Legislative update from Rep. John Ley

Rep. John Ley

18th Legislative District

I want to provide an update on Senate Bill 6346, the majority party’s proposal to establish a state income tax in Washington. This legislation would create a 9.9% tax on income earned above $1 million beginning in the calendar year 2028, including married couples whose combined income reaches that threshold. While it is being marketed as a “millionaires’ tax,” the structure would impact many small business owners who report business income on personal tax returns.

This proposal will hurt Washington

I explained more about this tax and how it will hurt Washingtonians in a recent video.

There are several reasons to oppose this tax proposal, including:

1. Opens the door to a broader income tax. Once a state establishes any income tax, it becomes easier to expand it to lower income brackets over time, fundamentally changing Washington’s tax structure.

2. Potential constitutional and legal risks. Washington has a long legal history treating income as property for tax purposes. Even though the bill amends statutory barriers, it could face costly litigation and uncertainty if challenged.

3. Risk of outmigration of high earners and investors. Many high-income individuals are likely to relocate to lower-tax states, reducing investment, entrepreneurship, and charitable giving within Washington.

4. Impact on small businesses and pass-through entities. Many small and mid-sized businesses report income on personal tax returns. A high-rate income tax could effectively raise taxes on business owners, discouraging expansion and hiring.

5. Revenue volatility. Taxes tied to high-income earners and capital-related income tend to fluctuate sharply during economic downturns, making budgeting less stable than broader tax bases.

6. Competitive disadvantage. Washington currently has no personal income tax. Adding one could weaken the state’s economic competitiveness.

7. Uncertain long-term economic effects. Higher marginal tax rates may discourage investment, innovation, and the creation of high-wage jobs, especially in sectors reliant on high-skilled labor and capital.

Tell the Legislature how you feel about this proposal

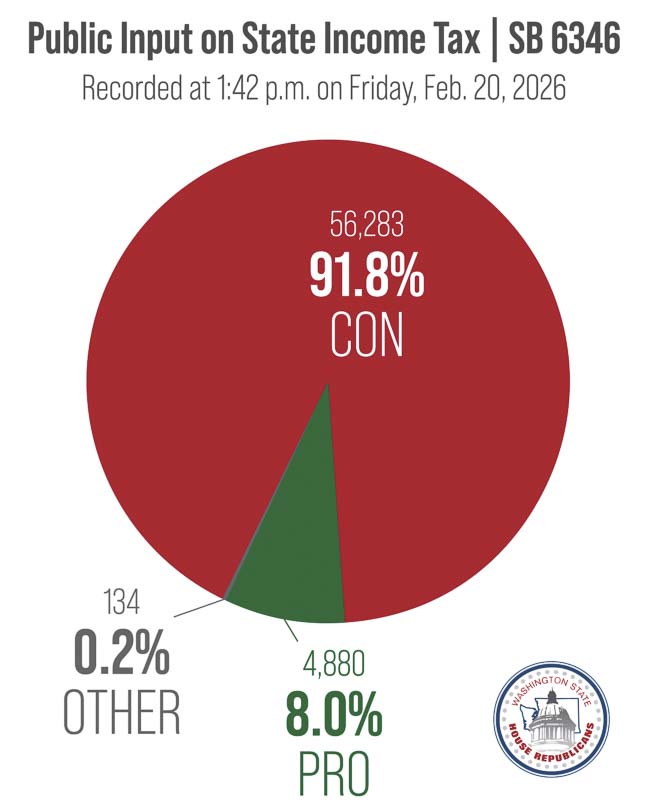

SB 6346 has passed the Senate, with only three Democrats joining all 19 Republicans in voting against the policy. The bill is scheduled for a public hearing before the House Finance Committee on Tuesday, February 24, at 8:00 a.m. I strongly encourage you to share your opinion and join the tens of thousands of people who have already done so, as you can see in the chart below.

There are several ways for you to participate. You can testify in person in Olympia, remotely via Zoom, or by signing in on the legislative website to register your position as “pro” or “con” without testifying. Use the links below to participate:

Register to testify in-person or remotely

Submit your position for the legislative record

Please get involved. This proposal is very concerning as it would make our state less competitive, threaten job growth, and open the door to broader income taxes in the future, at a time when families are already facing rising costs across the board.

I will continue fighting against policies that increase taxes and make Washington less affordable for everyone.

Also read:

- Opinion: Make your voice heard about the majority party’s state income tax proposalRep. John Ley outlines his opposition to Senate Bill 6346 and urges residents to participate in the February 24 public hearing before the House Finance Committee.

- Letter: County Council resolution ‘strong on rhetoric, weak on results’Peter Bracchi calls on the Clark County Council to withdraw its ICE-related resolution and replace it with a measurable public-safety plan.

- Trump vows new tariffs, criticizes Supreme Court justices after rulingPresident Donald Trump said he will pursue new tariffs under different authorities after the Supreme Court ruled he exceeded his power under IEEPA.

- Opinion: A loss at the Supreme CourtLars Larson reacts to a Supreme Court decision limiting President Trump’s tariff authority and outlines his view of its economic impact.

- Belkot reminds other Clark County Councilors that there is active litigationMichelle Belkot cited her active lawsuit against fellow councilors as the Clark County Council discussed potential changes to its Rules of Procedure.