The district would need voter approval to approach the state’s new lid for local levies of $2.50 per $1,000 of assessed home value

VANCOUVER — The Vancouver School District is mulling whether to ask area voters to shell out a bit more money.

The state legislature’s passage of SB 5313 allowed districts to raise up to $2.50 per $1,000 of assessed property value for local education and operations levies, up from the previous $1.50 per $1,000 limit (some districts can raise a per-student amount, depending on enrollment, but that option doesn’t apply to districts in Clark County).

But several districts, including Vancouver and Evergreen, have already run and passed replacement levies at the former cap of $1.50 per $1,000. To raise that amount they would need to have voters approve a supplemental levy.

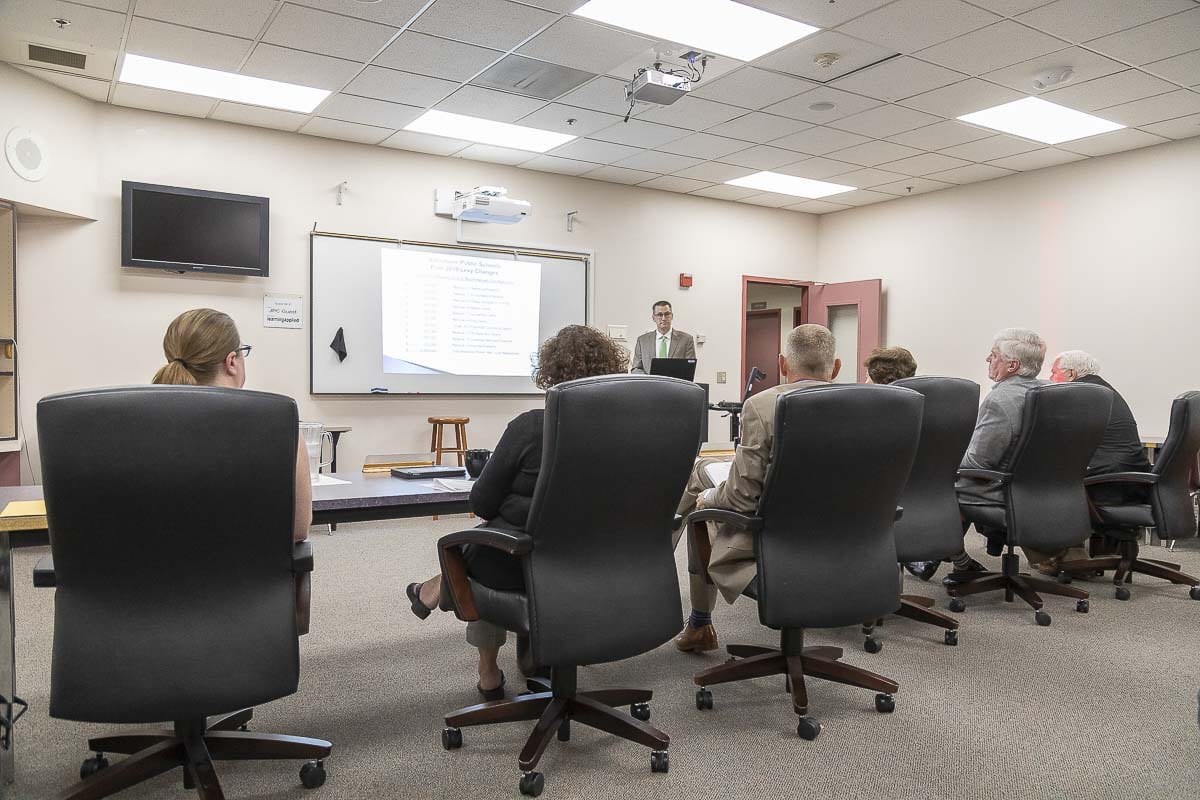

The option of doing that was the topic of a work session this week for the Vancouver School Board.

Facing a massive budget shortfall going into next year, Vancouver used $10.3 million in one-time funding to stave off cuts that included 21 teaching positions, a dozen counselors, custodial cutbacks, and more. A total of $3.8 million of that came from the district’s ending fund balance, and $6.5 million was a one-time infusion from the state negotiated by Sen. Annette Cleveland as a levy equalization amendment.

“We can all do the math,” said District CFO Brett Blechschmidt during the work session. “We have $10.3 million of services that are being sustained with one-time money, so there would still be some difficult conversations even under that scenario.”

On May 28, the Management Task Force, an advisory group to Vancouver Public Schools (VPS), took a look at the possible fallout of SB 5313.

“The group’s advice? Let the community have a say, put the issue before voters and let them weigh in,” said District Superintendent Steve Webb at Tuesday’s meeting.

Webb pointed out that the services that were saved through the use of one-time funds this year are not part of the state’s prototypical basic education funding model.

“Now, that does not mean that our community hasn’t come to expect that level of service and support for their children and their public schools,” he added. “The simple fact is the legislature has chosen to staff and fund our schools at different levels. Let’s be clear about that.”

In the meeting, Webb repeatedly referred to the legislature’s McCleary funding fix for basic education as a “mess” and said the changes made during this most recent session will do nothing to fix that. Board Vice President Mark Stoker wondered “if we choose to go out and get money to fund these positions, is that supplemental to what the state defines, or are we still in the same McCleary conundrum of funding basic education out of local levies?”

Webb said that question could define the next round of potential litigation over how the state is funding basic education, and a lack of funding for special education that was only touched on this past session.

“As this plays out, as the dust post-McLeary mess settles, there is some conversation statewide about potential litigation around special-ed underfunding,” said Webb. “What we know is that, even with the additional $77 million in the biennial budget, which is going directly into supports in classrooms, it’s still a long ways from the $350 to $400 million shortfall that OSPI (Office of Superintendent of Public Instruction) has already identified.”

According to Webb, VPS will receive somewhere around $850,000 in additional special education funding from the state due to this year’s legislative changes, but that still leaves the district paying around $5 million out of local funds for services mandated by the state.

“We have no option other than to redirect resources to pay for those costs,” said a visibly frustrated Webb, “or risk due process hearings or litigation.”

Board urges caution

According to Blechschmidt, if the district wants to receive any funding from a supplemental levy in time for next year’s budget, it would need to be on the ballot this November.

“I’m concerned about tax fatigue,” said Board President Rosemary Fryer, “and I’m not saying we shouldn’t give voters an opportunity to say ‘yay’ or ‘nay’ to a levy, I just feel like we always keep shifting the legislative responsibility back to the taxpayers, and I just get … it’s not right.”

Stoker agreed.

“I’m also mindful of a significant voice that there’s school funding fatigue,” he said. “There’s definitely a position out there that we have a big enough budget to do what we need to do, and what we really need to do is reprioritize where we’re spending it.”

At the end of the work session, the board seemed in agreement that more time and public input was needed before going to the voters. That would mean a community survey and other meetings to determine if voters have the appetite for any more local school funding, and at what level.

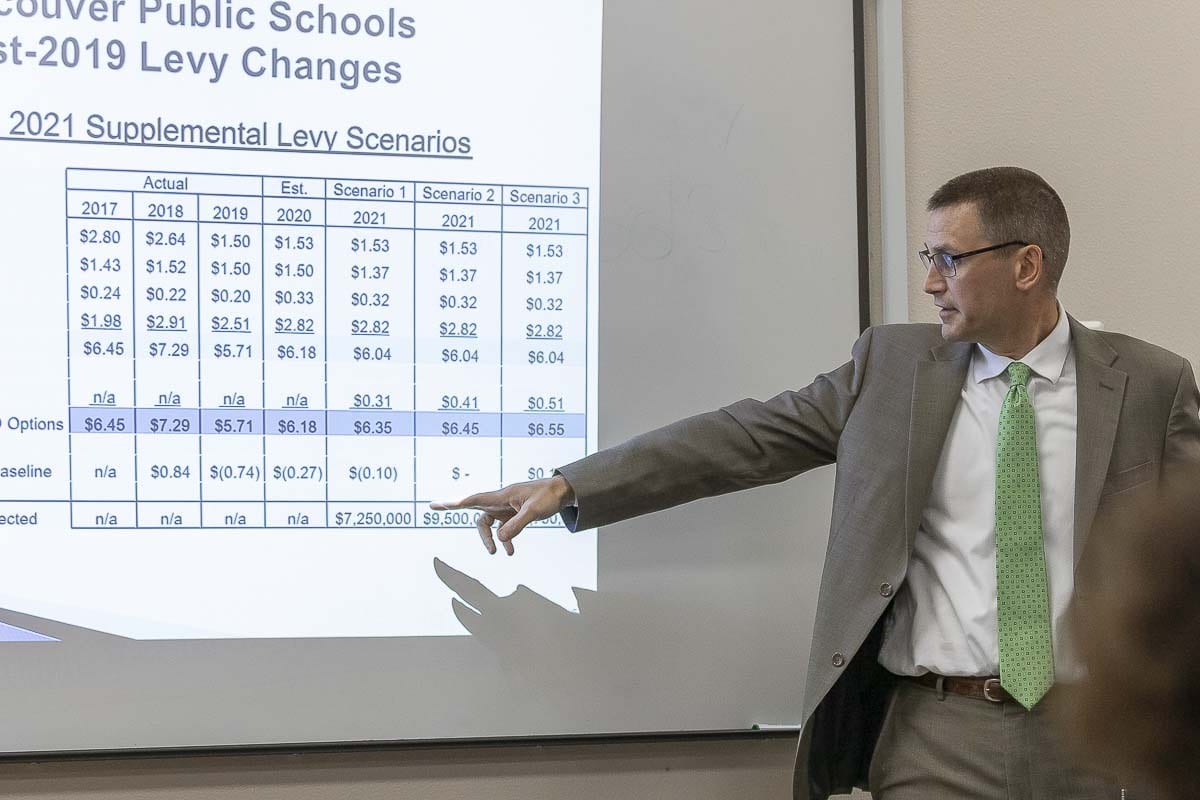

Blechschmidt presented several options, compared against 2017 tax levels because those were the last stable year before taxes went up last year before falling again temporarily this year.

“We believe, practically, the soonest we could get that before voters and begin to collect would be for the 2021 collection year,” said Blechschmidt, noting that, even with the end of the one-time property tax relief from the state this year, next year’s property tax rate for education will still be around $0.26 per $1,000 less than 2017 levels.

The lowest supplemental levy option, at $0.31 per $1,000, would raise approximately $7.25 million, and still be $0.10 lower than 2017 tax rates, even when accounting for the increase in statewide property taxes for education funding. A $0.51 per $1,000 top-end option would raise an additional $11.75 million, which could fund current service levels and help replace some of the district’s aging school buses.

“We just need a longer runway,” concluded Webb. “We simply don’t have enough time between now and the general election to get this dialed in.”

Other districts

As mentioned, any district that passed a local M&O Levy prior to the signing of SB 5313 must gain voter approval for any supplemental levy above that amount. Several districts, including Battle Ground and Camas, are currently in the midst of previously approved levies, and could choose to raise them to the new maximum rate without going to voters. Webb says he’s heard some preliminary conversations about how those districts might proceed, but right now school boards seem reluctant to push any new tax increases in the current climate.