Congress has until about June to raise the debt ceiling or potentially default on the U.S. debt obligations for the first time ever

Casey Harper

The Center Square

U.S. Secretary of the Treasury Janet L. Yellen sent a letter to Congressional leaders Thursday notifying them that the agency has begun taking “extraordinary measures” as the federal government bumps up against its debt limit of just over $31 trillion.

That means Congress has until about June to raise the debt ceiling or potentially default on the U.S. debt obligations for the first time ever.

“First, I have determined that, by reason of the statutory debt limit, I will be unable to fully invest the portion of the Civil Service Retirement and Disability Fund (CSRDF) not immediately required to pay beneficiaries, and that a ‘debt issuance suspension period’ will begin on Thursday, January 19, 2023, and last through Monday, June 5, 2023,” the letter said.

“I respectfully urge Congress to act promptly to protect the full faith and credit of the United States,” she added.

The Congressional Budget Office recently released budget figures showing that the federal government borrowed $4 billion per day in 2022, which is more than $10,000 per household and on overall deficit of about $1.4 trillion. Pre-pandemic deficits were less than $1 trillion.

Lawmakers can raise the debt limit, but they were hardly able to agree on who should serve as Speaker of the House, raising serious questions about whether they can come together on this issue. Many want to use the opportunity to implement fiscal reforms.

“The debate over our debt ceiling is the perfect example of Washington elites refusing to prioritize your best interests,” said U.S. Sen. Rick Scott, R-Fla. “We can’t keep rubber-stamping reckless spending. I’m fighting every day to stop it.”

Republicans also blasted the Biden administration and the recent omnibus spending bill. The White House said earlier this week there will be no negotiations with Republicans on the debt limit.

“Just a few weeks ago, Joe Biden signed a $1.7 trillion spending monstrosity,” said U.S. Rep. Jim Jordan, R-Ohio. “And now the White House says it will not negotiate with Republicans over the debt ceiling. They created the problem!”

Experts raised the alarm, arguing this need for yet another debt ceiling increase shows the current unsustainable trajectory of federal debt spending.

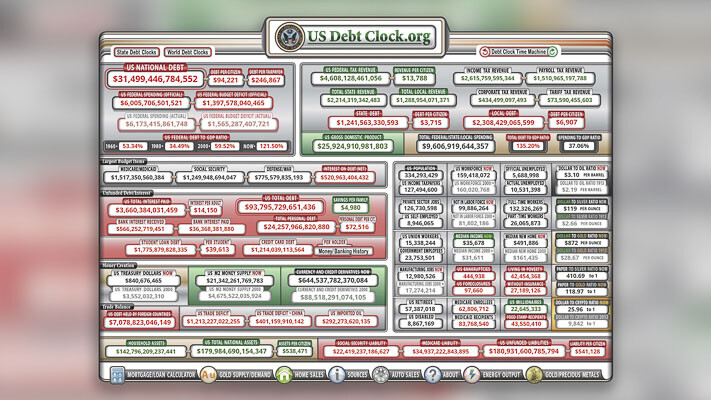

“America will hit the $31 trillion debt ceiling today,” said economic expert Stephen Moore. “That’s 120% of our GDP and $246,876 per taxpayer. How can anyone believe this is sustainable?”

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, cautioned about the consequences of going too far with using the debt ceiling for political purposes.

“The debt ceiling is too important to turn into a game of chicken, and default should never be suggested by those with a fiduciary responsibility to govern the nation,” she said. “Politicians who are rightly worried about the nation’s unsustainable borrowing path should take a hard stance against new borrowing and oppose legislation that would add to the debt while offering specific solutions to control the debt already on the books, rather than threatening not to pay the bills on borrowing that has already been incurred.”

MacGuineas also argued that the debt problem is only going to get worse.

“The debt ceiling does offer the opportunity for all lawmakers to pause, assess the fiscal situation of the nation, and take action as necessary. And it is necessary. The debt as a share of GDP is at near record levels,” she said. “We are on track to begin adding $2 trillion per year to the debt by the end of the decade. Interest payments are the fastest growing part of the budget and are projected to start costing $1 trillion annually in only a few years. The Social Security and Medicare Hospital Insurance trust funds are headed toward insolvency. And last year alone, Congress and the President passed bipartisan legislation that added nearly $2 trillion to the projected national debt. This is an urgent problem that is not getting the attention it needs.”

This report was first published by The Center Square.

Also read:

- VFD dispatched to motor vehicle accidentVancouver Fire Department responded to a truck versus SUV collision at NE 117th Avenue and NE 87th Street, extricating trapped patients and transporting three to area hospitals.

- State high school basketball: Celebrating a coaching connection at Camas and Fort VancouverCamas and Fort Vancouver saw their state playoff runs end on the same night, highlighting a unique coaching bond between Scott Thompson and James Jones.

- $1B for WA broadband gets Trump administration approvalFederal approval unlocks over $1 billion to expand high-speed internet to unserved and underserved communities across Washington.

- WA passes legislation requiring no-cost insurance for state recommended vaccinesHouse Bill 2242 shifts the trigger for no-cost vaccine insurance coverage in Washington from federal recommendations to the state Department of Health.

- Opinion: WA House Finance Committee passes income tax billRyan Frost argues that ESSB 6346, which would impose a 9.9 percent income tax, advances to the House floor despite widespread opposition and ongoing budget growth.

- Journey Theater presents Mary PoppinsJourney Theater will stage six performances of Mary Poppins at Fort Vancouver High School beginning March 6, featuring a cast of local youth performers.

- Opinion: A-pillars – The safety feature that increases crashesDoug Dahl explains how wider A-pillars designed to protect occupants in rollovers may also reduce visibility and increase crash risk for other road users.