Area resident and former County Councilor Dick Rylander offers information about the FVRL levy lid lift proposal

Dick Rylander

for Clark County Today

In an effort to get as much information as possible regarding the Fort Vancouver Regional Libraries (FVRL) levy increase I reached out to the Director Jennifer Giltrop. Following are the questions I posed along with her responses. Hopefully this helps voters make an informed decision on the August special ballot. https://www.fvrl.org/levy

Question: An increase from the current $0.27 per $1000 of assessed value to $0.50/$1000

Levy life data?

Can you provide data on your service changes since the last levy increase? How do you justify an 85% increase in the levy? A breakdown of services provided, attendance/usage; etc., since the last levy broke out by year. Ideally it would be over the past 10 years (by year).

Answer: FVRL, like all library districts in WA (RCW 27.12) is funded primarily by property taxes. Property taxes represent 96% of our revenue. As a junior taxing district, FVRL may not increase the total levy amount collected from current assessed valuation by more than 1% annually or the rate of inflation, whichever is lower. FVRL last sought a levy lid lift in August 2010, and received approval to restore funding back to $0.50/$1,000 of assessed value. On Aug., 5, 2010, FVRL again is asking voters to restore its levy rate back to $0.50/$1,000 of assessed value. In the fifteen years since the last levy lid lift was approved, inflation has risen by 43%. FVRL is operating at a $4.7 million budgeted deficit this year, with a projected $7.6 million deficit in 2026. In 2026, FVRL would not be able to sustain that level of deficit, and therefore a reduction in services will be necessary should the levy vote fail on August 5. You can learn more at: https://www.fvrl.org/levy

The Circulation (check out of both physical and electronic items) since the last levy lid lift follows:

Some additional questions and responses:

1. Should the levy lid fail will your revenue continue and if so at what rate per $1,000 and how many dollars does that represent?

Answer: FVRL will continue to levy taxes at the current rate, subject to end of year calculations that include the assessed values (including the 1% cap and new construction). We would anticipate the rate going down slightly based on the historical trends. The current rate is $0.2686/$1,000 of taxable assessed value.

2. Please share the last five years of revenue by year.

Response:

· 2020 $27,039,179

· 2021 $33,565,780*

· 2022 $28,639,814

· 2023 $29,158,235

· 2024 $33,220,314*

NOTE: *2021 and 2024 – FVRL received state construction grants that boosted revenue for the Ridgefield and Woodland buildings respectively.

3. Please provide the projected revenue, by year, for the next five years if the levy increase passes.

Response:

· 2026 $55,896,483

· 2027 $56,761,484

· 2028 $57,471,002

· 2029 $58,480,722

· 2030 $59,258,157

4. 85% increase – you didn’t answer the question. Are you saying inflation is up 43% since 2010 but you are asking for an 85% increase? (.27 vs .50)

Response: The answer provided in the earlier response describes the budget shortfall and why FVRL is on the ballot asking for the levy rate to be restored. FVRL is operating at a $4.7 million budgeted deficit this year, with a projected $7.6 million deficit in 2026. In 2026, FVRL would not be able to sustain that level of deficit, and therefore a reduction in services will be necessary should the levy vote fail on Aug. 5.

Between inflation and increased demand on services, and maintenance of our facilities, the Levy Lid Lift is essential for sustaining and growing with the District we serve. You can learn more at: https://www.fvrl.org/levy

It will cost FVRL an estimated $833,000 to be on the Aug. 5 ballot – that is the cost paid to the four counties directly for election costs. The average time between levy lid lift ballot proposals in the state is 4-5 years, it has been 15 years since FVRL has asked voters to restore the levy rate. It is estimated that this levy lid lift would last 10 years before the need to go back to the voters. Due to the cost of being on the ballot, FVRL attempts to spread the timeframe out as to reduce the expenses for being on the ballot.

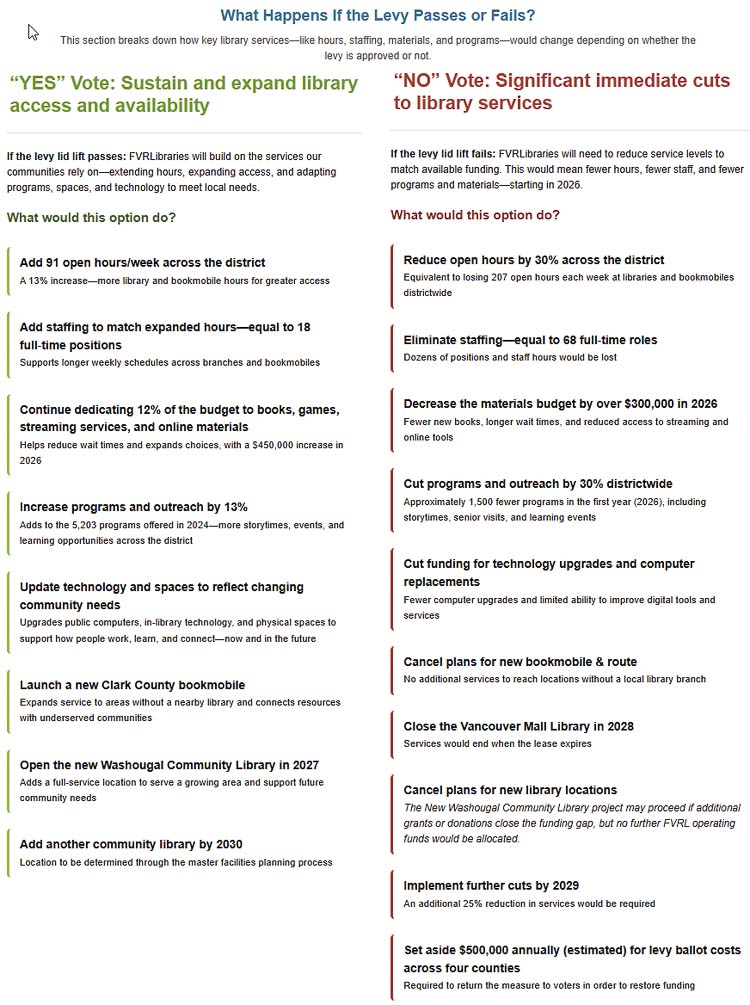

The details of service changes should the levy pass or fail are listed on our website at: https://www.fvrl.org/levy.

Website review

Review of the website raises several questions the public may have:

If approved, the levy would restore the rate to $0.50 per $1,000 of assessed value. For a home assessed at $400,000 (the 2024 district average), the total annual cost would be $200, or about $16.67 per month (this reflects the full amount the homeowner would pay in 2026).

Editorial comments

1) It appears the current “median” home value in Clark County is closer to $550,000. This means the annual tax would be about $275 or $22.91 per month

2) The Pass/Fail section of the website shows cut backs if the levy remains the same

3) Passing the lid lift increase spending, positions, etc. It’s either an expansion or meeting current and projected needs.

4) A NO vote would mean the existing rate ($0.27/$1000) would stay in place

You be the judge. Does it make sense to increase taxes or not?

Also read:

- Letter: The Missing Skamania Report – The prosecuting attorney is still sitting on itRob Anderson questions why an investigative report into potential County Charter and OPMA violations has not received an outside review after being declined by multiple offices.

- Opinion: Washington’s charter schools deliver – if the state lets themVicki Murray argues that Washington’s charter schools are posting stronger academic results than comparable peers while facing funding inequities that are shrinking the sector.

- Letter: IBR’s money pitBob Ortblad argues the Interstate Bridge Replacement Program is withholding a higher cost estimate while moving forward with limited funding and an unclear construction timeline.

- Opinion: Democrats side with Tehran while Trump defends AmericaLars Larson argues Democrats are aligning with Iran while President Trump acts against what he calls a national security threat.

- Letter: Facts over fictionBrian D. Kendall disputes claims about LEOFF 1 pensions and urges voters to focus on facts and democratic norms.