Jason Mercier of the Washington Policy Center offers a step-by-step account of his search to reveal the truth

Jason Mercier

Washington Policy Center

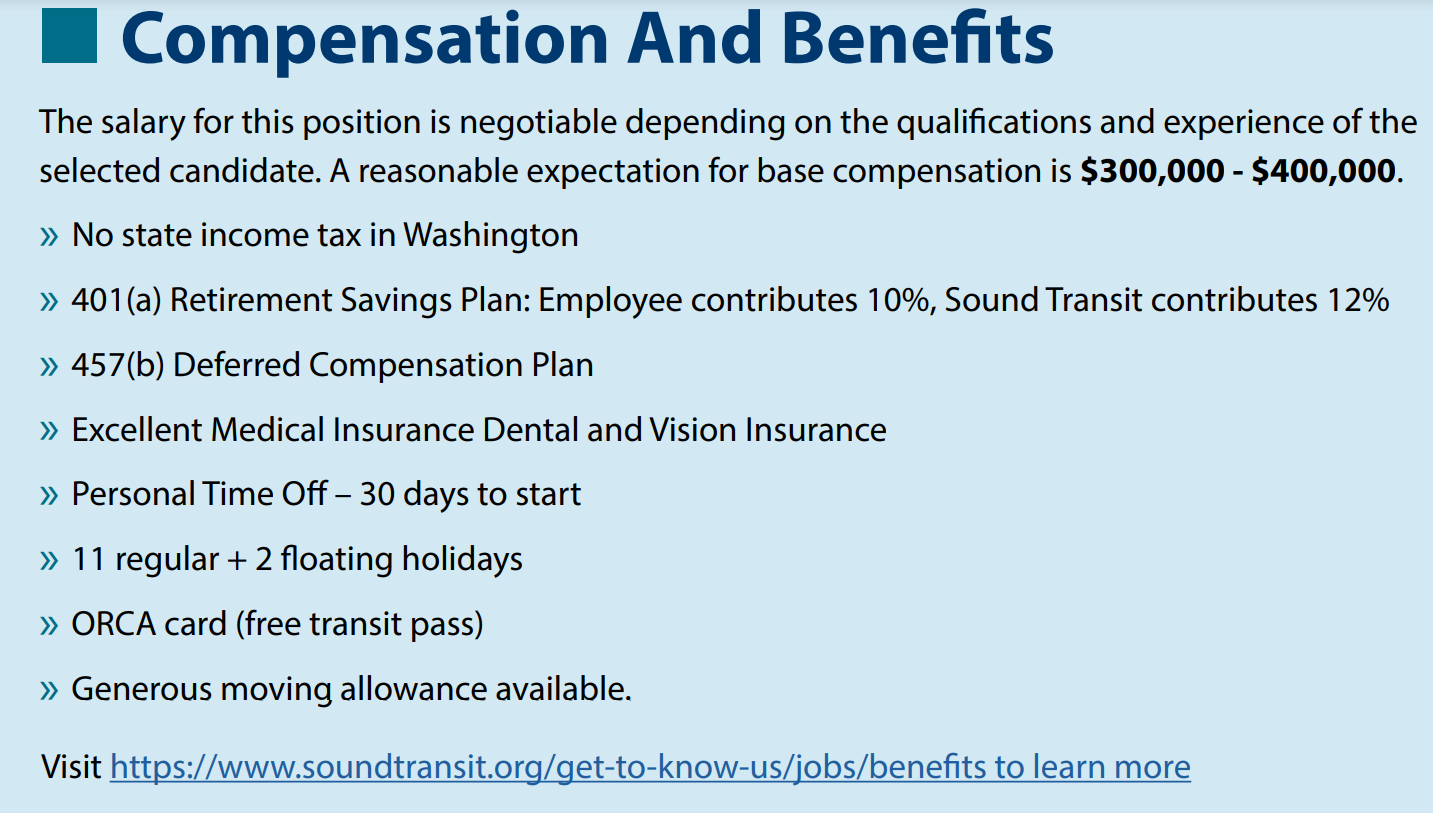

When looking for a new CEO earlier this year, Sound Transit posted a recruiting brochure and the very first thing highlighted on the compensation and benefits page after salary said: “No state income tax in Washington.” I highlighted this in a February 20 blog post. Shortly after my blog, Sound Transit removed just the no income tax reference from the brochure. I was curious why and sent a public records request. It took a while to get the record, but now I know the no income tax reference was removed because someone complained to Sound Transit about my blog and said that it wasn’t a good look for them to advertise no state income tax.

Initially, I didn’t get the public record with this information after Sound Transit first closed my public records request. I followed up and said that I assumed there was at least one responsive record making the request to remove the no income tax sentence from the updated brochure. Here is what Sound Transit said yesterday when sending the updated public record to me:

“This is an update on your public records request. The initial email search used the search term ‘no state income tax in Washington as quoted in the original request. A new email search was run using the search term ‘no state income tax’ and the attached responsive email was located. This completes our response to your request and we are closing your request file.”

The lesson for those making public records, trust your gut and follow up if you feel like a “closed” public records request didn’t quite hit the mark.

Additional Information

Sound Transit says no income tax is job benefit

Timeline of my May 9 records request to Sound Transit

I requested “… all emails, memos, etc., related to adding or removing the phrase ‘No state income tax in Washington’ from the Sound Transit CEO brochure. See page 8 from the original with the phrase (https://www.documentcloud.org/documents/21870296-report-sound-transit-ceo-flipbook) and the updated version without the phrase (https://www.soundtransit.org/st_sharepoint/download/sites/PRDA/FinalRecords/2022/Report%20-%20Updated%20Sound%20Transit%20CEO%20Flipbook%2002-24-22.pdf).”

Sound Transit on May 13

“…We received your request on May 9, 2022. Please note that Sound Transit offices remain closed until June 1, 2022. In the meantime, we continue to work remotely, however, with limited resources. Given the current COVID-19 situation, our staffs’ workload, connectivity issues and the number of requests we are currently handling, we estimate it will take another four to five weeks to identify and gather responsive records. If we are able to provide responsive records sooner, or if we need more time to complete your request, we will let you know.”

Sound Transit on June 21

“This email acknowledges receipt and responds to your status inquiry email dated Friday, June 17, 2022. Please note Sound Transit offices were closed yesterday, Monday, June 20, 2021. We are currently working on your request, however, we will need additional time to complete our search. We are currently reviewing approximately 40 emails that we located from a search in our email system using the key phrase: ‘No state income tax in Washington’. We are also working with staff and our attorneys to identify additional records. We estimate we will have the responsive records available for release in one to two weeks. If we are able to provide records sooner or need additional time, we will let you know.”

Sound Transit on July 7

“This is an update on your public records request. We have identified 44 emails responsive to your request…Additionally, staff has provided updated versions of the two documents listed below…This completes our response to your request and we are closing your request file.”

Me on July 7

“I had a chance to review the records. I didn’t see anything addressing the removal of ‘No state income tax in Washington’ from the updated Sound Transit CEO brochure. I’m assuming there is at least one responsive record making the request to remove that sentence from the updated brochure.”

Sound Transit on July 7

“This email acknowledges receipt of your email inquiry regarding not seeing ‘anything addressing the removal of ‘No state income tax in Washington’ from the updated Sound Transit CEO brochure.’ We are searching for any additional records responsive to this request. Given our staffs’ workload, vacation schedules and the number of requests we are currently handling, we estimate it will take another one to two weeks to identify and gather responsive records. If we are able to provide responsive records sooner, or if we need more time to complete your request, we will let you know.”

Sound Transit on July 20

“This is an update on your public records request. The initial email search used the search term ‘no state income tax in Washington as quoted in the original request. A new email search was run using the search term ‘no state income tax’ and the attached responsive email was located. This completes our response to your request and we are closing your request file.”

Jason Mercier is the director of the Center for Government Reform at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?