The district will benefit from a state legislature move to bump up the amount schools can receive in local property tax levies

BATTLE GROUND — The Battle Ground School Board this week approved a $188.5 million budget, including over $11.5 million for capital projects. District 5 Director Tina Lambert was the lone no-vote, with board President Troy McCoy absent on Monday.

The Battle Ground School District was one of the few in Clark County to benefit from the 2019 state legislature’s move to raise the local levy lid from $1.50 per $1,000 of assessed property value, approved in 2017, to $2.50 per thousand.

According to the district’s Chief Financial Officer Meagan Hayden, the lift in that levy lid will cover an anticipated $4 million budget shortfall in the 2020-2021 budget. It will also allow a number of capital projects to move forward, including security fencing at some schools, a gym/cafeteria conversion and roof recoat at Pleasant Valley, upgrades to the district’s Wi-Fi technology, and a phase-in of middle school sports using existing facilities.

“The funding changes of the past few years have been difficult for our district,” said Superintendent Mark Ross in a release from the district. “The additional levy capacity approved by the legislature will allow Battle Ground to maintain the programs that serve our students, make some much-needed safety and infrastructure improvements at some of our schools, and add middle school sports—a beneficial program that our community has been asking us about for years.”

Unlike surrounding districts, such as Vancouver or Evergreen, Battle Ground was entering the first year of a four-year levy when the legislature initially approved the levy swap as part of the McCleary basic education funding decision. That meant Battle Ground could approve an increase to the new cap approved this year without voter approval.

Between the levy and a 2005 building bond, which will retire in 2023, the district’s local tax rate is anticipated to be $3.09 per $1,000 of assessed value in 2020. Hayden says that is still the least expensive total rate of any district entirely in Clark County. Green Mountain is lower, but much of that district is in Skamania County.

For comparison, Woodland sits at $3.13 per thousand. Camas is the most expensive taxing district in the state at $5.03 per $1,000 when all levies and bonds are taken into account.

The price tag could go up slightly in the near future though, as Battle Ground is nearly certain to introduce a modified building bond to voters next year, after it was twice rejected in 2018.

Despite the good news, Hayden said the district continues to experience upward pressure on the budget. Staffing costs continue to rise with salary increases and a new state-pooled benefits program. Unlike previous years, local districts can no longer use savings if an employee declines health coverage to defray the cost for other employees. That money is now sent back to the state to be redistributed at a state level.

Hayden also noted the state did away with a staff mix measure for budgeting, meaning districts with more experienced teachers would get more funding. Each district now receives a base amount per teacher, so districts with more experienced staff will need to cover more out of local funding.

Over the past three years the district says state funding made up approximately 74 percent of their budget, with 17 percent coming from local funds (the rest is from Federal and non-tax revenue). In the 2019-2020 year, with the new funding model fully in effect, the state-provided amount will be 80 percent, with local funding falling to 12 percent.

The 2019 legislature also approved a small increase in special education funding, but Hayden says expenses continue to rise more quickly. The state also caps per student spending beyond 13.5 percent.

“Our special ed enrollment keeps on growing,” Hayden told the board, “so at the end of the year we were actually at 13.7 (percent), so for .20 percent of our special ed students we don’t get any money.”

The district has also faced challenges with student enrollment, which has declined by nearly 500 students in the past year.

“When you budget 500 less students, you’re going to be getting less state funding, which means you’re going to have … less staff,” said Hayden, noting that the district will go into the coming school year with 91 fewer certificated and non-certificated staff than last year, though most of that reduction was through retirements and people leaving for other jobs.

Hayden said demographers believe the trend of declining student populations may begin to reverse within the next few years, but it remains a difficult thing to predict. Analysis done in 2016 anticipated major student gains across the district, most of which hasn’t panned out.

Battle Ground isn’t alone in this trend either. Both Vancouver and Evergreen school districts experienced major budget cuts due to reduced enrollment.

One other thing Hayden noted is that, even with the 91 fewer employees, the district’s overall staffing costs barely budged from last year, thanks to rising salaries and other costs. The percentage of staffing costs unfunded by the state under the prototypical model of education funding has also increased from 21 percent in 2018-19 to an expected 23.3 percent this coming school year.

As for where the overall budget goes, 55 percent is for basic and alternative education, with 14 percent for special education. A total of 12 percent covers district-wide support services. The rest is divided between student transportation, nutritional services, Career and Technical Education (CTE), community education, and other instructional programs.

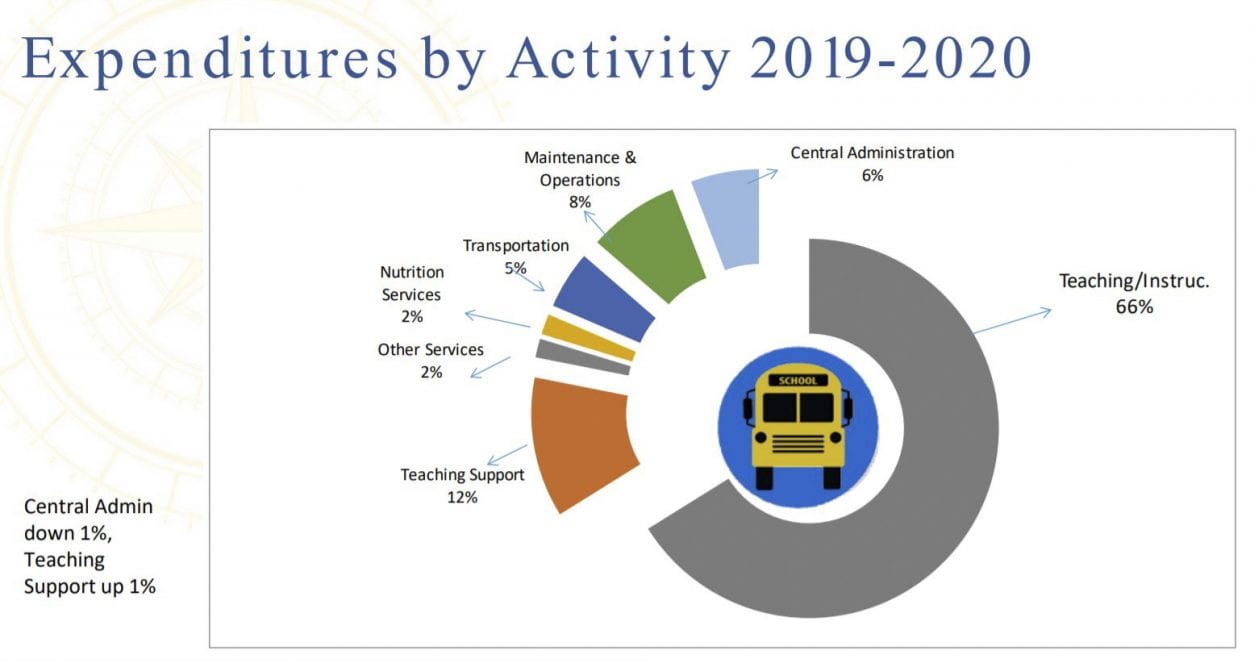

Overall, the district spends 66 percent of its budget on teaching and instructional staff, with another 12 percent on teaching support. Eight percent covers maintenance and operations, six percent for central administration, five percent for transportation, two percent for nutrition services, and two percent to other services.

Hayden said the district expects to carry over $19.8 million from next year’s budget, though all but $6.7 million is tied up in what’s called an unassigned fund balance, which includes nonspendable inventory and prepaid balances, uninsured risk, and curriculum adoption.

The remaining $6.7 million ending fund balance represents an increase of $500,000 over 2018-19, but remains well short of the Board’s policy of a 6 percent balance.

For more information on the Battle Ground school budget, click here.