$695,000,000 bond to be used to replace, upgrade ageing facilities

VANCOUVER — Voters and homeowners in the boundaries of Evergreen Public Schools have the opportunity to vote on a bond measure for the district during the Feb. 13 special election.

The total cost of the bond if passed would be $695,000,000 over a 21-year period. If the bond passes, the money will be used to replace and rebuild several schools in the district.

Ellsworth, Marrion and Sifton Elementary schools, along with Wy’east Middle School and Mountain View High School, would all be replaced on their current sites. Burton and Image Elementary Schools, along with Legacy High School, including the 49th St. Academy and Transitions programs, would be rebuilt on lots nearby their current locations.

Heritage High School, which when built was intended to be a 3-year high school, and which became a 4-year school upon opening, will have a wing added to replace portables on campus.

Finally, should the bond pass, a new elementary school will be built at NE 162nd Avenue and 39th Street.

The bond is also designed to replace and upgrade systems at schools that the district says have reached the end of their useful lives. Some of the money would be used to update security measures at schools, such as securing entrances and additional surveillance system upgrades.

According to information on the school district’s website, high schools will receive new turf fields, and schools will get new LED lighting and sound systems in auditoriums, new musical instruments, a new phone system and updates to McKenzie Stadium.

According to Evergreen Public Schools Superintendent John Steach, the bond being proposed to voters is the result of three years of work studying the needs of the district and the feasibility of a bond. Steach said that the last time a bond had passed in the district was in 2002, and studies conducted by and on behalf of the school district found that 2018 would offer an opportunity to “run a bond and potentially not increase tax rates.”

A look at the numbers

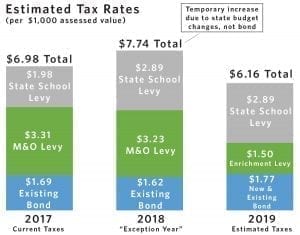

Steach said that in 2014, the tax rate for homeowners in the district for bond debt was $1.82 per $1,000 of assessed home value. According to Steach, that number has dropped to $1.62 per $1,000 because of a growth in the district’s assessed valuation and new construction in 2018.

If the bond passes, the combined total bond rate paid by homeowners in the school district will be $1.77 per $1,000. Steach said that due to changes in the state legislature regarding school levies and funding, state taxes increase, but local levies are capped at $1.50 per $1,000 of home value.

This means that the total amount of school taxes paid by voters in 2019, when the bond would take effect, would be $6.16 per $1,000 of home value. In 2017, the total state and local school tax rate was $6.98 per $1,000. Steach said that changes at a state budget level mean that taxes in 2018 will increase to $7.74, but if the bond is adopted and takes effect in 2019, total tax rates “will drop considerably.”

Steach said that when the last bond passed in 2002, it was used to build Union High School, renovate Evergreen High School, and build Endeavour Elementary School and Cascade Middle School. Those projects were supposed to be the first phase of a multiphase district project, and were completed by 2008.

In 2008, the district tried to pass a bond, but that bond would have increased taxes, and with the economic effects of the recession, the bond failed. Steach said that since the bond failed, the district has spent $3-5 million a year to maintain its facilities. With changes in state funding regulations, Steach said that there is more restriction on what funds can be directed to, and therefore the bond is designed to provide for those maintenance costs.

Steach noted that Evergreen Public Schools has approximately 368 portable classrooms in the district. The bond would provide enough permanent facilities to reduce the number of portable classrooms to 200, as Steach said this was a major concern.

According to Steach, a community survey was conducted about a year ago, and found that respondents were concerned with the safety of older schools and the number of portables in the district. He also said that growth in the eastern portion of the district raised concerns.

With the bond, Steach said that the school’s priority is to have a manageable tax rate and “to be able to provide quality facilities for our staff and students.”

Gail Spolar, director of communications and community engagement for Evergreen Public Schools, said that in addition to the bond, if the measure passes the district could receive additional funding of $95 million from state assistance and $12 million in local development impact fees.

If the state were to increase the amount of assistance, Steach said that the district could either complete more projects with the bond money, or reduce some of the bond being collected.

Opposition to the bond

Steach said that he believed that many people were favorable to the bond, and that the public’s response has been positive.

However, not everyone in the district will be voting in favor of the bond. Vancouver resident Stephanie Turlay said that while she recognizes there are needs in the school system, the district is trying to get too much money for too many projects out of homeowners.

“What the children need is an education, not fancy surroundings,” Turlay said.

Turlay said that students should have what they need, so if a school needs to be replaced, the district should replace it. However, most of the money in the bond, Turlay said, goes to improve students’ surroundings, not the quality of their education.

Turlay explained that within Evergreen Public Schools’ boundaries, there are many senior citizens and people on fixed incomes on which the bond will place an unbearable financial burden. She cited numbers that estimate $17 million will be spent to replace musical instruments and $3 million to replace phone systems as going beyond a definable need for the district and instead constituting waste.

According to Turlay, one of the common reasons given for a bond, that the school district’s population is growing, is actually not true. She cited information provided by the district that said the enrollment across the district declined last year. Turlay also said that an economic development consulting group characterized the district as a “mature district” with minimal growth.

Addressing the possibility of a tax decrease, Turlay said that the decrease is mainly from older bonds being retired, and that the information constitutes a “false positive.” She expressed concern about future bonds that could be added onto the proposed bond over its 21-year period, and noted that the district did not take into account tax increases at the county and city level that will, according to Turlay, equate to a 5 percent increase in taxes if the bond passes.

Turlay said that of the projects on the proposed bond, eight are replacement campuses. Five of those are rated poor by the district, and three are in fair condition. She said that there are five other campuses in the district rated poor, but those are not on the bond. According to Turlay, this appears as a misallocation of funds.

When taken into account with other projects on the bond, Turlay said that she believes the district is asking for too much money to fund unnecessary projects and items, rather than focusing on what is truly needed.

“They want the Cadillac when they only need a Ford,” Turlay said. “I think it’s a con job to the people.”

Turlay said that the district’s survey was skewed, and said that she believed the district only solicited teachers, parents, builders and community leaders that were believed to be favorable to a bond.

While she believes that some needs, such as new schools, should be addressed by a bond, Turlay said that the school district has not adequately justified the amount of money it is asking for, especially when many people in the district boundaries are senior citizens.

“You cannot keep gouging, and I call it gouging, senior citizens to pay for more and more and more fluff in the school system,” Turlay said.

More information about the projects the bond would fund can be found online at the Evergreen Public Schools website at http://www.evergreenps.org/Envision. Information Turlay referenced is available online at http://www.swweducation.org/?page_id=4461.