The brief in question was submitted by the Building Industry Association of Washington and Washington Retail Association

Lawrence Wilson

The Center Square

The Washington Supreme Court has rebuffed Attorney General Bob Ferguson’s request that it refuse to accept an amicus brief Ferguson deemed “offensive.”

The brief in question was submitted by Building Industry Association of Washington and Washington Retail Association in an appeal of the case Quinn v. Washington State Department of Revenue, which challenged the constitutionality of the state’s capital gains tax, enacted by the Legislature last year.

Ferguson objected to the brief in a Dec. 15 motion to the Supreme Court on the grounds that it questions the integrity of the Legislature by arguing that it knowingly passed a law that violates the state Constitution, also that the Court would tarnish its reputation by upholding the action.

“The BIAW and WRA may disagree with that policy, but their claim that a ‘tyrannical legislature’ is purposefully evading decisional law from this Court is both wrong…and offensive,” Ferguson wrote, asking the Court to either reject the brief outright or require the authors to revise and resubmit it without the language he considered inappropriate.

The Court declined to do so without comment, issuing a notice to the BIAW on Dec. 21 that the brief had been accepted.

An amicus brief is intended to provide an appellate court with additional information or arguments it may wish to consider before making a ruling.

“We are pleased that the Court has accepted our brief on behalf of the nearly twelve thousand businesses we represent,” Jackson Maynard, General Counsel to the BIAW, told The Center Square by email. “We were right to criticize the Legislature’s passage of a law in defiance of 100 years of case law.” He added, “We now look forward to the State’s response now that they are forced to contend with the merits of our brief.”

Douglas County Superior Court Judge Brian Huber ruled the tax unconstitutional in March in that it amounts to a progressive income tax. The case made its way to the state Supreme Court, where it is scheduled for a hearing on Jan. 26.

In support of the claim that lawmakers knowingly enacted a law that would not withstand the test of constitutionality, Jason Mercier of Washington Policy Center had pointed to an email exchange among legislators proposing that by enacting a capital-gains tax they could circumvent the legal prohibition against a progressive income tax.

The April 20, 2018, email from Sen. Jamie Pederson, D-43rd Dist., states, “But the more important benefit of passing a capital-gains tax is on the legal side, from my perspective. The other side will challenge it as an unconstitutional property tax. This will give the Supreme Court the opportunity to revisit its bad decisions from 1934 and 1951 that income is property and will make it possible, if we succeed, to enact a progressive income tax with a simple majority vote.”

The email was made public by Washington Policy Center in March 2020.

This report was first published by The Center Square Washington.

Also read:

- CCSO discovers human remains in homeless campOn Monday, CCSO patrol deputies, acting on an online report from a resident, located partially decomposed human remains in a tent structure at a transient camp in the wooded area north of NE 179th St near NE 10th Ave.

- Union High School baseball celebrates those who serve at Honor GameThe Union High School baseball team invited veterans, first responders, and educators to their game against Battle Ground on Tuesday to participate in their Honor Game, celebrating those who serve others.

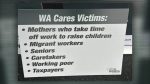

- If voters decide to repeal WA Cares, will the state refund tax collections?If voters approve Initiative 2124 this November to repeal the program known as WA Cares, workers can opt out of having 58 cents out of every $100 earned deducted from their paychecks.

- County Permit Center moves to new office in Public Service CenterThe Clark County Permit Center has a new home within the Public Service Center.

- City of Vancouver wants to hear from the public about city manager recruitment surveyThe city recently launched a nationwide recruitment process to hire Vancouver’s next city manager.

- Vancouver Fire responds to house fireOn Tuesday (April 23) at 3:45 p.m., the Vancouver Fire Department was called for a house fire at 100 S. Knoxville Way.

- Ridgefield School District school bond proposal appears to be failingThe first results of the April 23 special election show the school bond proposal in the Ridgefield School District is currently failing approval.