A preferred pharmacy and different health insurance provider offered substantial savings; online discounts are also available.

Clark County consumers can save money by shopping their medications and health insurance

On Oct 15, senior citizens began their annual enrollment for medicare. This open window will continue through Dec 7, allowing seniors to change their supplemental insurance provider for medicare coverage. But employer-provided health insurance plans require similar choices at the annual enrollment period.

A recent health experience highlighted the need to understand coverage, and to shop for medications and your health insurance.

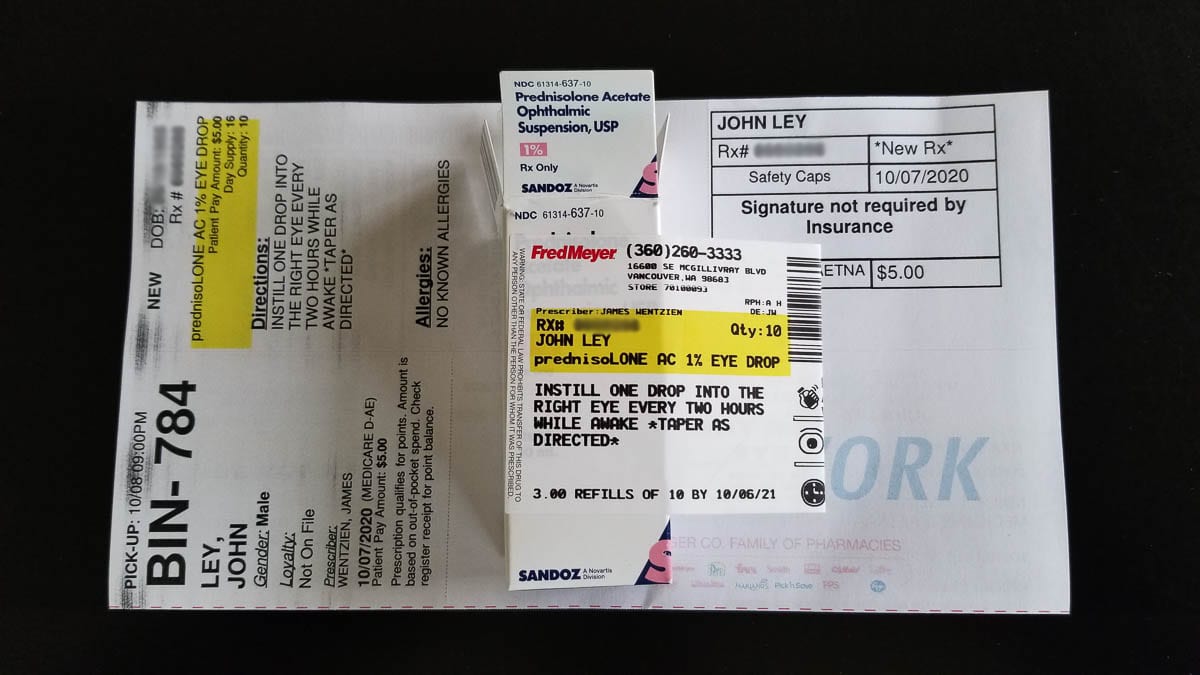

A flareup of iritis earned this reporter a trip to an eye specialist and the need to fill a prescription for prednisolone, a steroid eye drop prescribed to help the injured eye heal. After recently having “aged in” to medicare, I was offered UnitedHealthcare by my employer as our group insurance plan. I had recently chosen Aetna for my MedAdvantage insurance.

Before leaving for the eye doctor, I had gone online, knowing I would need a prescription for my eye drops. I had recently discovered GoodRx as an online discount prescription provider. Prices on the website ranged from $38.83 at Walmart to $65.83 at Safeway. Fred Meyer was $40.08. Another online firm, Northwest Pharmacy was $30.69, but it was mail order. I didn’t want to wait for delivery.

My physician asked where I wanted the prescription sent, but noted previously it had been sent to Fred Meyer. I said that was fine, knowing it was a buck or so more. Fortunately, the drug is a generic designed to lower costs.

The pharmacist at Fred Meyer checked me in and found me in their system. She said the price was $42.50 as I handed her my GoodRx discount coupon. She said “that will save you a couple bucks from the UnitedHealthcare cost.”

I told her UnitedHealthcare was my previous employer’s insurance and that I was now on medicare with Aetna. I gave her my insurance card. She entered the information and then said “you’re going to love this!”

The Aetna price was $5. No GoodRx coupon needed.

Later, I learned that Fred Meyer was a “preferred” pharmacy with Aetna. I was informed that had I gone to a non-preferred pharmacy, it would have cost me more, even with my Aetna insurance. Apparently every health insurance company has “preferred” and “non-preferred” pharmacies, just like they have “in network” and “out of network” healthcare providers and hospitals.

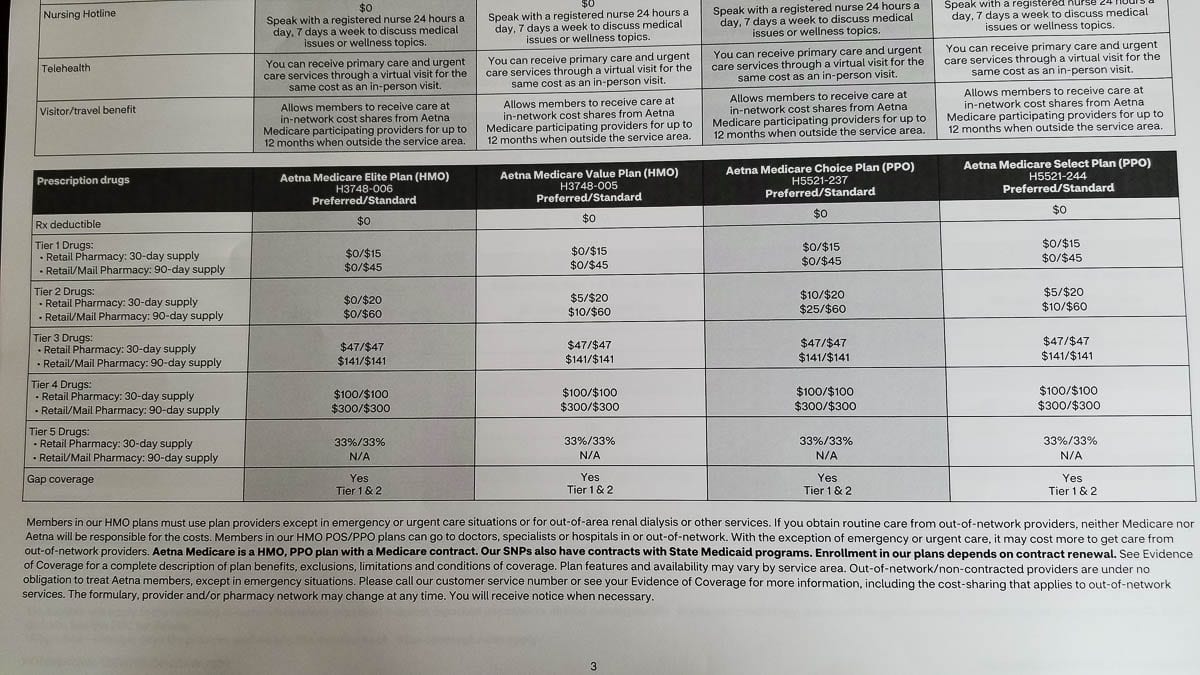

A Tier 1 medication would have cost me nothing. It was $5 for my Tier 2 medication. A Tier 3 medication is $47 and Tier 4 is $100 on my Aetna medicare insurance.

When shopping for health insurance, it pays to have a knowledgeable health insurance broker work with you. They should ask for your regular medications, so they can factor in the variations of costs to you, of the various insurance plans offered. There can be differences in which tier a drug is listed between insurance plans, and between insurance companies.

Your broker should also check to see if your regular healthcare providers and specialists are “in network.” And if you travel regularly, then make sure your regular destinations are covered as well for emergencies, etc.

Finally, make sure to check out which pharmacies are the “preferred” for your insurance company.

It’s always wise to ask your doctor if there is a generic drug available. Then do some online shopping as well. Sometimes online discount chains have saved me a lot of money, but this time my insurance at a “preferred” pharmacy was the best deal.

And for senior citizens living on a fixed income, keeping that $35 savings is very nice.