Majority of council opted to revisit subject in 2021 and likely put to vote of the people

CLARK COUNTY — After the passage of House Bill 1590 by the state legislature, RCW 82.14.530 now gives the Clark County Council the authority to implement a 0.1 percent sales tax for affordable housing projects, independently.

In their work session on the morning of Dec. 10, the councilors heard from county staff on what the tax could and could not do, as well as the two methods for enacting it.

“Previously, the tax offers had to go out to a vote of the people and had to be passed by a majority vote. 1590 made it so that it can be imposed by councilmanic action,” said Lindsey Shafer, a senior policy analyst for the county. “It can still be done by a vote of the people, but it now is able to be done by councilmanic action. The allowable uses of the tax didn’t change with the legislation.”

The bill passed the legislature by a largely partisan vote of 27-21, with proponents speaking to greater needs in housing due to homelessness and financial difficulties from the pandemic. Opponents were concerned with a law providing another way for county and city councils to raise taxes on their own authority.

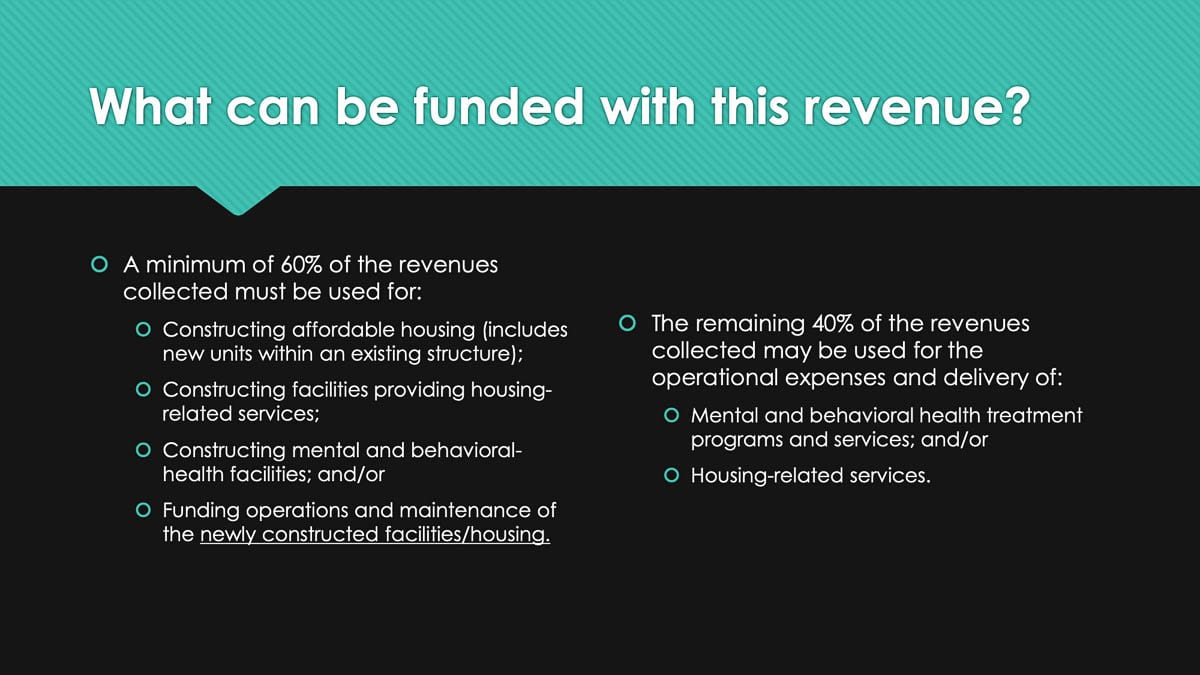

Similar to the previous House Bill 1406, 1590 is aimed at more quickly supplying resources in the forms of affordable housing units, mental and behavioral health facilities and the funding thereof. A minimum of 60 percent of funds from 1590 must go directly to new units.

The tax is required to serve those with income of 60 percent or less of the county median income, and it has to meet one or more of the particular criteria, Shafer said. Potentially served populations would be persons with behavioral health disabilities, veterans, senior citizens, families with children that are homeless or at risk of being homeless, unaccompanied homeless youth or young adults, persons with disabilities, and domestic violence survivors.

The county would only be able to enact such a tax in areas where there is not already a city municipality doing the same. As of now, Vancouver is the only Clark County city to have implemented the tax, and thus the county would work in direct collaboration on overlapping projects.

“When we talked about this this week in our meeting, I think it was very much project specific, looking at collaboration and the city said there may be projects that they move forward with on their own,” said Councilor John Blom. “There may be projects where there’d be an opportunity to jointly fund the development of housing units. We could look at projects in the unincorporated area, Hazel Dell, Orchards, some of those.”

Councilors Blom and Temple Lentz sit on the Joint Executive Board on Homelessness, which brought the housing tax to the attention of the full council. After hearing an overview and requirements, as well as options, the councilors could push to enact the new tax next week, or opt to revisit it at a later date and likely place it on the ballot in the next November general election.

Mark Gassaway, finance director for the county, gave a brief overview of how much such a tax could generate in the county with the subtraction of Vancouver, but with estimates based on 2020 numbers.

If the tax had been in place over this past year, it would have brought in around $3.2 million, Gassaway said. He was quick to point out that this is not entirely reflective of what 2021 or a future year may look like, however, since the pandemic has reduced sales tax funds over all. Gassaway said he estimates 2021 would bring in closer to $3.5 million.

Vanessa Gaston, the Department of Community Services director, explained that after looking at the Department of Commerce and studies from 2015, that a large deficit in affordable housing unit space existed; over 4,000 households too few. Gaston also explained a few of the projects that new funds could flow into if a tax were passed, including the Motel 6 used for those affected by COVID-19.

“There were about 169 people, unduplicated, that stayed there from April to the first part of December, only about 56 people were able to move to housing because we could not find housing for them in the community,” Gaston said. “So a number of them went to shelters or motels or some went back to the street. That’s a big issue is we just build the shelters but there’s no housing to move this population to and the county has the lead for the homeless plan.”

Ultimately, Councilors Julie Olson and Gary Medvigy, along with Council Chair Eileen Quiring O’Brien, favored the collection of additional information on potential projects and a vote of the people over councilmanic action. They will revisit the matter in 2021.

“I think it’s clear based on all the comments we’ve heard this morning that the need is there,” Olson said. “One thing that is a little bit missing for me still is what exactly are we funding? Do we have projects, I mean, we have some in the pipeline here. I think the case has been well made this morning, but I think it’s made well enough that we could ask our voters to vote on this. If the case is strong enough, our voters should support it.”

Medvigy and Quiring O’Brien echoed Olson’s comments and voiced support for the joint committee continuing it’s process with Vancouver in the time leading up to November.

“This is the most complex vexing problem we have between affordable housing and taking care of those in most need,” Medvigy said. “We have a huge gap right now, and as just explained by all the questions and answers, it’s getting bigger, we’re making marginal progress on it. I think we have made a case we need to do more.”

Lentz expressed support for a vote, but also disappointment at the choice for future deliberation rather than immediate action.

“We’re going to have multiple eviction crises coming as restrictions around COVID come up and eviction moratoriums are listed,” Lentz said. “By next November, this is going to be even worse. I think we can make the case and I think we can put it before the voters and have it pass. I also think that we were elected to make hard decisions, and I wish that that’s what we were seeing here.”