Todd Myers of the Washington Policy Center continues to make the case that the costs of that policy should be offset by tax cuts and that cost increases should be small

Todd Myers

Washington Policy Center

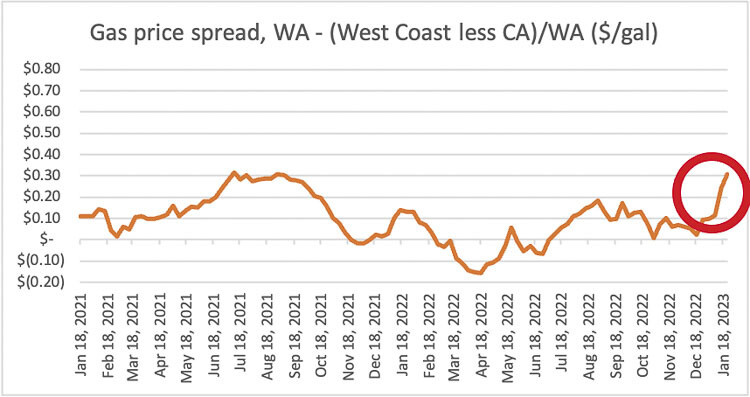

Since Washington state’s new tax on CO2 emissions took effect at the beginning of the year, gas prices have increased 25 cents per gallon compared to other West Coast states.

The latest data, released yesterday, show that – despite the governor’s protests – the CO2 tax is working as expected and intended, increasing the price of fossil fuels to encourage people to switch to alternative sources of energy.

To calculate the impact and distinguish it from standard price fluctuations, let’s look at the work of carbon tax advocate and environmental economist Yoram Bauman. He created a formula to estimate the increases due to the new tax on CO2 emissions. Yoram’s formula uses weekly gas price data from the U.S. Energy Information Administration. We compare Washington’s price for Regular gasoline to the West Coast minus California. We removed California because it has a similar tax on CO2 emissions and their prices are more volatile. As Bauman explains in this tweet, the gap between prices in Washington and the other West Coast states is smaller and more stable, making it a better baseline against which to compare.

The calculations can be found on this public spreadsheet.

Price data from AAA are used to confirm the 25 cent per gallon estimate is about right. For example, Washington’s gas prices have increased 17 cents per gallon in the last month according to AAA. During that same period, average gas prices in Oregon fell by 7 cents per gallon. Compared to Oregon, Washington’s gas prices are now 24 cents per gallon higher than they were a month ago.

The numbers are similar for Idaho. In the last month, Idaho’s gas prices have fallen about 12 cents per gallon. Compared to Idaho, Washington’s gas prices are now 29 cents per gallon more than a month ago.

This should not be a surprise. The very purpose of taxes on CO2 emissions is to increase the price of fossil fuels. As pointed out by the Tax Policy Center, run by the center-left Urban Institute and Brookings Institution, the goal of taxing CO2 emissions is to encourage “people, businesses and government to produce less of them.” Increased prices are not a side effect of Washington’s tax on CO2 emissions – it is the goal.

Not surprisingly, Governor Inslee has denied the taxes are responsible for the jump in Washington’s gas prices.

Last week during a press conference he blamed the war in Ukraine for increasing gas prices in “Arkansas, New York, and Connecticut.” That would not explain why prices have increased in Washington state while they have declined in neighboring states unless the impact of the Ukraine war is only being felt here. And, as President Biden noted, gas prices nationally have been declining since the summer. The impact of Russia’s invasion of Ukraine has dissipated.

Echoing Department of Ecology staff two weeks ago, the governor also blamed oil companies for the increase, saying they “jacked up” the prices to increase profit. If so, the oil companies are choosing to limit their profit-taking to Washington state, choosing to forego increased profits in Idaho, Oregon, and the rest of the West Coast.

The increase in prices reflects increased costs in Washington, something we predicted last year. We were simply following the lead of the State of California and energy experts. When she announced her desire to adopt a “cap-and-invest” system like Washington’s, New York Governor Kathy Hochul made her first point the creation of a rebate program to “mitigate consumer costs.” Only in Washington state do politicians deny that taxes on CO2 increase gas prices.

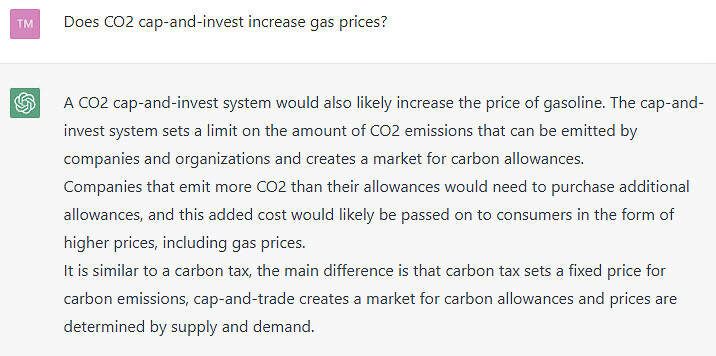

And if that wasn’t enough, I even asked ChatGPT, “Does CO2 cap-and-invest increase gas prices?” Evidence that AI is becoming more intelligent (or honest) than some politicians, it said “A CO2 cap-and-invest system would also likely increase the price of gasoline.” Frankly, it provided a very concise and accurate description of the program, and it is virtually identical to the Department of Ecology’s explanation.

The actual price of the CO2 taxes won’t be known until the end of February, when the Department of Ecology holds the first auction of CO2 allowances. Until then, fuel distributors have been left to guess at the cost because Ecology staff failed to put the system in place before the tax took effect. An increase of 25 cents per gallon implies an allowance price of about $31 per metric ton of CO2. This is more than the minimum price of $22/MT CO2, but still lower than the price estimated by the Department of Ecology and futures markets. If those estimates are accurate, gas prices would go even higher.

There is a risk from CO2 and climate change and we have long argued that providing incentives to reduce the risk is a good thing. We have also been very clear that the costs of that policy should be offset by tax cuts and that cost increases should be small. The current policy fails both of those tests.

We will continue to track the impact of the state’s tax on CO2 emissions as gas price data are released.

Todd Myers is the director of the Center for the Environment at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?