Jason Mercier of the Washington Policy Center offers a decade of research and short educational videos discussing this income tax

Jason Mercier

Washington Policy Center

The State Supreme Court will hear oral arguments on the capital gains income tax lawsuit at 9 a.m. on January 26. TVW will broadcast the hearing. Here is a decade of research and short educational videos discussing this income tax:

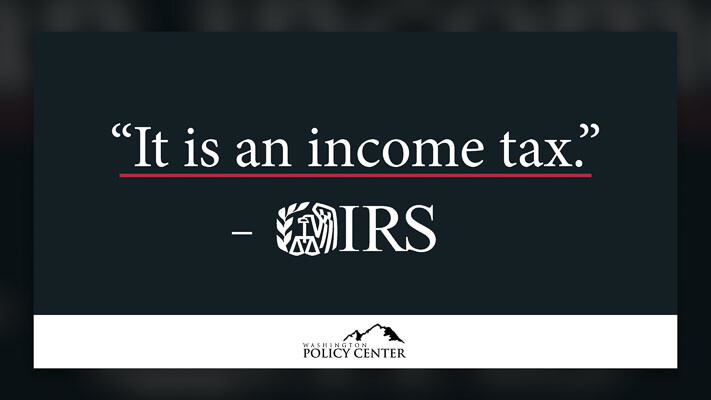

- IRS: Capital gains tax “is an income tax”

- Summary of capital gains income tax amicus briefs

- Washington’s constitution has broadest definition of property in the country

- Lawmaker’s emails confirm goal for capital gains proposal is broad income tax

- Public records reveal WA DOR’s thoughts on capital gains income taxes

- State Revenue Departments Describe Capital Gains Income Taxes

- Capital gains income tax quotes – who said it?

- State tax officials across country agree – capital gains income taxes are extremely volatile and unpredictable

- WA Department of Commerce: No state income tax “is great marketing” for Washington

- Attorney General goes on capital gains income tax rabbit hunt

- Capital gains income tax webinar with Rob McKenna

- Former IRS attorney “dumbfounded” by Washington’s capital gains income tax arguments

- UW Tax Law Professor on new capital gains income tax: “It’s going to be found unconstitutional”

- WPC played important role in capital gains income tax being ruled unconstitutional

Jason Mercier is the director of the Center for Government Reform at the Washington Policy Center.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?