A half year or more of tax savings could be available

The COVID-19 pandemic has delivered a lot of bad financial news to citizens. But for the roughly 75,000 Clark County residents who work in Oregon, there may be some good news. Those citizens may be able to save significantly on Oregon income taxes if they have worked from home the past month.

Vancouver CPA Dan Barnes has many clients who work in Oregon and have to pay the 9 percent Oregon income tax rate each year on the money they earn in Oregon.

“If you’re a non-resident, the state of Oregon allows you to exempt those wages you’ve earned outside the state of Oregon, from Oregon income tax,” said Barnes, who added that money earned from a full day’s work in Washington wouldn’t apply.

In the era of COVID-19, during which a significant number of people are working from home, Washington residents should document all the days they worked from home, preferably on a calendar or have some other written record.

Barnes indicated it is acceptable for your employer to provide documentation on your behalf as well.

“The rule is, the number of days worked outside Oregon versus the number of days worked inside Oregon,” said Barnes. “If you work 180 days, and 60 of them, you work outside the state of Oregon, then you get to exempt one third of your wages from Oregon income tax.”

“The trick is, it’s days worked — total days worked, versus total days worked in Oregon,” said Barnes. “So day’s worked does not include vacation, holidays, or sick time. It’s actually the number of days worked. I recommend everybody take advantage of that.”

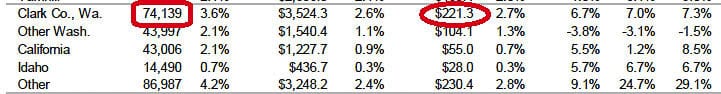

The Oregon State treasurer issues an annual report on where income taxes are received. Clark County routinely contributes the eighth largest amount of income taxes to Oregon. In 2017 (the latest information available), 74,139 Clark County residents paid $221 million to Oregon. Another 43,997 Washington residents paid $104 million to Oregon.

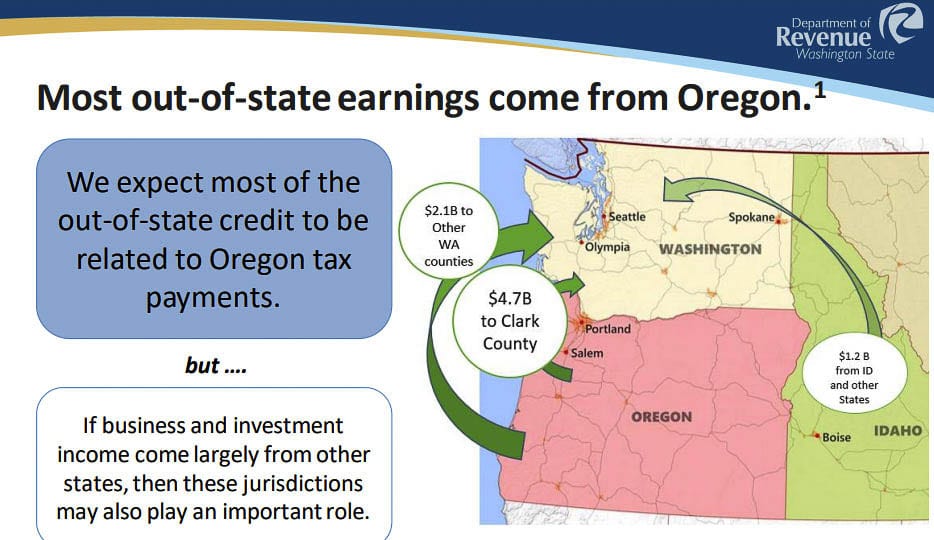

The Washington State Department of Revenue estimated Washington residents paid $325 million to Oregon in a July 2020 report. Clark County Residents earned $4.7 billion in Oregon according to the report, which was based on federal income tax returns.

According to the Oregon Department of Revenue, roughly 7 percent of people who make their living in Oregon, make their home in some other state. Not surprising to anyone driving the two bridges over the Columbia River during rush hour, four out of five of these nonresident workers come from Southwest Washington.

The total Oregon personal income tax liability of nonresidents was nearly $639 million in 2017, or 8 percent of the total tax liability according to the Oregon Department of Revenue,

Oregon rule 150-316-0165 provides this clarification: “Physical presence is determined by the actual physical location of the employee performing the services and not by the location of the employer … employees who work in Oregon and at an alternate work site located outside of Oregon may allocate their compensation under the provisions of this rule.”

As always, people should consult their tax advisor for details and how this rule applies to them.