Vancouver lawmaker offered her about the so-called ‘wealth tax’ proposed today by Democrats in the Senate and House of Representatives

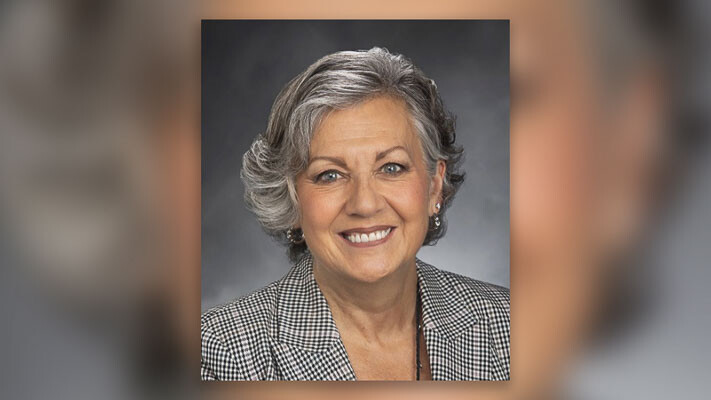

OLYMPIA – The budget leader for the state’s Senate Republicans isn’t buying the idea that Washington needs to slap another tax on residents who are financially successful. Sen. Lynda Wilson, R-Vancouver, offered these remarks about the so-called “wealth tax” proposed today by Democrats in the Senate and House of Representatives:

“On the surface this may have a Robin Hood kind of appeal, but that’s just not enough to make it a good idea. The sponsors know this is constitutionally questionable but are charging ahead anyway. It’s how the state income tax was adopted: push the tax through and cross your fingers that the judicial branch will ultimately come to your rescue. We need less legislating from the bench and more listening to the people.

“The ‘wealth tax’ didn’t make the list of tax options recently recommended to the Legislature by the bipartisan Tax Structure Work Group. You wonder why the Democratic chair of that work group decided to introduce the Senate version of this bill, even though her colleagues on the work group decided the idea wasn’t worth further consideration.

“State government has 6 billion dollars in reserve. Maintaining the programs and services in the current budget will cost 1.5 billion. A lot of good can be done with even a portion of what’s left. The Robin Hood angle falls apart completely when you see the revenue from this tax is aimed at growing government, with no promise of any real tax relief. And why talk about new taxes when the focus should be on using the existing revenue wisely?

“These bills repeat the Democrats’ myth that Washington has the most regressive tax system in the nation. Let’s keep in mind these Democrats just last year refused to join with Republicans on two pieces of progressive tax reform – one to lower the state sales tax, the second being my bill to offer a property-tax exemption that would have benefited owners of lower-value property more. At the same time they have created new laws that increase costs related to driving and energy, both of which hit lower-income people harder. If the Democrats truly want to help people at lower income levels, they should stop supporting regressive taxes and fees, and lower or eliminate the ones they’ve created. A ‘wealth tax’ doesn’t do any of that.”

Also read:

- A Christmas Message from Clark County TodayThis Christmas message from Clark County Today reflects on the Nativity and the birth of Jesus Christ.

- Vancouver hires former Los Angeles City Fire Department leader as its new fire chiefThe city of Vancouver has selected John L. Drake II, a former Los Angeles City Fire Department leader, to serve as its new fire chief beginning Dec. 29.

- Opinion: Hard work is being done to try to trade one bad health care system for anotherElizabeth New (Hovde) cautions that efforts to create a universal, taxpayer-financed health care system in Washington risk replacing existing problems with new challenges tied to cost, access, and centralized control.

- Play area at Hazel Dell Community Park closed January through March for installation of new play equipmentPlay areas at Hazel Dell Community Park will close from January through March for removal of old equipment and installation of new, community-selected play features.

- Opinion: The progressive attack on Washington’s sheriffsNancy Churchill argues that proposed legislation would shift power over county sheriffs away from voters and concentrate control within state government.

- Letter: Is Secretary of State Hobbs really JUST protecting your voter information?Camas resident Rick Vermeers questions the Washington secretary of state’s refusal to provide voter roll data to the U.S. Department of Justice and raises concerns about voter list transparency and compliance with federal law.

- VIDEO: WA GOP budget lead blasts Ferguson’s fiscal plan as ‘a complete joke’Republican lawmakers sharply criticized Gov. Bob Ferguson’s proposed 2026 supplemental budget, arguing it fails to meet Washington’s four-year balanced budget requirement and masks deeper fiscal problems.