An in-depth look at the levy request put before voters by Vancouver Public Schools

Editor’s note: Former Clark County Councilor and long-time Clark County resident Dick Rylander conducts a great deal of research on public education in the area, region and state and shares his findings on his blog, swweducation.org. Rylander recently compiled in-depth analysis on the levy requests on the Feb. 14 special election ballot from the Vancouver, Washougal and Woodland school districts. Here is the information he has gathered on the Vancouver Public Schools Levy.

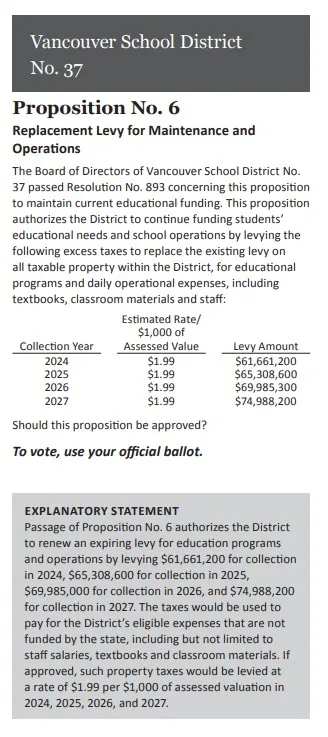

If you live in the Vancouver School District you should have received a ballot for a special election request for a new four-year levy. In this article, we’ll share the details about the levy with you. It’s your choice whether you vote yes or no but it’s critical that you vote. We’ll try to cut through the clutter.

Here’s what you will find below:

- Link to the Vancouver School District’s website so you can see exactly what they claim: https://vansd.org/levy/

- Links to the Clark County Elections department.

- First is the link to the actual Proposition wording submitted by the school district: https://clark.wa.gov/sites/default/files/media/document/2022-12/Vancouver%20School%20District%20No.%2037%20-%20Resolution%20No.%20893%20%28Proposition%20No.%206%29_0.pdf

- This second link is to the Clark County Elections site which has the Pro; Con and rebuttal statements: https://clark.wa.gov/sites/default/files/media/document/2022-12/Vancouver%20School%20District%20No.%2037%20-%20Proposition%20No.%206%20-%20Replacement%20Levy%20for%20Maintenance%20and%20Operations.pdf

Before we dig in you may want to review some of our past articles on the VanSD that may help you understand some of the past issues:

- https://swweducation.org/esser-fund-elementary-and-secondary-school-emergency-relief-fund-southwest-washington/

- Vancouver School District – New Levy Feb 2020 (swweducation.org)

- https://swweducation.org/vancouver-school-district-new-levy-feb-2020/

- https://swweducation.org/vancouver-school-district-2019-levy-requests/

- https://swweducation.org/vancouver-school-district-proposed-equity-policy/

- Gender Identity questionnaire – Vancouver School District (swweducation.org)

Following is the actual detail from the links in case you don’t want to sift through it all. We finish with some analysis and clarifications on terminology and impact.

Overall statement:

Pro (Voting Yes) statement and rebuttal:

Con (Voting No) statement and rebuttal:

Analysis:

- It’s a levy extension and not a new levy = true and false. Because there is a levy expiring that was for four (4) years and this new levy is also for four (4) years it can be called an extension. However, the amount of money is greater. They make this “extension” claim to attempt to give voters comfort that it’s business as usual and there’s nothing to worry about.

- The “Pro” statement says “Let’s maintain…” when they are asking for an 84% increase. How does that math work out? Should “maintain” mean the same or close in amount?

- They project a levy “rate” of $1.99/$1000 of assessed value. What does that mean? Take the total amount of money they want to collect; total the entire value of all real estate in the school district and then calculate how much that works out to per $1000 of assessed value. If property values continue to climb the “rate” will actually decline. If property values go down the “rate” will go up. It’s critical to understand that the amount of money collected stays the same no matter what the “rate” is.

- They are asking you to give them $271,943,300 over the 4 years of the levy.

- The previous 4 year levy was $147 million.

- They are asking you for $272 million – $147 million = $125 million MORE. That works out to an INCREASE of 84%.

- Inflation is up about 15% in the last 2 years so they certainly need more money than they had but they are asking for about 5.6x more than the inflation rate?

- You should also be aware that the district received federal funds (COVID) of over $64 million. You can read about it in this link: https://swweducation.org/esser-fund-elementary-and-secondary-school-emergency-relief-fund-southwest-washington/

- You are also paying off a massive capital bond.

- You are also paying a 6 year “tech levy” of over $48 million on TOP of this new operations levy.

- Your student population is in decline (as are most public schools). In the last 5 years the student population has declined by about 7.15% in the Vancouver School District.

- OSPI published test scores: 57.7% are failing English Language Arts. 70.6% are failing Math. 60.3% are failing Science.

- Spending per student, in Washington state, has doubled over the past decade. We are now spending, on average across the State, nearly $20,000 per student…which is about double the cost of private school.

- Finally, over 52% of your property taxes go to schools. How much is enough? Should school districts need to live within a reasonable budget like you do?

Are you getting what you want, need and expect from K-12 education? Have your earnings kept pace with inflation and tax increases? Are you pinching pennies to make ends meet?

We all love children and education. The real question is whether you continue to be the money spigot?

Other data and information sources:

Also read:

- Passionate arguments made before Fort Vancouver Regional Libraries Board of TrusteesA standing room only crowd addressed the Fort Vancouver Regional Libraries Board of Trustees over new strategic plan language, with speakers split over protecting children and concerns about censorship.

- Seattle Seahawks officially up for saleThe Estate of Paul G. Allen has launched a formal sale process for the Super Bowl LX champion Seattle Seahawks, with the team expected to fetch a record-breaking price.

- Tension rising over how to spend revenue from proposed WA income taxGov. Bob Ferguson and fellow Democrats are clashing over how much of a proposed 9.9% income tax on earnings above $1 million should go toward tax relief versus the state budget.

- Opinion: Senate shenanigans – Income tax debate, double-standardsElizabeth New writes that Senate Bill 6346 would impose a 9.9% tax on income above $1 million and is likely headed for a legal challenge if approved by the House.

- Battle Ground Public Schools opens 2026–27 enrollment for alternative, specialty programs and schoolsBattle Ground Public Schools is accepting applications for its tuition-free alternative and specialty programs for the 2026-27 school year.

- CCSO responds to assault at Heritage High SchoolA 15-year-old student was hospitalized with non-life threatening injuries after being stabbed by another 15-year-old at Heritage High School.

- Shipboard fire response at Port of VancouverA fire in a cargo hold aboard a 656-foot break bulk carrier at the Port of Vancouver was brought under control in under four hours with no reported injuries.