If approved by voters, both levies would provide funding for three years and replace the current levies expiring at the end of 2026

The Washougal School District Board of Directors voted unanimously on Tuesday (Nov. 25), to place a renewal Educational Programs & Operations (EP&O) levy and Capital levy on the Feb. 10, 2026 special election ballot.

If approved by voters, both levies would provide funding for three years and replace the current levies expiring at the end of 2026. District officials point out that these are not new taxes.

Continuing strong support for student programs and school maintenance

The EP&O and Capital levies work together to fund student programs and keep schools safe and in good condition. These local funds account for about 20% of the district’s overall budget.

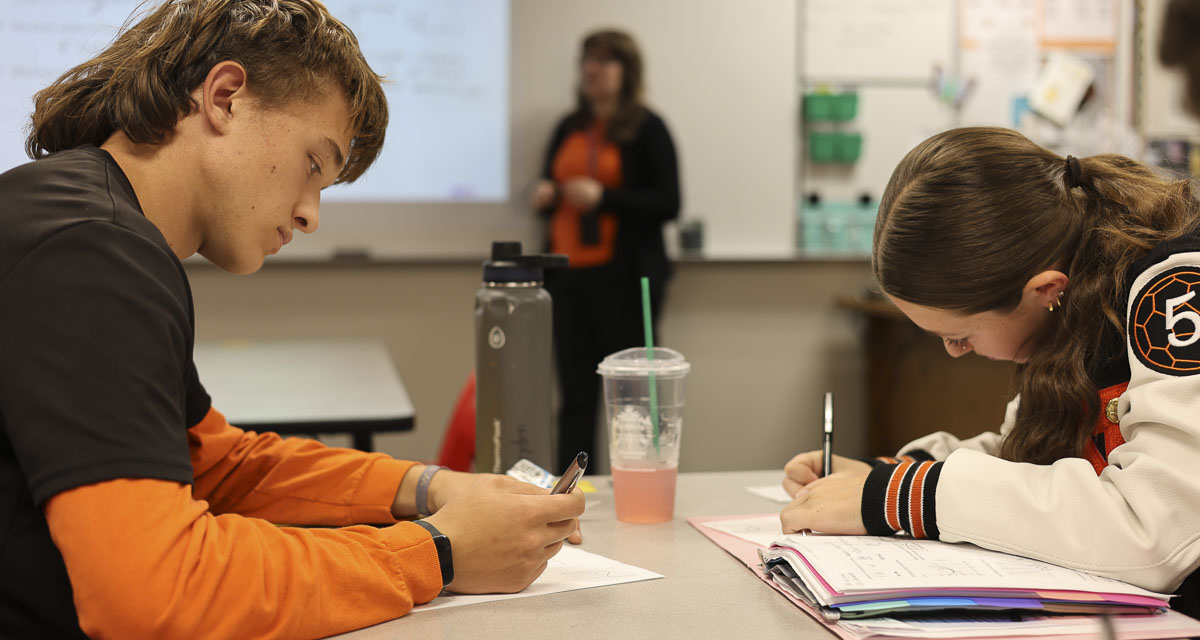

If approved by voters, the EP&O Levy would continue programs and services that go beyond what the state provides. Local EP&O levy dollars support classroom teachers to maintain small class sizes, security staff, nurses, school counselors, instructional support staff, arts, music, drama, athletics, after-school activities, learning technology, Advanced Placement and Highly Capable programs, operations & maintenance staff, fuel, and utilities.

The Capital Levy would fund school safety improvements, heating and cooling systems, repairs to playground and parking areas, carpet and drywall repairs, instructional technology, and updates to athletic and performing arts spaces.

“The proposed levies continue our community’s strong tradition of supporting Washougal students, and fund the programs and staffing that make Washougal’s schools a great place for our kids,” said Sadie McKenzie, School Board president.

Lower estimated total school levy amount projected in 2027 compared to 2026

The proposed EP&O Levy rate would be $1.95 per $1,000 of assessed property value. The proposed Capital Levy would be $0.62 per $1,000. If approved by voters, estimated total school levy rates would be lower than what homeowners are projected to pay in 2026.

If voters approve the levies, the owner of a $636,000 home is projected to pay about $9 less per month in local levy costs in 2027 than in 2026. According to projections, levy costs would dip in 2027-28, then return in 2029 to about the same monthly amount as 2026 to account for inflation.

“These renewal levies would result in a lower estimated tax rate than what homeowners are projected to pay in 2026,” said Aaron Hansen, superintendent at Washougal School District. “We’ve been intentional in asking for an amount that gives some relief to taxpayers in the next two years, while still supporting the experiences and opportunities the community asked us to provide for students through our strategic planning process.”

Student programs & improvements supported by local levy dollars

The proposed levies will continue funding that supports student programs, technology, and facilities maintenance in Washougal School District.

EP&O Levy dollars would support:

- Classroom teachers to maintain small class sizes

- Health & safety staff, including security staff, nurses and school counselors

- Instructional support, including paraeducators, library staff, curriculum, food service and more.

- Arts, music, and drama

- Athletics and after-school activities

- Learning technology

- Advanced Placement and Highly Capable programs

- Operations & maintenance, including custodial and grounds staff, maintenance staff, fuel, and utilities

Capital Levy dollars would support:

- School safety improvements

- School heating and cooling systems

- Playground and parking repairs

- Carpet and drywall repairs

- Instructional technology and student devices

- Updates to athletic facilities and performing arts spaces

“Our goal is to maintain high quality opportunities for Washougal students while being responsible stewards of taxpayer dollars,” said McKenzie.

For more information about the upcoming levies, visit the Washougal School District website:

www.washougal.k12.wa.us/district-budget-information/levy

Information provided by the Washougal School District.

Also read:

- Mat Classic: Clark County celebrates nine state champion wrestlersClark County wrestlers captured nine state titles and 14 finals appearances at Mat Classic in the Tacoma Dome.

- HVAC leak safely mitigated at Vancouver Community LibraryVancouver firefighters responded to an HVAC leak at the Vancouver Community Library and confirmed the building was safe after air quality testing.

- Opinion: Interstate Bridge replacement – the forever projectJoe Cortright argues the Interstate Bridge Replacement Project could bring tolling and traffic disruptions on I-5 through the mid-2040s.

- 2026 Columbia River spring Chinook seasons announcedWashington and Oregon fishery managers approved 2026 Columbia River spring Chinook seasons, with a forecast of 147,300 upriver fish and specific fishing windows from March through early May.

- Opinion: Make your voice heard about the majority party’s state income tax proposalRep. John Ley outlines his opposition to Senate Bill 6346 and urges residents to participate in the February 24 public hearing before the House Finance Committee.

- A late starter in her sports, Clark College athlete is excelling in basketball and track and fieldClark College’s Emily Peabody, a late starter in basketball and track, now leads the NWAC in scoring and is a conference champion sprinter.

- Letter: County Council resolution ‘strong on rhetoric, weak on results’Peter Bracchi calls on the Clark County Council to withdraw its ICE-related resolution and replace it with a measurable public-safety plan.