The changes were passed as part of the 2025-27 biennial budget package, which lawmakers approved in May, and are projected to generate billions in revenue

Carleen Johnson

The Center Square Washington

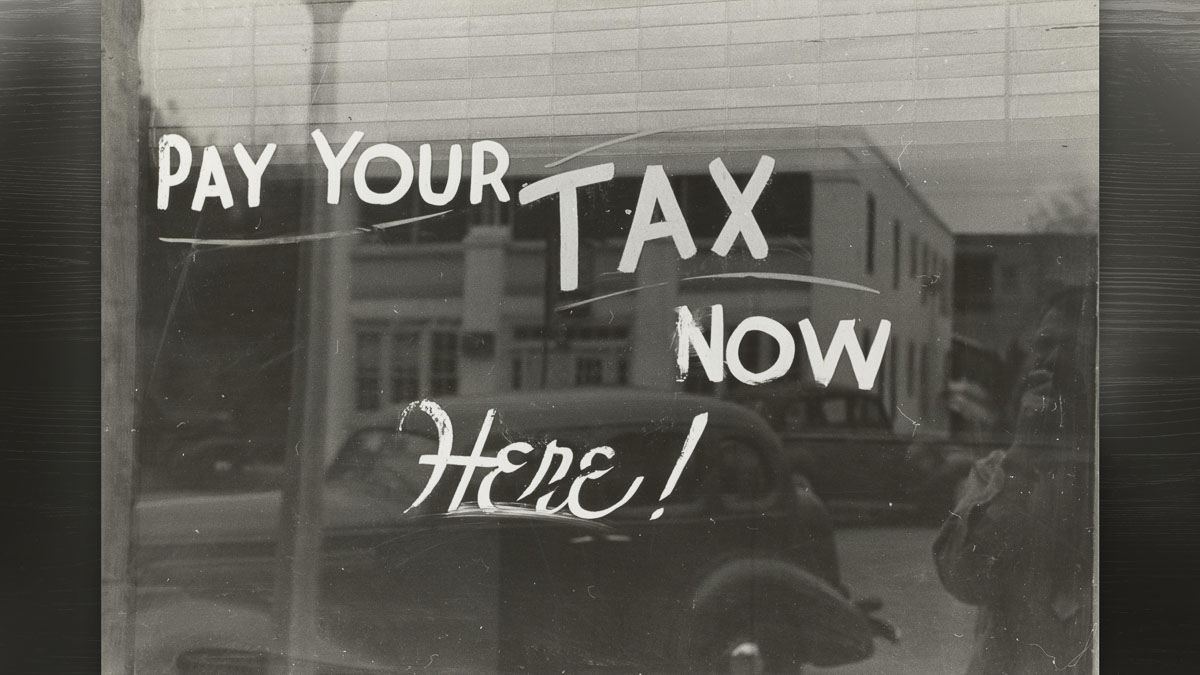

A new slate of taxes goes into effect on Wednesday. The changes were passed as part of the 2025-27 biennial budget package, which lawmakers approved in May, and are projected to generate billions in revenue.

The changes include an expansion of the retail sales tax to several new services and increased B&O tax rates for financial institutions and large service businesses.

But there are many questions about which sectors of the economy have to pay these new taxes, how they will be collected, and what the impact will be on the economy.

As reported by The Center Square, cable giant Comcast believes the newly required sales tax on digital advertising services is illegal and is suing to stop it.

Comcast claims the new law is discriminatory and violates the Internet Tax Freedom Act by exempting non-Internet advertising services while taxing most Internet-based advertising.

The Department of Revenue held listening sessions over the summer to educate the more than 90,000 businesses impacted by the new taxes.

Feedback surveys from DOR included responses that were dominated by frustration and confusion from a variety of groups representing various industries, including farm labor and agriculture, event staffing, professional consultants, travel and hotel, healthcare staffing (dental offices), and school districts.

“Respondents were concerned with over-taxation and the impact on small businesses… Many expressed that this tax would negatively impact their business. Respondents also expressed frustration with Washington’s tax structure and past policy decisions, as well as complexity and administrative burden,” DOR reported.

Sample comments included the following:

- “This will likely drive me out of business.”

- “Stop taxing everything.”

- “We now hire out-of-state through agencies to avoid compliance burden.”

Sen. Drew MacEwen, R-Shelton, told The Center Square that Washingtonians are already hurting enough under the current tax burden.

“I got an email from a constituent, who happens to be a Democrat, and said, ‘Hey, are these tax increases true?’ It’s affecting his business. I told him yes, that’s what you get with a progressive Democrat majority,” the senator said. “And so, I dare say there’s probably a fair number of people still that aren’t even aware of this tax that’s kicking in tomorrow, and that’s a real concern.”

The new tax burden applies the retail sales tax to additional services, including advertising, temporary staffing, live presentations, and information technology services, among others.

“That’s one of the biggest dangers in all of this, too,” MacEwan continued. “You could have a small business, a mom and pop shop that is operating with every intent of operating under the law, and be subject to this tax. They’re not even aware of it. And you know, it could be six to eight months from now, the Department of Revenue turns around and says they owe. It could be a five-digit tax bill.”

Rep. Ed Orcutt, R-Kalama, also spoke with The Center Square on Tuesday about the new taxes.

“This was kind of billed as being a tax on business, but ultimately anytime you hit a business with a new tax or a new fee, or any kind of new regulatory cost … that eventually gets passed on to the consumer because the business cannot perpetually absorb that,” Orcutt explained. “The problem is these businesses have to figure out by tomorrow morning if they’re charging sales tax.”

Orcutt said there will most certainly be unintended consequences that lawmakers will have to address in the 2026 session.

“They’ve taxed so many people so much that now they’re really digging down to try and find who they can tax next, and ultimately it ends up being the consumer,” he said. “The business eventually must pass that cost on, even if they don’t collect the sales tax directly from the end user. The cost gets added into their total cost of doing business, which ends up affecting prices down the road. And it may not be immediate, but at some point, they’re not going to be able to absorb that kind of a cost.”

Proponents argue that the tax changes are necessary to generate revenue and address the state’s budget shortfall. The state’s most recent revenue forecast, released earlier this month, revealed that revenue projections were down by approximately $900 million through 2029.

Additional transportation-related fees also take effect on Wednesday.

Washington State Ferries is adding a 3% increase to vehicle and passenger fares on all routes.

Public and private transit services that were previously exempt must now pay tolls on the SR 520 floating bridge and the Tacoma Narrows Bridge.

This report was first published by The Center Square Washington.

Also read:

- Opinion: Neighbors for a Better Crossing urges Oregon Legislators to demand full audit of IBR project, echoing Washington’s HB 2669Gary Clark of Neighbors for a Better Crossing urges Oregon lawmakers to pursue an audit of the Interstate Bridge Replacement project similar to Washington’s HB 2669 proposal.

- Opinion: ‘Privacy’ is not a license for government secrecy – Supreme Court’s Mirabelli Ruling puts Washington’s school parental notification policies on noticeVicki Murray argues a recent U.S. Supreme Court ruling on parental notification policies could affect Washington’s approach to student gender identity nondisclosure in schools.

- WA Senate narrowly advances bill to reduce education spending by $176M through 2031The Washington Senate passed a bill by a 25-24 vote that would reduce and delay some education funding to help address the state’s budget shortfall.

- Opinion: Climate Commitment Act – Washington’s hidden carbon tax hits hardOpinion, columns, Washington state, Climate Commitment Act, CCA Washington, Washington carbon tax debate, Washington gas prices, Nancy Churchill, Dangerous Rhetoric, Washington climate policy, Washington fuel costs, Travis Couture, Washington Department of Ecology, Washington Department of Commerce, Washington carbon credit auctions, Washington cap and trade program, Washington environmental policy

- Legislation from Rep. David Stuebe to strengthen Medicaid support for emergency ambulance services moves closer to becoming lawA bill from Rep. David Stuebe updating Medicaid reimbursement for emergency ambulance services passed the Senate and now heads to the governor’s desk.

- Coffee Caturday is this Saturday in Battle Ground sounds purrrrrfectCoffee Caturday on March 7 will bring pet-themed vendors, coffee, and donation opportunities to the Battle Ground Senior Center.

- WA governor: Passage of income tax could slip to 2027Gov. Bob Ferguson warned Washington lawmakers may need until 2027 to finalize a proposed tax on income above $1 million as negotiations continue over how to use the revenue.