New initiative will allow workers to avoid new state payroll tax

Former state Rep. Cary Condotta has introduced a citizens initiative to give people a choice regarding Washington state’s long term care (LTC) program and the payroll tax that goes with it. The legislature passed the law in 2019 and it will go into effect in January 2022. Employers will be forced to collect a tax of 58 cents per $100 of earnings and remit it to the state.

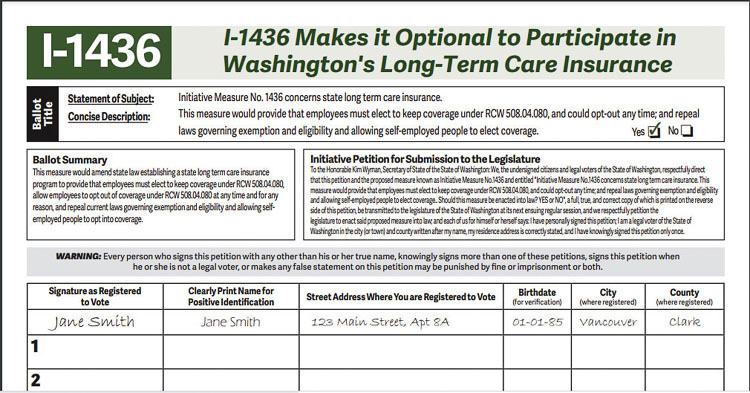

Condotta’s group has submitted I-1436 to the Secretary of State. Citizens will have through the end of the year to collect signatures on the petition. A copy of the initiative can be obtained here. I-1436 would make it optional to participate in Washington’s long-term care insurance.

He shared the news of the initiative petition on KVI’s John Carlson radio show Thursday morning. “You’re in a program that you’ll probably never see the benefit of,” he said.

Condotta listed several examples of flaws in the program. If you’re less than 10 years from retirement, you can’t get vested; yet you’ll still have to pay into it. If you move out of state, you can’t use the benefit as a resident of another state. “Everybody pays the tax,” he said.

Carlson responded “that’s taxation without representation.”

The initiative, if enacted into law, would require people to “opt in,” to actually choose to be in the program. That is a stark contrast to the current law that only allows people a one-time opportunity to opt out.

The current opt-out provision only applies during the month of October. Citizens must get private long term care insurance prior to Nov. 1. After providing proof of insurance to the state, they then must get a state form to submit to their employer by the end of the year. Otherwise the employer must begin withholding the new payroll tax.

This tax will fund a long-term care insurance program known as the WA Cares Fund. The state’s mandatory LTC program provides a maximum benefit of $36,500, or $100 per day. “It’s not good for workers,” says Elizabeth Hovde of the Washington Policy Center.

The intent statement of the initiative says the following.

“The state of Washington’s government-operated long-term care insurance scheme has too many conditions and restrictions to propose good value to working people and families in the state. More troubling still, the scheme is actuarially unsound, which means the moneys the state deducts from workers’ paychecks are not enough to cover the scheme’s overhead, operating costs, and benefits obligations. In short, the scheme is a bad deal and working people in Washington should have the ability to opt out of it. This initiative provides all Washington workers that reasonable option.”

“I’m concerned that there are too many questions about the program’s viability, and that the people who are supposed to benefit the most from this program will end up being hurt financially in the long run,” said Senator Curtis King, (14th District). “I think the tax rate for the program eventually will need to rise, which will hurt lower-income workers.”

For example, if you make $50,000 per year, you will pay $290 per year until you retire or leave the state, King shared. “If you move out of Washington, your benefits are not portable, and your contributions will be forfeited to the state.”

People desiring to opt out must purchase a private long-term care plan before Nov. 1, 2021. King said: “Starting Oct. 1, 2021, through Dec. 31, 2022, you will need to fill out an application attesting to the Employment Security Department that you have purchased private long-term care insurance. ESD will provide you with an exemption letter, and this letter will need to be shown to your employer and any future employers to keep you from permanently paying the payroll tax.”

The program can’t pay for itself according to Condotta. “It’s 58 cents. It’ll turn it into $1.58 and then $2.50,” he said.

“Explain why it is that my Social Security is portable; wherever I go my Social Security comes with me,” Carlson said. “My 401k comes with me, my medical insurance comes with me. Why wouldn’t this brand new Long Term Care Program come with me if I paid the taxes into it?”

“Because that’s the way they wrote it,” Condotta responded. “It’s got a lot of problems like that.”

The initiative does two things according to Condotta. “It says you have to opt in to start with,” he said. “You have to tell them you want in this program. And then it says you can opt out at any time if you’re already in the program.”