The U.S. Supreme Court is scheduled to review the petition for certiorari filed by the plaintiffs in Quin ...

-

Opinion: United States Supreme Court to consider hearing Washington capital gains tax lawsuit during Friday conference

Opinion: United States Supreme Court to consider hearing Washington capital gains tax lawsuit during Friday conference

-

SCOTUS decision could come soon on taking Washington tax lawsuit

SCOTUS decision could come soon on taking Washington tax lawsuit

-

Opinion: New bill proposes ‘excise tax’ on compensation

Opinion: New bill proposes ‘excise tax’ on compensation

-

Opinion: Summary of capital gains income tax amicus briefs

Opinion: Summary of capital gains income tax amicus briefs

-

Opinion: State Supreme Court sets Jan. 26 hearing for capital gains income tax lawsuit

Opinion: State Supreme Court sets Jan. 26 hearing for capital gains income tax lawsuit

-

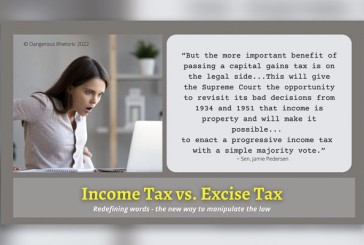

Opinion: Income Tax vs. Excise Tax

Opinion: Income Tax vs. Excise Tax

-

Opinion: Judge removes ‘excise tax’ from I-1929 (capital gains income tax repeal) ballot title

Opinion: Judge removes ‘excise tax’ from I-1929 (capital gains income tax repeal) ballot title

-

Opinion: Attorney General drops ‘excise tax’ from new proposed ballot title for I-1929

Opinion: Attorney General drops ‘excise tax’ from new proposed ballot title for I-1929

-

Opinion: I-1929 campaign challenges AG’s ‘misleading’ ballot title and summary

Opinion: I-1929 campaign challenges AG’s ‘misleading’ ballot title and summary

12