Mark Harmsworth of the Washington Policy Center explains how high license fees destroy jobs and disincentives businesses from expanding into new areas to create new jobs

Mark Harmsworth

Washington Policy Center

Small businesses (and in fact all businesses in Washington) are seeing exponential cost increases in business license fees charged by local municipalities. Many cities are now charging business license fees based on revenue, employee counts and hours worked, rather than a fixed fee.

The latest city to consider increasing its fees is Tacoma with an increase to $1,000. This is an increase of 400% over last year’s fee ($250) for businesses with revenue over $1 million.

Complicating the calculation of the license fee charged, is the requirement, by some cities, to count only the hours that an employee works physically inside the city limits, or where a nexus is created. State law explicitly restricts a city from requiring a business license when work is performed from outside the city limits, as is the case for many remote service providers.

These fees can add up to several thousand dollars for a small business, and for larger corporations, several million dollars.

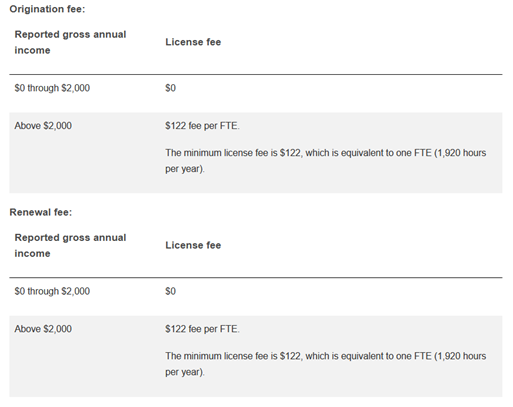

Using the City of Redmond as an example, the cities original business license structure was created in 1996 and has been updated most recently in 2020. For a small business of 5 full-time employees located inside the city limits with revenues above $2,000, the annual fee would be 5 x $122, or $610. The original fee was $10 per employee in 1996 and through a series of council actions, by 2022 had increased to $122 per full time employee, over a 1,100% increase.

For some of the largest employers in Redmond, the fees will be in the millions of dollars.

The problem is compounded when businesses operate in multiple jurisdictions. For businesses that only operate in one municipality, the filing is relatively simple. However, for businesses that operate in multiple locations, the license fees become significant. A business may be located within one City, but is required to pay license fees in every city it operates in.

The filing process, while more streamlined due to the recent requirement for municipalities to use the Washington Department of Revenue centralized system, is complicated by the requirement to calculate the revenue generated in each city while physically located inside the city limits.

The business license qualification requirement requires the business to track the hours and revenue for work performed inside and outside the city limits separately. In the case of a contractor, who may only perform a minimal amount of work inside the city, this is a massive administrative burden.

Many businesses, because of the difficult licensing process, do not bother applying for a license, particularly if the work being performed is minimal, or infrequent within a jurisdiction’s boundaries. As fees increase, the profit from the work in the jurisdiction is reduced and the incentive to ignore licensing requirements increases. Complicating the process further, is each municipality has different rules, fees and qualification processes.

Licensing fees are a hidden cost of doing business and these costs are added to the cost of products and services that businesses provide and, in some jurisdictions, provide no benefit or service to the business as other taxes pay for essential services inside the city limits.

High license fees destroy jobs and disincentives businesses from expanding into new areas to create new jobs.

Mark Harmsworth is the director of the Small Business Center at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?