Elizabeth Hovde reports on the ongoings of WA Cares, the state-imposed, long-term-care program

Elizabeth Hovde

Washington Policy Center

We have lift-off! That was the theme at Tuesday’s meeting for the commission set up to oversee the ongoings of WA Cares, a state-imposed, long-term-care program that is supposed to be funded by Washington state workers and help some individuals fund activities of daily life, if they are needed someday.

Many workers likely noticed additional cuts to their paychecks this month, even if they hadn’t heard about WA Cares. The tax is 58 cents for every $100 earned.

Because the payroll tax just launched after an 18-month stall that seemed to take place not to fix all the troubles with WA Cares, but to work on a few of its most glaringly unfair details and shut up detractors until after an election, there was a lot of congratulatory talk and back-slapping of staff members for a job well done.

State agency workers have done a great job navigating the avalanche of exemptions they received in the last few years. Other accomplishments include offering employers tool kits and signage to play tax collector and handling a mountain of calls and complaints about the coming payroll tax.

An aggressive marketing campaign for WA Cares in the countdown to the launch of the state’s latest payroll tax is also seen by some as a success. I see it as inappropriate: Marketing by the state has not informed Washingtonians about the payroll tax or WA Cares’ details but has strived to create an affinity for WA Cares. A Department of Social and Health Services spokesperson said that between January and May, the state commissioned the placement of more than 2,500 TV ads and 6,600 radio spots about WA Cares. Digital materials for the program received nearly 74,000 clicks. (I might have accounted for a couple hundred of those clicks.) The ongoing administrative costs for WA Cares, which are not small, are going to be something to watch.

Recaps, exemptions and unknowns

Between the kudos given to state workers who helped get WA Cares launched, the Long-Term Services and Supports Trust Commission was given another recap of the program as well as an update on the growing number of exemptions people have sought.

While a limited opt-out window provided people who had private long-term-care insurance (LTCI) the opportunity to opt-out of the program and tax (that brought in nearly half a million exemption applications), the Legislature passed a law last year allowing more exemptions to be granted to people unlikely to ever qualify for a WA Cares benefit.

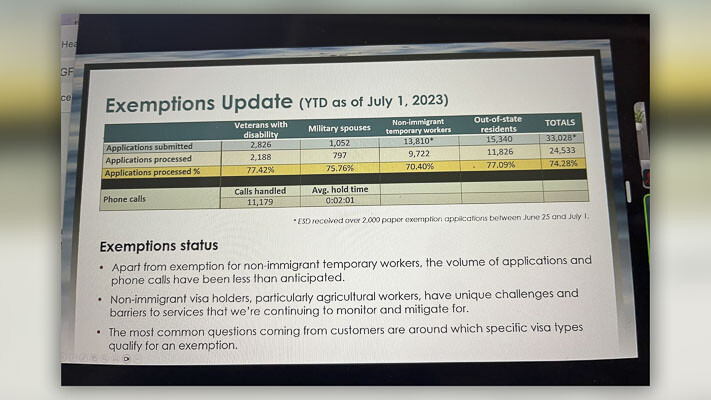

You have to be a state resident, pay the tax for 10 or more years without a five-year break and have several health needs to qualify for a WA Cares benefit. While many Washingtonians won’t meet all the qualification criteria, including those who move out of state in retirement and family caregivers who transition in and out of formal work, four groups of people are thought to be ruled out from the benefit from the get-go. They have the opportunity to seek voluntary exemptions from the tax. (They aren’t exempt automatically.) These Washington workers include those who reside outside of Washington state, military spouses, some disabled vets and people on non-immigrant work visas. As of July 1, more than 33,000 exemption applications have been received from people in these groups. The exemption requests can keep coming in and will, as people learn about the voluntary exemption. Unlike the window that closed on those who have or who want private LTCI, there is no window that will shut on these voluntary exemptions.

The state agency handling exemptions will request legislation that allows the non-immigrant visa worker group to receive automatic exemptions. The commission was told the number of paper exemption applications from, and information given to, this group of workers is time-consuming and unsustainable. (I say all of the groups should receive automatic exemptions.)

It was reported that there is still no solution for making the program benefit portable to other states in a way that can be done without raising the tax on workers or decreasing the program benefit outlined. And a workgroup is completing recommendations on what will be required of caregivers hoping to be paid with WA Cares dollars and will present them at a future meeting. We do already know that Service Employees International Union 775 will play a role in the training that the long-term-care law requires. The union heavily supported the passage of the law.

What didn’t come up at the meeting, perhaps rightly so, is that there are several lawmakers who have committed to trying to take the program and tax down in the next legislative session. See more about the efforts to get rid of WA Cares and its payroll tax in one of my previous writings here.

For now, the WA Cares show is going on — with money that Washingtonians could be using to take care of today’s life needs, savings and investments.

Elizabeth Hovde is a policy analyst and the director of the Centers for Health Care and Worker Rights at the Washington Policy Center. She is a Clark County resident.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?