The libertarian Cato Institute released the report, which graded states by spending, revenue and taxes

Casey Harper

The Center Square

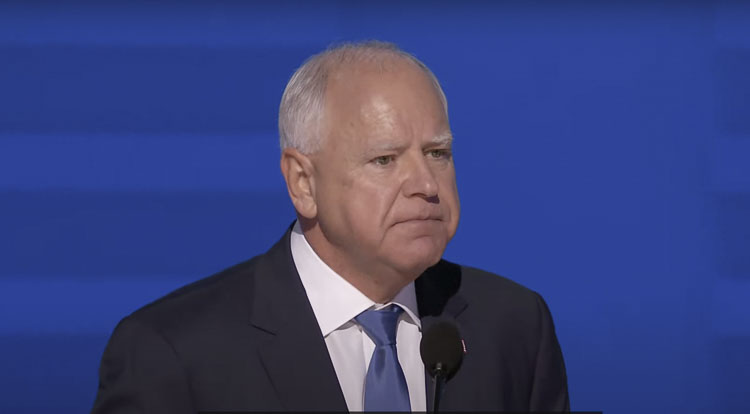

A newly released analysis of fiscal policy ranked all 50 states with Iowa Gov. Kim Reynolds’ state coming in first and Democratic Vice Presidential Nominee and Minnesota Gov. Tim Walz in last.

The libertarian Cato Institute released the report, which graded states by spending, revenue and taxes. The top ten states in the rankings starting at the top are Iowa, Nebraska, West Virginia, Arkansas, South Dakota, Montana, Hawaii, Georgia, Idaho, and Vermont.

The bottom ten states, according to the analysis, are New Mexico, Missouri, Oregon, Michigan, Wisconsin, Delaware, Washington, Maine, New York and lastly, Minnesota.

The bottom six states received a grade of “F.”

Walz’ poor rating comes just three weeks before the presidential election where he and his running mate Vice President Kamala Harris are in a nearly tied race with former President Donald Trump and his running mate, Sen. J.D. Vance, R-Ohio.

The report explains the reasoning for Walz’ low score, pointing to a series of tax hikes under his leadership as well as spending increasing by 36% since 2022, from from about $52 billion to nearly $71 billion.

From the report:

In 2019, Walz’s budget would have added ‘$2 billion more in new spending and taxes would increase by $1.3 billion to pay for it, with the rest of the money coming from an existing surplus.’ But he compromised with the legislature, and the final tax increase was about $330 million annually. Walz also pushed for higher gas taxes and higher vehicle fees to raise about $1 billion annually for transportation, but those increases were rejected.

Walz pushed for more tax hikes in 2021. He proposed adding a new individual income tax rate of 10.85 percent above the current top rate of 9.85 percent, a surtax on capital gains and dividends, and a hike to the corporate tax rate from 9.8 percent to 11.25 percent. The proposals—which would have raised about $1.6 billion annually—were rejected by the legislature…

Walz hit the middle class with HF 2887, which raised taxes and fees on vehicles and transportation. The increases included indexing the gas tax for inflation, increasing vehicle registration taxes, raising fees on deliveries, and raising sales taxes in the Twin Cities area.

This report was first published by The Center Square.

Also read:

- Passage of income tax bill more likely as Gov. Ferguson now says he will sign itGov. Bob Ferguson says he will sign a revised income tax proposal targeting earnings above $1 million if the Legislature approves the measure.

- Opinion: Many important decisions looming as the 2026 session nears the endRep. John Ley outlines budget concerns, energy policy debates and several tax proposals as the 2026 legislative session approaches its final days.

- Opinion: Study shows 2025’s record tax increases reduce Washington’s GDP growth and worker payTodd Myers writes that a new economic analysis projects Washington’s 2025 tax increases will slow GDP growth and reduce wages over the next several years.

- WA Senate narrowly advances bill to reduce education spending by $176M through 2031The Washington Senate passed a bill by a 25-24 vote that would reduce and delay some education funding to help address the state’s budget shortfall.

- Legislation from Rep. David Stuebe to strengthen Medicaid support for emergency ambulance services moves closer to becoming lawA bill from Rep. David Stuebe updating Medicaid reimbursement for emergency ambulance services passed the Senate and now heads to the governor’s desk.