Rep. John Ley provides his latest legislative update

Rep. John Ley

18th Legislative District

It is an honor to represent you in the state Legislature, and I want to thank you for taking the time to stay engaged with what is happening in Olympia. Your perspectives matter, and they help guide the work I do every day on your behalf. As the legislative session continues, my focus remains on working with my colleagues to advance practical, responsible solutions that make Washington a better and more affordable place to live.

Affordability remains a top concern I hear from families, seniors, and small business owners across our district. It continues to be a common theme in our news media as well.

House Republicans are working together on legislation aimed at lowering everyday costs – whether that means addressing housing supply and regulatory barriers, opposing tax increases that drive up the cost of living, supporting energy policies that keep utility bills in check, or ensuring state government spends responsibly. These efforts focus on helping people keep more of what they earn and on making it easier to live, work, and raise a family in Washington.

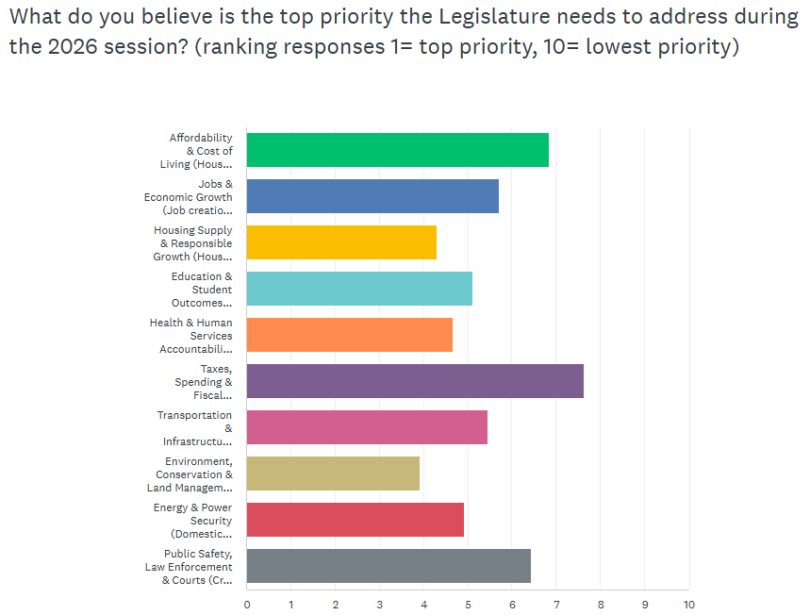

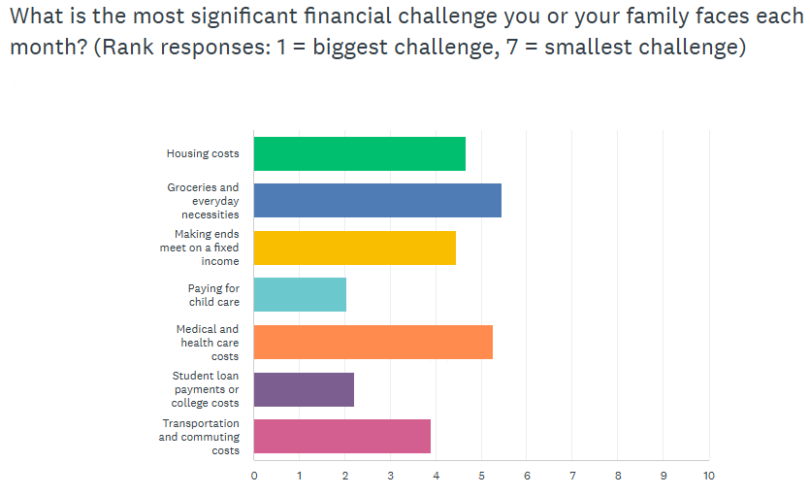

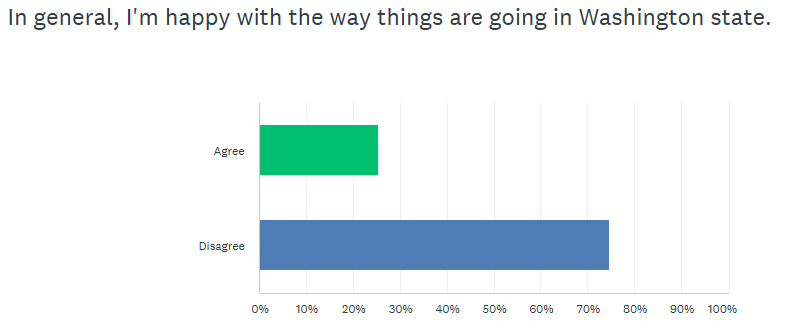

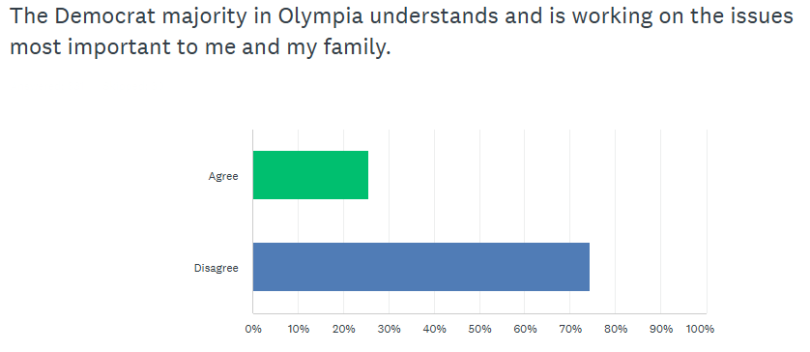

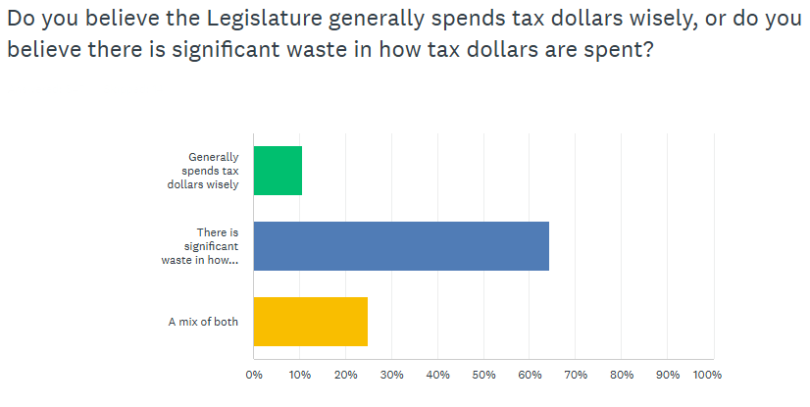

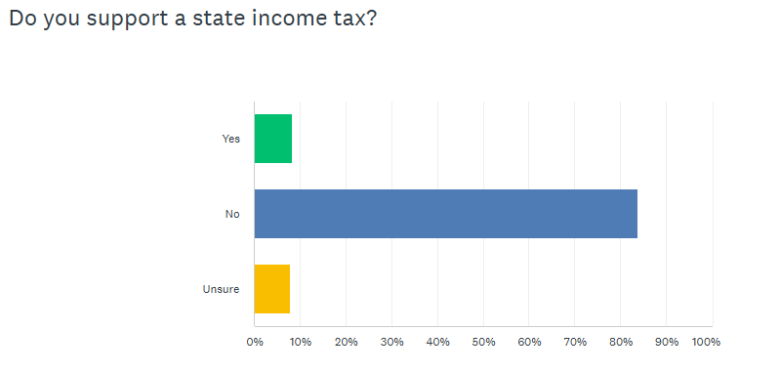

Earlier this session, Rep. Stephanie McClintock and I asked for your input through a legislative priorities survey, and I want to thank everyone who participated. The response was strong and clear. The results reinforced what we hear in conversations throughout the district: affordability, public safety, and government accountability are top priorities for the people we serve. Your feedback helps ensure that our work in Olympia stays focused on the issues that matter most to you. Here is an overall summary of your responses, and below you will find several graphs showing the results. You can also click here to see the graphs.

Summary of survey responses

1. Washington already taxes enough

- Many believe Washington is already one of the highest-taxed states when sales tax, property tax, gas tax, fees, and levies are combined.

- A state income tax is seen as “just another tax,” not a replacement.

- Strong skepticism that any existing taxes would be reduced if an income tax were adopted.

- Widespread belief that an income tax would start with “the wealthy” or “millionaires,” and eventually expand to middle- and working-class earners.

2. Distrust of government spending and accountability

- Repeated claim that the state has a spending problem, not a revenue problem.

- Perception of waste, fraud, abuse, and lack of transparency.

- People want lawmakers to prove they can manage current revenues responsibly before asking for more.

- Many explicitly say they do not trust Olympia to use income tax revenue wisely.

4. Cost-of-living pressures

- Commenters cite rising housing costs, groceries, gas, property taxes, and stagnant wages.

- Fixed-income seniors and families feel especially vulnerable.

- Many say Washingtonians cannot absorb another financial hit.

6. Mobility and outmigration concerns

- A significant number say no income tax is “why they moved to Washington, and implementing an income tax would push them to Idaho, Oregon, or other states

- Fear that high earners and businesses would leave, shrinking the tax base.

7. Wealth and inequality concerns

- Some argue the wealthy should pay more.

- Support is often for narrowly targeted taxes:

- High thresholds (e.g., $1.5M+ income)

- Investment or capital gains taxes

- However, even supporters often do not trust the legislature to implement this fairly.

In general, commenters believe a state income tax would increase costs and government spending, undermine voter intent, and ultimately place a burden on all Washingtonians without delivering meaningful improvements or greater transparency.

However, despite opposition from most Washingtonians, the majority party in Olympia introduced a bill this week to impose an income tax in Washington state, even though Washington voters have rejected similar unconstitutional income taxes 10 times. Here’s a summary of Senate Bill 6346:

- Levies a 9.9% rate on individuals with Washington taxable income over $1 million, which also captures many small businesses.

- Also applies to married couples who earn $1 million combined — not $1 million each.

- Projected to raise $4 billion per year.

- Amends the I-2111 law passed in Olympia in 2024 (Prohibition on Income Tax) to say the state income-tax prohibition does not apply to this act.

- Applies to income from public pensions (current law prohibits state and local taxation of such funds.)

- Begins in January 2028.

I am grateful for your input, and I will continue to show up in Olympia, offer thoughtful solutions, and fight for policies that strengthen our communities and make Washington a place where families can prosper today and well into the future.

Survey results

Thank you for your support

Thank you for allowing me the privilege of representing you in Olympia. Please stay engaged and continue reaching out to share your input.

It’s an honor to serve you!

Also read:

- Clark County Council Chair Sue Marshall will not seek reelectionSue Marshall announced she will not run for reelection to the Clark County Council, citing family, farm life, and other priorities as she completes her final 10 months in office.

- Opinion: The Democrats’ conduct was ‘downright disgusting and offensive’Ken Vance criticizes Democratic lawmakers for refusing to stand during a State of the Union pledge and calls their conduct “disgusting and offensive.”

- No cops hired so far with WA’s new $100M grant programWashington’s new $100 million police hiring grant program has not yet distributed funds, as local officials cite technical issues and bureaucratic hurdles

- Opinion: The upside-down world of Washington DemocratsNancy Churchill criticizes Washington Democrats over HB 2034, LEOFF 1 pension funds, and a proposed income tax, urging residents to oppose the bill ahead of a Feb. 26 hearing.

- Hockinson student joins Rep. Kevin Waters in Olympia to serve as a House pageHockinson Middle School student Ary’el Dutton served as a page in the Washington State House of Representatives in Olympia, sponsored by Rep. Kevin Waters.