Vancouver lawmaker offered her about the so-called ‘wealth tax’ proposed today by Democrats in the Senate and House of Representatives

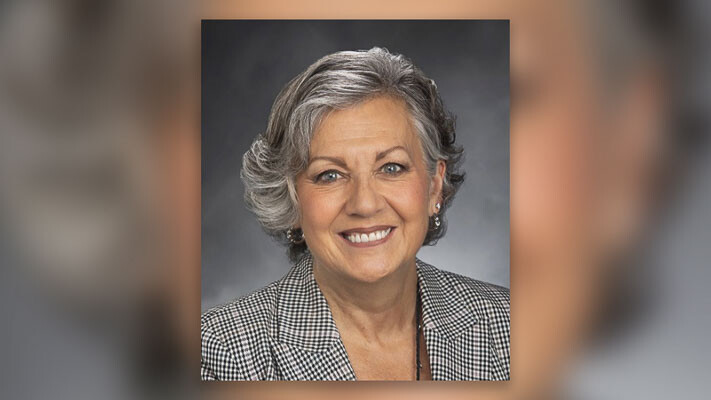

OLYMPIA – The budget leader for the state’s Senate Republicans isn’t buying the idea that Washington needs to slap another tax on residents who are financially successful. Sen. Lynda Wilson, R-Vancouver, offered these remarks about the so-called “wealth tax” proposed today by Democrats in the Senate and House of Representatives:

“On the surface this may have a Robin Hood kind of appeal, but that’s just not enough to make it a good idea. The sponsors know this is constitutionally questionable but are charging ahead anyway. It’s how the state income tax was adopted: push the tax through and cross your fingers that the judicial branch will ultimately come to your rescue. We need less legislating from the bench and more listening to the people.

“The ‘wealth tax’ didn’t make the list of tax options recently recommended to the Legislature by the bipartisan Tax Structure Work Group. You wonder why the Democratic chair of that work group decided to introduce the Senate version of this bill, even though her colleagues on the work group decided the idea wasn’t worth further consideration.

“State government has 6 billion dollars in reserve. Maintaining the programs and services in the current budget will cost 1.5 billion. A lot of good can be done with even a portion of what’s left. The Robin Hood angle falls apart completely when you see the revenue from this tax is aimed at growing government, with no promise of any real tax relief. And why talk about new taxes when the focus should be on using the existing revenue wisely?

“These bills repeat the Democrats’ myth that Washington has the most regressive tax system in the nation. Let’s keep in mind these Democrats just last year refused to join with Republicans on two pieces of progressive tax reform – one to lower the state sales tax, the second being my bill to offer a property-tax exemption that would have benefited owners of lower-value property more. At the same time they have created new laws that increase costs related to driving and energy, both of which hit lower-income people harder. If the Democrats truly want to help people at lower income levels, they should stop supporting regressive taxes and fees, and lower or eliminate the ones they’ve created. A ‘wealth tax’ doesn’t do any of that.”

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Progress being made at GRO Parade of Homes siteThe 2024 GRO Parade of Homes, presented by the Building Industry Association of Clark County, is a little more than a month away, and builders are busy completing the luxury homes before the big event, scheduled for Sept. 6 through 22 in Felida.

- Has trust in the media tanked over coverage of President Biden’s decline?After President Joe Biden’s calamitous debate performance against former President Donald Trump, and days after Biden’s decision Sunday not to seek reelection, there are still many questions about how the news media covered Biden’s mental and physical decline.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- Major gas line leak closes major arterial in Clark CountyFirefighters from Clark County Fire District 6 responded Thursday (July 25) afternoon to the scene of a major natural gas leak on NE 99th Street, directly in front of Columbia River High School.