Gov. Jay Inslee’s $70.4 billion budget proposal assumes $1.4 billion in revenue from the capital gains income tax that lawmakers passed and the governor signed into law in 2021

Brett Davis

The Center Square Washington

The majority party’s top budget writer in the Washington State Senate can’t say if the state’s 2023-25 operating budget will include anticipated revenue from a new capital gains income tax currently in legal limbo.

“I don’t know the answer to that right now,” Sen. Christine Rolfes, D-Bainbridge Island, told “Inside Olympia” host Austin Jenkins during a Thursday appearance on the TVW program. “Ideally we’d get an answer from the Supreme Court before April, but we can’t count on that.”

The chair of the Senate Ways & Means Committee continued, “And how we decide to budget, I don’t know if we’ll do what the governor did, or hold some back. I don’t know the answer.”

Gov. Jay Inslee’s $70.4 billion budget proposal, which he released last month, assumes $1.4 billion in revenue from the capital gains income tax that lawmakers passed and the governor signed into law in 2021.

Targeting the state’s wealthiest residents, the measure adds a 7% tax on capital gains above $250,000 a year, such as profits from stocks or business sales.

That is, assuming the tax passes constitutional muster with the Washington State Supreme Court.

On March 1, 2022, Douglas County Superior Court Judge Brian Huber ruled the tax was “properly characterized as an income tax…rather than as an excise tax as argued by the State” and struck it down. The state constitution’s uniformity clause does not allow income to be taxed at different rates.

Huber said the tax “is declared unconstitutional and invalid, and therefore, is void and inoperable as a matter of law.”

Washington Attorney General Bob Ferguson asked the state Supreme Court to take up the case on direct appeal. This past summer, Washington’s highest court agreed to do so.

In November 2022, the Supreme Court stayed the lower court’s order, allowing the state Department of Revenue to administer and collect the tax in the meantime.

That has resulted in a situation in which the Supreme Court will hear oral arguments in the case on Jan. 26, with the tax going into effect on Jan. 28, per the DOR.

The ranking Republican on the Senate Ways & Means Committee, appearing on the same “Inside Olympia” program, was skeptical of counting on revenue from the disputed tax.

“It probably won’t be decided before the end of the year when we have the budget done,” Sen. Lynda Wilson, R-Vancouver, said. “It is $1.4 billion that he is banking on, and it’s already been declared unconstitutional by a superior court judge.”

She pointed out that counting on revenue from the tax could cause problems down the road if the Supreme Court rules against the tax.

“I’m a little surprised that they went ahead and banked on that $1.4 billion, because if it does come back after the budget, then we’ll have a hole in the budget,” Wilson observed. “And then what happens, right? Where do we get the funding if everything else has been spent? It’ll then give them an open door toward maybe tax increases.”

At least one Democratic legislator thinks it’s a bad idea to assume revenue from the tax, indicating doing so could imperil the state’s financial standing.

“I’ll just say, in the last few years Washington has earned a AAA bond rating, and to have earned that rating because of fiscal responsibility of making sure that we have a rainy day fund, making sure that we are spending wisely,” Sen. Manka Dhingra, D-Redmond, said at a Jan. 6 legislative preview hosted by Seattle City Club.

It’s not prudent to depend on something that has yet to happen, she indicated.

“I know it’s out there,” the Senate deputy majority leader said of the tax, “but I don’t think you can rely on it until you have it.”

This report was first published by The Center Square Washington.

Also read:

- Union High School baseball celebrates those who serve at Honor GameThe Union High School baseball team invited veterans, first responders, and educators to their game against Battle Ground on Tuesday to participate in their Honor Game, celebrating those who serve others.

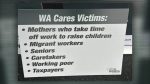

- If voters decide to repeal WA Cares, will the state refund tax collections?If voters approve Initiative 2124 this November to repeal the program known as WA Cares, workers can opt out of having 58 cents out of every $100 earned deducted from their paychecks.

- County Permit Center moves to new office in Public Service CenterThe Clark County Permit Center has a new home within the Public Service Center.

- City of Vancouver wants to hear from the public about city manager recruitment surveyThe city recently launched a nationwide recruitment process to hire Vancouver’s next city manager.

- Vancouver Fire responds to house fireOn Tuesday (April 23) at 3:45 p.m., the Vancouver Fire Department was called for a house fire at 100 S. Knoxville Way.

- Ridgefield School District school bond proposal appears to be failingThe first results of the April 23 special election show the school bond proposal in the Ridgefield School District is currently failing approval.

- Opinion: Not guilty verdict appropriate resolution in case of VPD officerClark County Today Editor Ken Vance offers his praise to the jury in the trial of Vancouver Police Officer Andrea Mendoza.