After a year denying that the tax on CO2 emissions would meaningfully increase prices, the governor and others are now inventing new excuses for why their policy isn’t doing what they promised.

Todd Myers

Washington Policy Center

For more than a year, Governor Inslee and staff and the Department of Ecology claimed their new tax on CO2 emissions wouldn’t significantly increase gas prices. That turned out to be completely inaccurate, causing Ecology to scrub their web page of those erroneous claims. Now, they – along with climate activists – are changing tactic, attempting to blame others for the predictable results of their own policy. And their new excuses are as deceptive as their previous claims.

As gas prices in Washington increased, pushing the cost at the pump to the top in the nation, Governor Inslee, legislative leaders, and climate activists began blaming others for the intended impacts of the state’s new tax on CO2 emissions.

At the top of the governor’s list are the oil and gas companies. He claims they are making “80 cents of profit on every gallon.” When asked by KIRO TV if the new tax on CO2 emissions was to blame, he told the anchors, “The author of these gas prices are the oil and gas companies. Their rapaciousness, their greed, is beyond imagination. They are making 80 cents of profit on every gallon.”

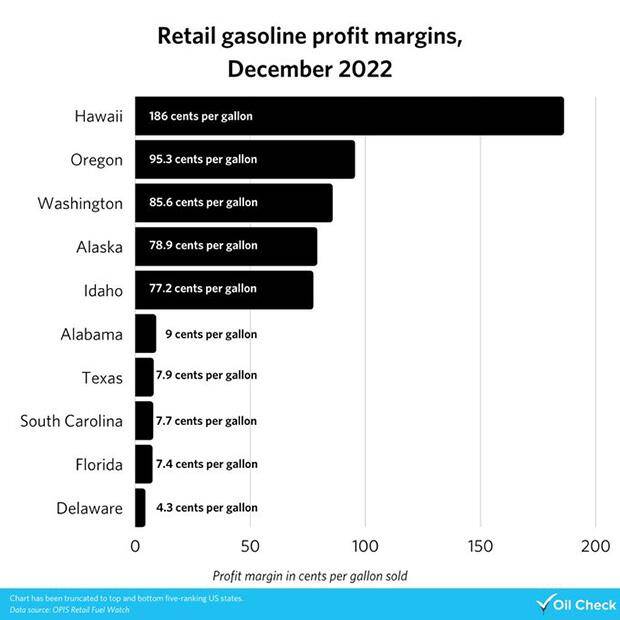

His words were echoed by Climate Solutions, a group who helped design the state’s climate tax. After Washington’s gas prices surged to the top in the nation, they tweeted the oil industry “made 85.6 cents in profits for every gallon of gas sold in WA,” and linked to a blog that included this mislabeled and inaccurate chart.

The claims from the Governor and Climate Solutions are entirely false.

The source they cite, the Oil Price Information Service (OPIS), says the statistic being cited doesn’t measure profit and isn’t about the oil industry.

I was able to contact the source of the data within a day and clarify the true meaning of the statistic.

The governor, Climate Solutions, and other legislators who have parroted these claims, apparently did no research to see if what he was claiming was accurate.

The claim about profits fails in three ways.

The data cited by Climate Solutions and the governor comes from OPIS’s Retail Fuel Watch which compares the gross margin between the price of gasoline sold at the wholesale terminal like a refinery (known as the “rack”) and the retail price at the pump, less taxes and a placeholder for freight. Last December, the difference between the price at the rack and retail averaged 85.6 cents per gallon in Washington state. The governor and Climate Solutions called that amount “oil company profit.” But that amount is gross margin and doesn’t include expenses.

First, the data they cite are from December 2022, before the tax on CO2 emissions took effect. Blaming the increase in gas prices that has occurred this year on data from last December is obviously inaccurate, but the governor and Climate Solutions are looking for the closest tool at hand, even if it is misleading.

Most recent OPIS data show the margins have declined since December. Perhaps the reason Climate Solutions used December is because more recent data aren’t as favorable to their claim.

Second, that amount cited by the Governor and others doesn’t go to the oil companies. That margin goes to gas stations, companies like Costco, Safeway, and other gas retailers. Many gas stations – even those that are branded – are owned locally, not by the oil companies. Saying that revenue goes to the “oil company” is simply wrong.

Third, the amount isn’t all profit. That amount is the gross margin between what gas stations pay for the fuel and what they sell it for before expenses. For example, for every credit card purchase, credit card companies typically take anywhere from two to three percent. At $5 per gallon, that can be as high as 15 cents per gallon. That comes out of the 85 cents. So do all other station expenses. The amount of profit is whatever is left over from that 85 cents per gallon after all other expenses.

Brian Norris, Executive Director of Retail Fuels at OPIS explained to me that they don’t track overall profits (average margins multiplied by average volumes per site) for Washington state, so how much ends up in the pockets of gas station owners is unclear.

What Climate Solutions claims is “oil company profit” isn’t all profit and it doesn’t go to the oil companies, but rather this is the gross margin for every gallon sold that the fuel retailer makes. Traditional oil companies no longer operate a significant portion of retail stations in the U.S.

It did strike me as strange that gas station margins varied so widely between states. Why would costs vary so much? Norris said there are several things at work.

He noted that in many parts of the country, gas sales have rebounded a lot more than they have on the West Coast compared to pre-COVID levels (about 15% behind pre-COVID levels for much of the rest of the country), but that on the West Coast they are still about 25 percent down. That means the margin from each gallon of gas must go farther just to pay things like rent, labor, etc.

Rather than looking at margin, which can be misleading, Norris said we should look at overall station profitability on fuel, combining margins with volumes. California is the only state on the West Coast where OPIS tracks station profitability and profit is down for the week ending July 1, 2023 compared to the same week last year.

Focusing on margins while ignoring costs and volumes tells a misleading story.

Remarkably, even if that 85 cents represented profit, it is still less than Washington is taking between the gas tax of 49.4 cents per gallon, and the about 44.3 cents per gallon from the tax on CO2 emissions – 93.7 cents per gallon. Complaining about the “rapaciousness” of the oil companies when the state of Washington takes more per gallon than anyone else is pretty brazen.

But the whole discussion about the impact of the tax on CO2 emissions has been brazen. Climate Solutions’ claims that the climate tax isn’t increasing gas prices are particularly disingenuous. One week before Washington took the top spot in national gas prices, their director had no problem telling the Everett Herald that the goal of the tax was to increase gas prices to push people to electric vehicles.

Suddenly, when gas prices became a political issue, they changed their tune.

It follows the strategy identified by Seattle Times columnist Danny Westneat, who said advocates of the state’s new tax on CO2 emissions engage in “strategic misinformation” (i.e. lies) to support the law because if they were honest, the public would oppose the policy.

This is only the latest example of dishonesty by the Governor and Climate Solutions – misusing a statistic in a way the source says is completely inaccurate.

After a year denying that the tax on CO2 emissions would meaningfully increase prices, the Governor, climate activists, and state agencies are now rapidly inventing new excuses for why their policy isn’t doing exactly what they promised. And just like their previous excuses, this one is again false and misleading. It won’t be the last time.

Todd Myers is the director of the Center for the Environment at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?