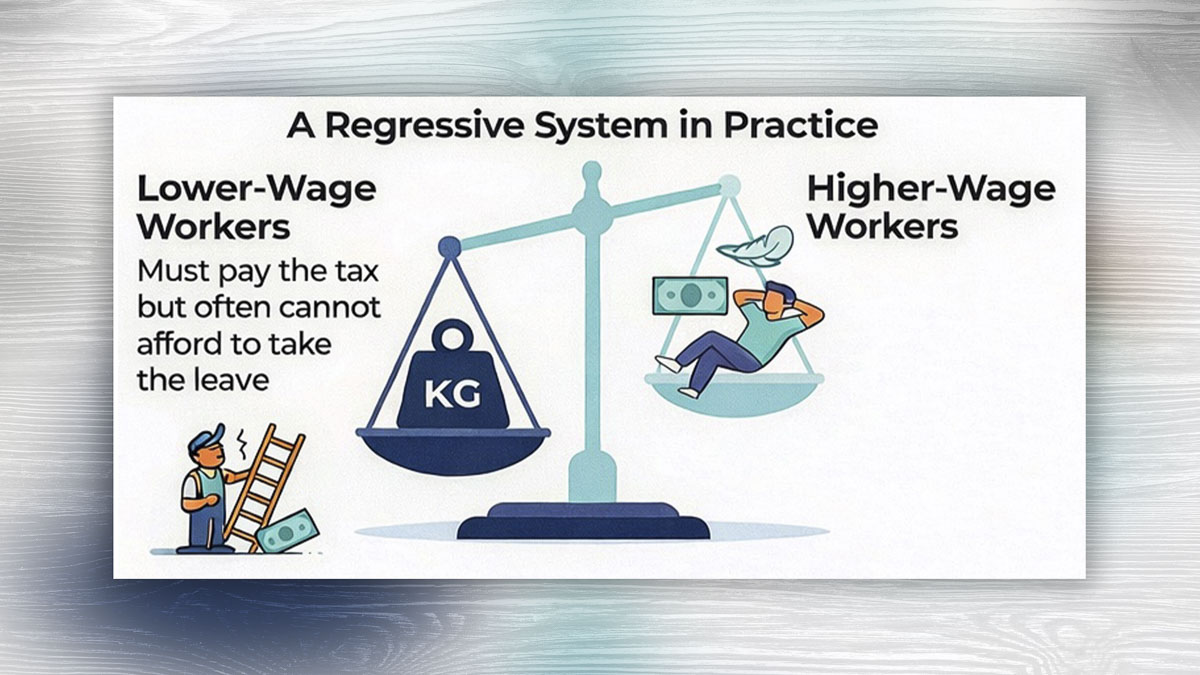

Meanwhile, PFML continues to be marketed as worker protection — a safety net — even though the workers least able to afford payroll deductions use the program least. Low-wage workers often don’t meet eligibility requirements tied to work history, and even when they do, the benefit structure doesn’t replace a full paycheck.

Usage patterns should make lawmakers pause before taking even more wages. The Employment Security Department’s own reporting shows participation differences by wage bands and persistent lower participation among the lowest-wage workers. In fiscal year 2025, workers earning $61 or more per hour used PFML more than twice as often as those in the lowest wage group. (Read more about this part of the problem here.)

PFML is progressive in rhetoric, but regressive in reality: taking money from workers least able to spare it to fund a benefit disproportionately used by those with more income and flexibility.

Course collision

SB 5292 proposes two things that matter here. The bill would eliminate the statutory formula used to calculate the PFML premium rate. It also adds a new requirement that rate-setting aim to close the rate collection year with a four-month reserve beginning in 2030, in addition to the existing four-year solvency requirement.

The bill says the premium rate still may not exceed the 1.2% cap — for now. Supporters will point to that and claim there is no cap increase.

But this structure sets up a future collision. What happens when the program can’t credibly meet both the new reserve requirement and solvency expectations within the cap? Lawmakers will predictably claim their hands are tied and the rate must increase to meet legal requirements they created.

If insistent on keeping PFML — as the majority lawmakers seem to be, and they have the control — reforms to PFML should be on the benefit side:

- Limit repeat usage.

- Tighten eligibility where appropriate,

- Reduce maximum duration.

- Address misuse made possible by loose standards.

Sen. Curtis King, R-Yakima, has already introduced solvency-focused bills intended to control costs without raising the cap. Those ideas deserved hearings and serious consideration, but they appear dead this session.

At this point, I think SB 5292 should be treated as presumptively dangerous. Even if it moves “clean” this year, it sets the stage for a cap increase when the new reserve requirement can’t be met.

So here’s my recommendation:

- If SB 5292 comes to a floor vote, as I think it will, senators should vote no.

- If it advances, as I think it will, the House should adopt an amendment that explicitly states that failure to meet the reserve target cannot be used as justification to raise the statutory cap.

In other words, if lawmakers want a more forward-looking rate process, fine. They should not be allowed to use that forward-looking process as a back door to higher payroll taxes on workers.

Washington workers are already paying 1.13% of wages into PFML. The cap is 1.2%. And the people least able to absorb payroll deductions are among the least likely to use the benefit — while higher earners use it far more. Making the rate even higher should not be a consideration. And lawmakers should stop pretending the only option for fund solvency is to take more of workers’ paychecks.

Elizabeth New (Hovde) is a policy analyst and the director of the Centers for Health Care and Worker Rights at the Washington Policy Center. She is a Clark County resident.

Also read:

- Opinion: Neighbors for a Better Crossing urges Oregon Legislators to demand full audit of IBR project, echoing Washington’s HB 2669Gary Clark of Neighbors for a Better Crossing urges Oregon lawmakers to pursue an audit of the Interstate Bridge Replacement project similar to Washington’s HB 2669 proposal.

- Opinion: Climate Commitment Act – Washington’s hidden carbon tax hits hardOpinion, columns, Washington state, Climate Commitment Act, CCA Washington, Washington carbon tax debate, Washington gas prices, Nancy Churchill, Dangerous Rhetoric, Washington climate policy, Washington fuel costs, Travis Couture, Washington Department of Ecology, Washington Department of Commerce, Washington carbon credit auctions, Washington cap and trade program, Washington environmental policy

- Letter: The Missing Skamania Report – The prosecuting attorney is still sitting on itRob Anderson questions why an investigative report into potential County Charter and OPMA violations has not received an outside review after being declined by multiple offices.

- Opinion: Washington’s charter schools deliver – if the state lets themVicki Murray argues that Washington’s charter schools are posting stronger academic results than comparable peers while facing funding inequities that are shrinking the sector.

- Letter: IBR’s money pitBob Ortblad argues the Interstate Bridge Replacement Program is withholding a higher cost estimate while moving forward with limited funding and an unclear construction timeline.