This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25-4.5 percent

Casey Harper

The Center Square

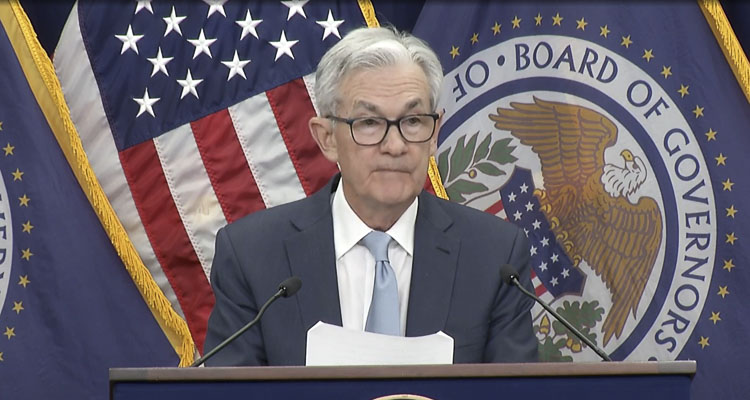

The U.S. Federal Reserve announced a new rate increase of half a percentage point Wednesday in its ongoing effort to curb inflation.

The Fed raised the rate by 50 basis points, as expected, the seventh rate hike this year. This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25%-4.5%.

“Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low,” the Fed said. “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

The Fed blamed the Russian war in Ukraine for the price hikes. That war delayed the supply chain and increased costs, but the price increases began long before that war, due in part to trillions of dollars in federal debt spending since the pandemic began.

“The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity,” the group said. “The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

The increase comes in response to inflation, which has soared during President Joe Biden’s term. The latest federal inflation data shows that those price increases have slowed but not stopped entirely.

Economists say these rate hikes help curb inflation but have negative economic consequences. Raising rates too much too fast can send the economy into a recession.

“We expect that as the Fed moves closer to its terminal rate the market will shift more directly towards growth, especially if valuations become compelling if the market sells off as the economy slows,” said Quincy Krosby, chief global strategist for LPL Financial.

Analysts say the U.S. economy and the possibility of a recession are still in flux.

“Though yesterday’s CPI report was encouraging, we believe the market has overreacted to an easing of inflationary pressures,” said John Lynch, Chief Investment Officer for Comerica Wealth Management. “A drop from 9.0% to 7.0% is likely the easiest of the 200 basis point moves lower that investors hope for … we suspect the next 200 basis point reduction will be much more difficult to achieve as wages, housing and energy prove stickier than consensus believes. Moreover, while the move lower in market interest rates has been received warmly by investors, balance sheet reduction remains a wildcard and may provide further upward pressure on market interest rates in 2023.”

This report was first published by The Center Square.

Also read:

- Opinion: OIC tells consumers not to pay for ‘insurance’ you won’t likely benefit from: Does that include WA Cares?Elizabeth New (Hovde) of the Washington Policy Center believes you should consider yourself warned by the Office of the Insurance Commissioner about WA Cares and its maybe-only benefit.

- Opinion: Same road, different speed limit?Target Zero Manager Doug Dahl addresses a question about speed limit signs going into and leaving town.

- Progress being made at GRO Parade of Homes siteThe 2024 GRO Parade of Homes, presented by the Building Industry Association of Clark County, is a little more than a month away, and builders are busy completing the luxury homes before the big event, scheduled for Sept. 6 through 22 in Felida.

- Has trust in the media tanked over coverage of President Biden’s decline?After President Joe Biden’s calamitous debate performance against former President Donald Trump, and days after Biden’s decision Sunday not to seek reelection, there are still many questions about how the news media covered Biden’s mental and physical decline.

- Opinion: Hiding the growing cost of the Interstate Bridge replacementJoe Cortright of the City Observatory addresses the rising cost of the Interstate 5 Bridge replacement project.

- Letter: ‘This election I am NOT voting for Greg Cheney’Clark County resident Wynn Grcich shares her thoughts on Rep. Greg Cheney and the issue of fluoridation in area drinking water.

- Major gas line leak closes major arterial in Clark CountyFirefighters from Clark County Fire District 6 responded Thursday (July 25) afternoon to the scene of a major natural gas leak on NE 99th Street, directly in front of Columbia River High School.