It would replace the current four-year Maintenance and Operations levy, which expires after next year

BATTLE GROUND — Voters in Battle Ground will likely get to decide next February whether to approve a new Maintenance and Operations Levy for the school district.

The current M&O Levy, which was approved by 53.69 percent of voters in 2017 will expire at the end of next year.

That levy was approved at $3.66 per $1,000 of assessed home value, though the McCleary basic education funding package approved by the Washington legislature in 2018 capped collections at $1.50 per $1,000 in 2019.

For 2020, that rate cap was increased to $2.50 per $1,000, which the district’s Board of Directors voted to enact for the final two years of the levy in order to raise $14 million for capital projects.

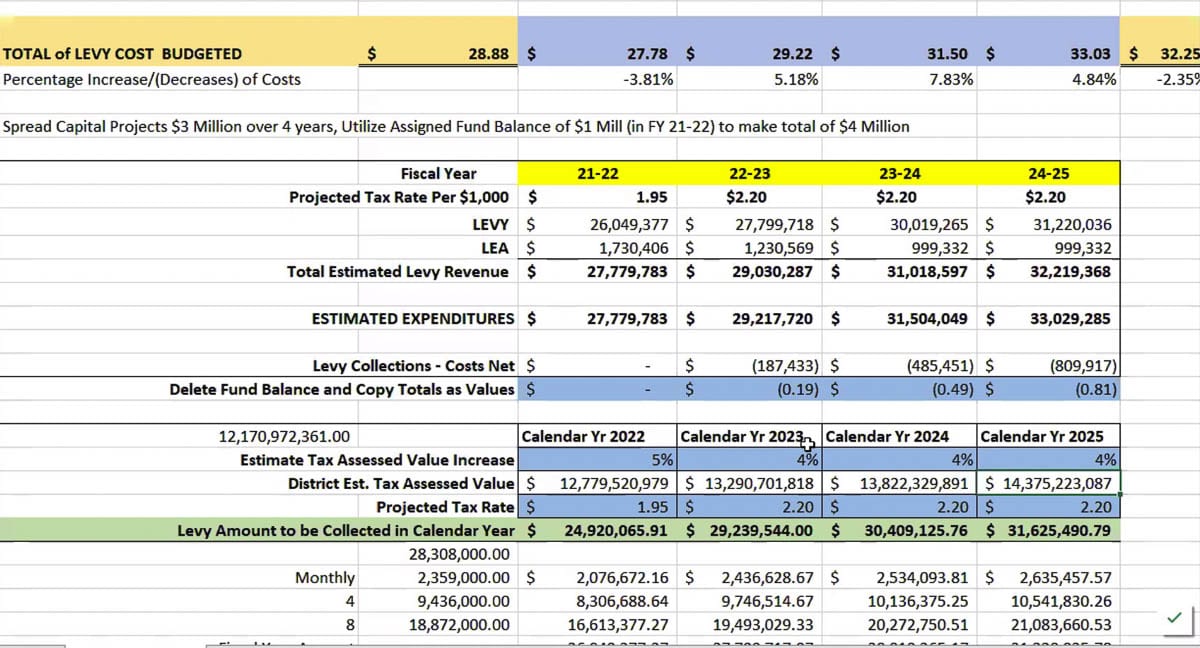

The proposed replacement M&O Levy would reduce the current collection rate to $1.95 per $1,000 for the first year, then increase to $2.20 in the final three years.

That would raise an estimated $25 million in 2022, $29.2 million in 2023, $30.4 million in 2024, and $31.6 million in the final year, assuming property values increase by an average of four percent each year.

The district would use an estimated $300,000 per year of ending fund balance to close the budget gap, assuming the state continues to provide levy equalization amounts similar to this school year.

The proposed budget would also spread approximately $4 million in capital improvement projects across four years, in order to reduce up front expenses.

Even with the current $2.50 local levy, the district is quick to point out their overall tax burden remains among the lowest for schools in Clark County.

That burden would go lower in 2023, with the expiration of an existing building bond costing taxpayers $0.58 per $1,000. The district has chosen not to seek supplemental technology or capital levies, similar to Vancouver or Evergreen Public Schools.

Overall, if approved the district’s local tax would be approximately $2.53 in 2022, and $2.78 in the final three years of the levy, assuming no new building bond is run or approved. That would still be lower than the current rate of $3.08, which is lowest among districts fully in Clark County.

“No matter when we run it, we need to pass it,” said Shelly Whitten, the district’s assistant superintendent of human resources during a work session on the levy this week. “So I would just advocate for us thinking through all the implications of those things and making the best decision we can, because we don’t have a crystal ball.”

Should the levy fail to pass in February, the district could face difficult decisions when it comes to staffing, without knowing whether a follow-up levy could potentially be approved in April.

“I think the biggest thing, regardless of when we do it, is it just really has to be communicated well how this is less than it is now,” said Director Jackie Maddux. “And it’s still needed. And I think that’s the hardest part for anybody to come across to our community when all those kids are at home.”

The board considered pushing the levy vote until April, assuming it would give more time for students to return to classrooms. With fully online instruction, parents could be tempted to wonder why the school needs the money right now.

Two things tipped the board into looking at February.

First, Camas School District is set to run their own levy, which is likely to be closer to the full $2.50. Several board members noted that might give Battle Ground room to show the relative affordability of their own levy request when measured against Camas. The districts would also be able to share the cost of putting the levy on the ballot.

A February date also gives the district time to regroup if voters fail to pass the levy, and either rework the request or spend more time selling the need.

While the state’s McCleary decision largely capped the amount districts can use local levy dollars to augment teacher pay, districts use the funding to provide additional staffing beyond the state’s basic model.

Generally, that includes additional school nurses, special education instructors, and elective classes, such as the Career and Technical Education programs.

Battle Ground has also chosen to roll most of their capital improvements into the levy, rather than seek a supplemental levy.

The district was able to fund $14 million of improvements this year, thanks to the legislature’s decision to raise the local levy cap. Those were projects that would have been funded through a building bond, which failed to pass in 2018, prompting a restructuring of boundaries in order to ease overcrowding at schools in the southern part of the district.

The board will be presented with a final proposal at a future meeting, during which they will need to vote on approving the levy for the February ballot.