Vancouver resident Elizabeth Hovde, of the Washington Policy Center, encourages area residents not to buy into the marketing campaign the state has recently implemented to promote its new long-term care law and accompanying payroll tax

Starting January 1, more of your paycheck will go missing if you are a W2 worker in Washington. The state will be taking 58 cents of every $100 you make, while claiming it is for your own good. But it isn’t really, even if you one day qualify for the measly $36,500 lifetime long-term care benefit that allows you to recoup some or all of your money.

Long-term care is something many people utilize at some point in their lives, and it generally refers to non-medical care for patients needing assistance with basic daily activities such as dressing, bathing, cooking, medicine management and so on. Long-term care can be provided at home, in nursing homes or assisted-living facilities. The best long-term care is private coverage that is affordable and designed to fit people’s individual needs.

Some state lawmakers, though, have a different idea. They don’t think you should be allowed to choose how you plan for your own long-term-care needs and that you should instead be forced to pay into a single, socialized program created by them. They call the mandatory program, misleadingly, the WA Cares Fund.

That is why a new payroll tax will soon be showing up on a paycheck near you.

Washington workers recently saw their incomes lowered when they all started paying a payroll tax for the state’s Paid Family and Medical Leave program. In 2022, they’ll see even more of their household budgets taken for this long-term-care fund.

This payroll tax has no salary minimum and no cap on income, so workers who earn $25,000 annually will pay $145 a year, a worker earning $100,000 will pay $580 each year and so on. Everyone who pays in for a required number of years (typically 10 or more) is vested and eligible for the same lifetime benefit, regardless of the amount of money they’re forced to contribute and regardless of their individual needs.

Don’t buy the marketing campaign the state has recently and proudly implemented. The long-term-care benefit of $36,500 isn’t enough for meaningful long-term care nor does it offer peace of mind, as advertised. Even a modest level of care can cost more than twice that. (See Genworth’s Cost of Care Survey.)

Worse, unless you pay in for 10 years without a break of five or more years within those 10 years, typically, you get zero dollars toward your long-term care. You get nothing if you don’t end up needing care for at least three daily needs. The benefit is also not portable, so if you leave the state in your retirement years you’re out of luck. No Arizona sun awaits you in your golden years. If you live out of state and work in Washington, you, too, forfeit your money to others for their long-term-care needs.

Offering false security to taxpaying workers, while acting like this is the best thing for them, has a lot of people in the state frustrated and trying to find a way out of the tax. That’s possible for some workers, given a limited, one-time-only opt out. (Learn more about opting out in the many blogs I’ve written for Washington Policy Center, visit the WA Cares Fund website or contact a long-term-care insurance provider. Know, however, that the insurance market has been disrupted by this mess and options are severely limited. It might be too late.)

Prompting a conversation about long-term care and encouraging people to make appropriate plans would have been an appropriate role for lawmakers; becoming a long-term-care insurer was not.

The state government is taking money from workers to fund a one-size-fits-all, long-term-care entitlement program that a lot of people don’t want or need — and that some people won’t use, even after paying into the program for years.

Legislators should repeal this unfair, costly and inappropriate law and its accompanying payroll tax when they meet again in Olympia. They also should open up more consumer choices, cutting insurance regulations that limit Washingtonians’ options.

Elizabeth Hovde directs Washington Policy Center’s Worker Rights and Health Care Centers and lives in Vancouver.

Also read:

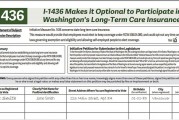

I-1436 will give workers choices on state’s Long Term Care insurance program

Opinion: Real-world situations show why a long-term-care mandate and tax should be repealed

Opinion: Details about the state’s mandated long-term care law and payroll tax are slowly emerging

Opinion: New payroll tax to hit workers this fall for mandated long-term-care program, but state commission has few answers on how it will work