Rep. John Ley provides legislative update as he prepares to return to Olympia for the 2026 legislative session

Rep. John Ley

18th Legislative District

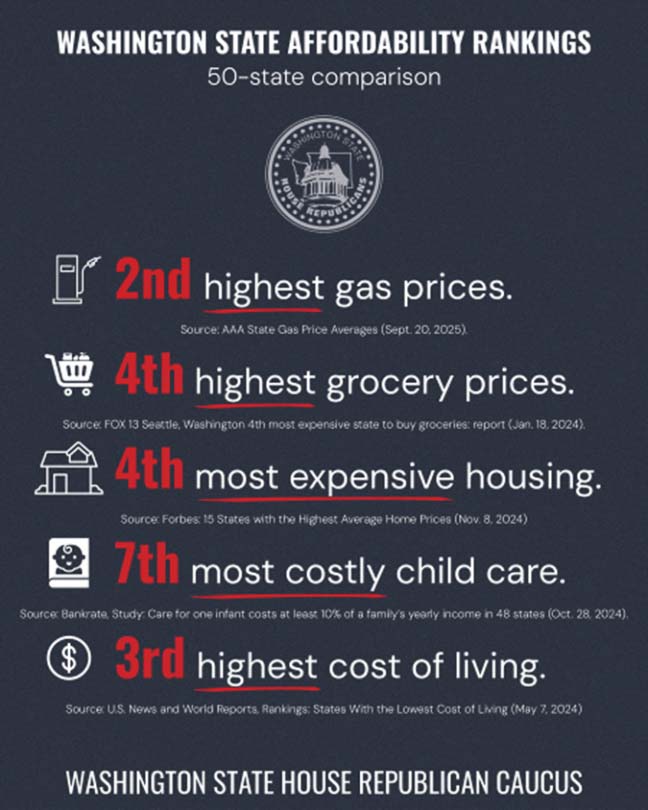

As I prepare to return to Olympia for the 2026 legislative session, I have been hearing your concerns. The primary issue for most people is the difficulty of making ends meet on their family budget. Property taxes, insurance, gas & diesel fuel costs, utility costs, healthcare, and so much more are on the top of your mind.

After passing the largest tax increases in state history last spring ($9.5 billion in General Fund taxes and $3.2 billion in transportation tax increases), the majority party overspent actual taxpayer revenues.

The majority party in the Legislature and the governor are now talking about creating an INCOME TAX to cover an estimated $4 billion shortfall. One Seattle representative is proposing a 5% income tax on earnings above $125,000. The governor’s proposal is a 9.9% tax on incomes above $1 million.

I remain firmly AGAINST increasing your tax burden and want to reduce it. The people gathered over 448,000 signatures on I-2111 two years ago to ban state and local income taxes. The legislature adopted it as law in 2024. The majority party now wants to ignore your will and silence your voice on this matter.

One recent study found that, since 2013, state spending increased 130%, whereas inflation was up just 32%, population up 14%, housing prices up 85%, and the state’s economy (GDP) grew 65%. Average wages rose 45%, while government spending grew 3 times faster. That’s just wrong.

The WA minimum wage increased to $17.13 from $16.66 – the highest in the nation. As an example, your “fair share” of taxes would have been $7,722 with inflation. You overpaid Washington state by $5,700 last year if you made $65,000. Click here to learn more.

Supplemental budgets

The Washington State Legislature’s 2026 session is a 60-day short session (January 12 to March 12), focused primarily on supplemental adjustments to the 2025–2027 biennial budget. Lawmakers face ongoing fiscal pressures from a projected multi-billion-dollar shortfall (estimates range from $2–4 billion or more over the near term, following a larger $12–16 billion gap addressed in 2025).

Top issues

- Budget Shortfall and Supplemental Adjustments – The dominant issues involve potential spending cuts, fund transfers, or limited new revenue to balance the books amid lagging tax collections and rising costs.

- New or Increased Taxes – Democrats are considering options like a payroll excise tax, income/wealth tax on high earners, or expansions of existing surcharges (e.g., on large tech companies) to generate revenue.

- Housing and Affordability – Addressing the cost of living, including rent stability, tenant protections, and housing supply, is highlighted as a top concern by both parties.

- Public Safety and Crime – Ongoing debates over policing, crime prevention, and related policies, building on prior sessions.

- Behavioral Health and Mental Health Services – Capacity issues, funding for treatment, and system improvements amid high demand.

- Education Funding – K–12 stability, special education, and potential protections against cuts; also, higher education access and financial aid.

- Energy and Climate Policy – Discussions around nuclear power development, clean energy siting, and adjustments to initiatives like the Climate Commitment Act.

- Healthcare Access and Costs – Including preventive services, workplace violence prevention in facilities, and insurance reforms.

- Workforce and Worker Protections – Issues like paid leave expansions, isolated worker safety, and labor standards.

- Transportation and Infrastructure – Supplemental funding tweaks, potentially tied to broader affordability and economic growth concerns.

These priorities reflect pre-session reporting, party statements, and pre-filed bills as of early 2026. The session’s short length and fiscal constraints will likely limit major new initiatives, emphasizing budget tweaks and targeted policies.

Daycare fraud in Washington?

Additionally, the massive daycare center scandal in Minnesota could be a widespread issue and affect many other states, including Washington, which has over 6,000 licensed facilities. Recent news reports indicate more than 500 “questionable” facilities. The Center Square recently reported that “daycare centers that receive hundreds of thousands in taxpayer subsidies did not appear to have any children when The Center Square visited the facilities this week.”

Legislation I’m working on in 2026

I have already introduced two new bills and co-sponsored several others. House Bill 2180 aims to protect youth sports programs from hiring convicted sexual predators, and House Bill 2226 would protect our small cities’ representation on the C-TRAN Board of Directors.

Additionally, bills from last session that I hope to move forward include:

House Bill 1559 would prohibit tolls on the Interstate Bridge.

House Bill 2030 would require a financial review of the Interstate Bridge Replacement Program.

House Bill 1869 would prohibit Washington taxpayers from funding the capital costs of Portland’s TriMet.

House Bill 1857 would allow small amounts of naturally occurring asbestos to be used in rocks and building foundations, to reduce the cost of new home/apartment construction.

I have also co-sponsored several bills to reverse the tax increases of last session. You can view the entire list of bills I have signed on to here.

Other issues of focus

Additionally, I am working hard with several legislators to get our Brockmann Campus mental health facility open. The state spent an estimated $42 million to build this 48-bed facility, but didn’t fund staff hiring to open it in the 2025 budget.

We have two firms willing to enter a public-private partnership that could have Brockmann open and treating patients in 2026, if the state is willing to engage. Several of us met with the governor’s staff and the DSHS Director last month. The governor’s office indicated a willingness to pursue this path to bring this much-needed facility online. The two firms will be submitting proposals early in 2026.

As always, it is a privilege to represent you in Olympia. Please don’t hesitate to reach out to my office at (360) 786-7812 or John.Ley@leg.wa.gov if we can be of assistance.

This independent analysis was created with Grok, an AI model from xAI. It is not written or edited by ClarkCountyToday.com and is provided to help readers evaluate the article’s sourcing and context.

Quick summary

In this opinion column and legislative update, 18th District Rep. John Ley criticizes majority‑party policies that he says have increased the cost of living through overspending and the potential for new taxes such as an income tax. He highlights a projected budget shortfall, outlines his priorities and sponsored bills for the 2026 legislative session, and discusses policy areas including mental‑health facility funding.

What Grok notices

- Lists Ley’s sponsored and co‑sponsored bills—such as HB 2180 on youth sports safety and proposals related to Interstate Bridge tolling—giving readers specific examples of his 2026 agenda.

- Explains the context of a short legislative session focused on supplemental budgets and suggests fiscal pressure is shaping what lawmakers can realistically accomplish.

- References Initiative 2111 (the voter‑approved measure banning an income tax) while arguing that an income‑tax push could still re‑emerge through policy proposals or future ballot efforts.

- Includes spending‑growth comparisons since 2013 and uses affordability examples to frame the argument that state policy choices are contributing to higher everyday costs.

- Flags several follow‑up angles—such as the status of pre‑filed bills and any investigations into daycare subsidies—that could help readers evaluate claims and track outcomes as the session progresses.

Questions worth asking

- If lawmakers pursue spending reductions or reallocations in the supplemental budget, which programs—such as K‑12 education, higher education, or behavioral health—would be most affected, and how?

- What alternatives to new taxes have been proposed for addressing the projected shortfall while maintaining existing service levels?

- Could public‑private partnerships or phased build‑outs accelerate opening projects like the Brockmann Campus, and what accountability measures would be used?

- How do Washington’s tax and spending trends compare with neighboring states that use different fiscal structures or revenue mixes?

- What measurable impacts have recent minimum‑wage increases had on small businesses, consumer prices, and employment patterns in Washington communities?

Research this topic more

- Washington State Legislature – bill texts and status tracking (including HB 2180, HB 2226, and related measures)

- Office of Financial Management – revenue forecasts, budget projections, and supplemental budget proposals

- Economic and Revenue Forecast Council – quarterly revenue updates and shortfall estimates

- Washington State House Republicans – caucus priorities and legislative updates

- Department of Social and Health Services – behavioral‑health facility plans and funding information

Also read:

- Former legislator and County Chair Eileen Quiring O’Brien announces candidacy for Clark County auditorFormer Clark County Chair Eileen Quiring O’Brien has announced her candidacy for county auditor following Greg Kimsey’s decision not to seek re-election.

- WA Democrats push for mid-decade redraw of congressional mapsWashington Democrats have introduced a constitutional amendment that would allow congressional redistricting outside the normal post-census cycle, drawing sharp partisan debate.

- County Council votes to increase sales tax for yet-to-be-finalized plan for affordable housingClark County Council approved a sales tax increase intended for housing-related uses despite concerns from one councilor that no final spending plan is in place.

- Opinion: Majority party policies still making life more expensive for WashingtoniansRep. John Ley outlines his opposition to new taxes, raises concerns about state spending, and details legislation he plans to pursue during the 2026 Washington legislative session.

- Fluoride fights bubble up around WashingtonCity councils across Washington are debating whether to remove fluoride from drinking water as dental and health experts cite long-standing evidence of its safety and benefits.