It is clear from the study that Washington’s anti-business approach to taxation, regulation and unstable fiscal policies isn’t attracting businesses to put down roots in Washington

Mark Harmsworth

Washington Policy Center

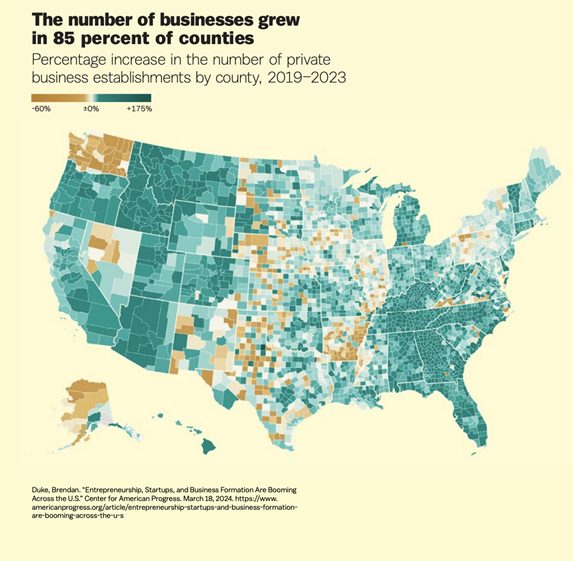

Following up on a Washington Policy Center (WPC) article that shows Washington is the 46th worst state in which to do business, a new study of business startups in the US also shows a bleak history of business growth in Washington over the last few years.

What’s more amazing is the report is from the left leaning Center for American Progress who normally champion progressive tax policy. The report details that while the rest of the US is seeing new business start-ups grow, despite federal government over-regulation, Washington is struggling compared to the rest of the county. This includes neighboring states Idaho, Oregon and California.

It is clear from the study that Washington’s anti-business approach to taxation, regulation and unstable fiscal policies isn’t attracting businesses to put down roots in Washington. Washington largest counties, King, Pierce, Snohomish, Clark, and Spokane, all experienced negative private business growth rates over the four-year period of the study.

The poor results depicted in the map are quite a come-down for a state that once prided itself on being “business friendly”.

Business capital and investment has become highly mobile in a post pandemic world. States, such as Washington, that overregulate and over tax will see investment leave the state and go to more business-friendly environments.

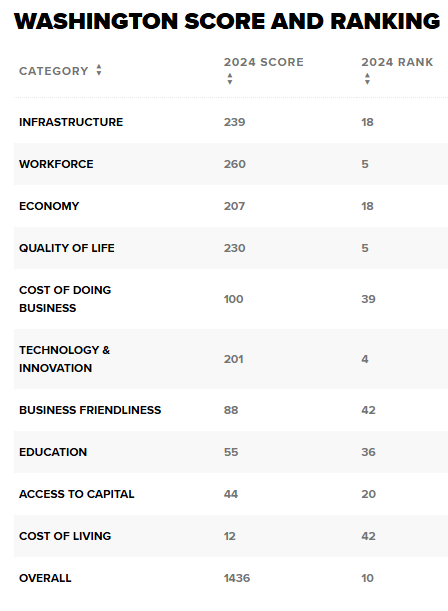

CNBC also publishes the Top States for Business and ranks Washington as in number 10. However, when you dig into the data, the factors used, which include Quality of Life and Technology, skew the results significantly. In the Business-Friendly category, Washington ranks 42. As a comparison, California ranks 47 for business friendliness. As a result of its poor ranking, California has seen some high profile companies exodus in the last 12 months.

Some of the factors that affect business in Washington include an expensive licensing process, Business and Occupation (B&O) taxes on gross income, including the ability for local municipalities to assess B&O at different rates and a state monopoly in workers compensation insurance that drives up rates.

Washington also has a complex destination sales tax that costs business thousands of dollars to comply with. Along with the myriad of smaller, time-consuming compliance regulations, makes it hard to do business in Washington.

A sales tax cut and repeal of the income tax on capital gains should encourage businesses to locate in Washington. Businesses look for a stable tax environment to start and run a business. Simplification of the license process, including an exemption threshold will reduce costs with minimal impact to state tax revenue. Opening up industrial insurance to private companies will reduce the cost of insurance.

Additionally, the Washington legislature passed initiative 2111 into law earlier this year to ban passage of new income taxes which will help stabilize the tax environment.

Washington is a fantastic place to live. If the legislature and governor’s office would get out of the way and help small businesses succeed, it would also be a great place to do business.

For more Washington Policy Centers recommendations, read the white paper that describes the simple changes that would have an immediate impact on the business climate and job growth in Washington.

Mark Harmsworth is the director of the Small Business Center at the Washington Policy Center.

Also read:

- Opinion: State CO2 report shows 86% of Washington’s claimed climate benefits are probably fakeTodd Myers argues a state climate report significantly overstates emissions reductions and raises concerns about data accuracy and accountability in Washington’s climate spending.

- Opinion: Majority party policies still making life more expensive for WashingtoniansRep. John Ley outlines his opposition to new taxes, raises concerns about state spending, and details legislation he plans to pursue during the 2026 Washington legislative session.

- Opinion: What happens when you build a state budget on the most volatile tax sources?Ryan Frost argues that relying on volatile tax sources like income and capital gains taxes risks destabilizing Washington’s budget and undermining long-term fiscal planning.

- Letter: Has $450 million been wasted on a bridge that’s too low for the Coast Guard with a foundation too costly to build?A Seattle engineer questions whether hundreds of millions of dollars have been spent on a bridge design he argues is unnecessarily risky and costly compared to an immersed tunnel alternative.

- Opinion: Fix Washington – House Republicans lead the charge against liberal chaosNancy Churchill argues that one-party Democratic control has driven up costs, weakened public safety, and harmed schools, and says House Republicans are offering a path forward through their Fix Washington agenda.

Tax & Spend Until The End! The State Of Washington Tries To Get Blood (Taxes) Out Of Turnips (Businesses)!

Small & Large Businesses Are Shutting Down Or Leaving This State of Confusion! Washington use to be a great state to have a Business many years ago. Good Bye Quality Of Life!