The Ridgefield School District budgeted a roughly $3 million loss for 2023-2024 and is projecting a roughly $1.3 million loss now. Ridgefield resident Heidi Pozzo doesn’t believe it is due to a lack of funding.

Heidi Pozzo

for Clark County Today

By now you’ve probably seen the news from Clark County Today that school districts are struggling with budgets. Those struggles aren’t confined to larger school districts, virtually every school district in the area is working on budget shortfalls.

Will Ridgefield School District suffer the same fate?

You may recall that Ridgefield budgeted a roughly $3 million loss for 2023-2024 and looks to be projecting a roughly $1.3 million loss now. But it isn’t due to a lack of funding.

The chart below shows Ridgefield revenue sources by type. The blue bar at the bottom is primarily EP&O levy funds. The orange bar is funds received from the state. The light blue bar is primarily bond levy funds to pay for past bonds and the green bar is a combination of state matching funds for construction projects and impact fees. The big jump in the green bar in 2017-2018 reflects receipt of state matching funds related to the last bond and reimbursement from the City for the sports complex and RACC.

Revenue went from about $20 million to just shy of $80 million in 12 years.

That is a 291 percent increase in funding between the 2012-2013 school year and the budgeted 2023-2024 school year.

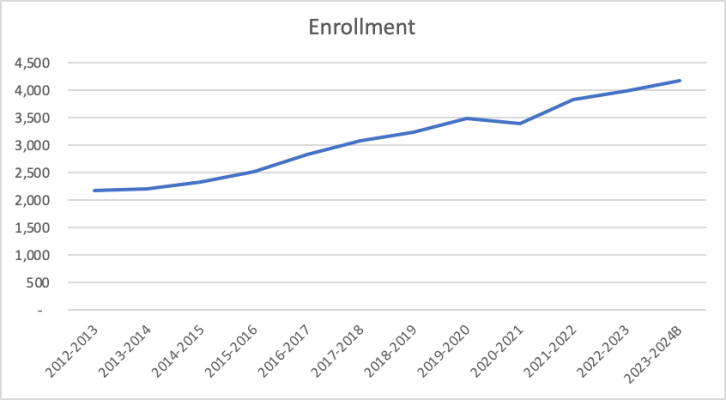

You’re probably thinking that enrollment has increased during this period. It has. By 92 percent.

In case you were wondering, inflation was up 35–37 percent depending on which calculator you use.

So, revenue is up 291 percent while inflation is up 35-37 percent and enrollment is up 92 percent.

That means costs are going up much faster than inflation and enrollment.

What does this have to do with bonds?

There’s a link between capital expenditures — new schools, expansions, etc. — and operating budgets. When new schools open, there is a need for more money to run the school. New administration, utilities, grounds keeping, cafeteria staff, etc. all need to be paid for. Additionally, when new programming space is added like a metals lab or CTE space, we should expect additional budget needs to run the new or expanded programs. There’s not any information available to understand how much cost this bond will add to operations.

But we do know that more levies are in the works in addition to this bond.

The new bond will add $9.7 million per year based on the $1.30 rate and the assessed property values in the 98642 zip code of about $7.5 billion in 2025.

Additionally, the bond worksheet provided also shows a levy rate increase next year as the current levy expires. There was also commentary at the March 12 Board meeting that another bond or capital levy is needed for capital maintenance.

That means the nearly $80 million in revenues will turn into more than $90 million in the 2025-2026 school year. Is it enough or will losses continue to mount?

Getting the needs and cost right on the bond impact both the cost of the bond and the cost to operate the schools. We’ll find out what voters think in April.

Heidi Pozzo has been a Ridgefield resident for 16 years. She is a concerned citizen who would like students to get a good education and thinks we can do it in a more cost-effective way.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- POLL: Should biological males who identify as females be allowed to compete in athletic events against biological females?Should biological males who identify as females be allowed to compete in athletic events against biological females?