Todd Myers of the Washington Policy Center says that using forest fires to justify the CO2 tax is a smokescreen

Todd Myers

Washington Policy Center

In his editorial on Washington’s CO2 tax, Dr. Vin Gupta claims he likes “to go to the data to find the truth.” But he starts by saying something false.

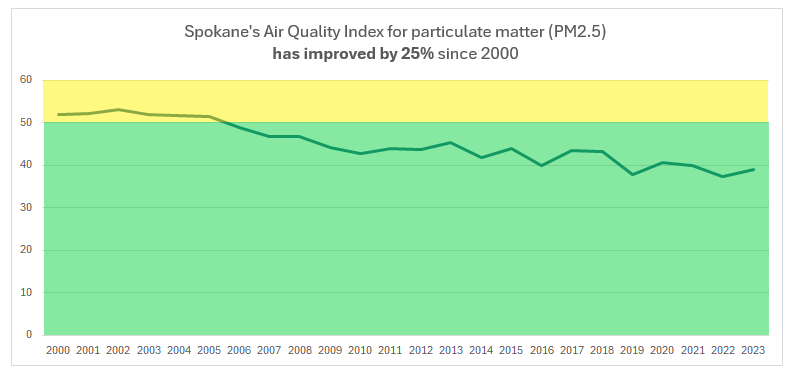

He claims Spokane has “declining air quality.” This is false. EPA data for Spokane County show that since 2000, average levels of particulate matter have fallen by more than 20% – from “moderate” to consistently “good.”

He clearly didn’t look at the data.

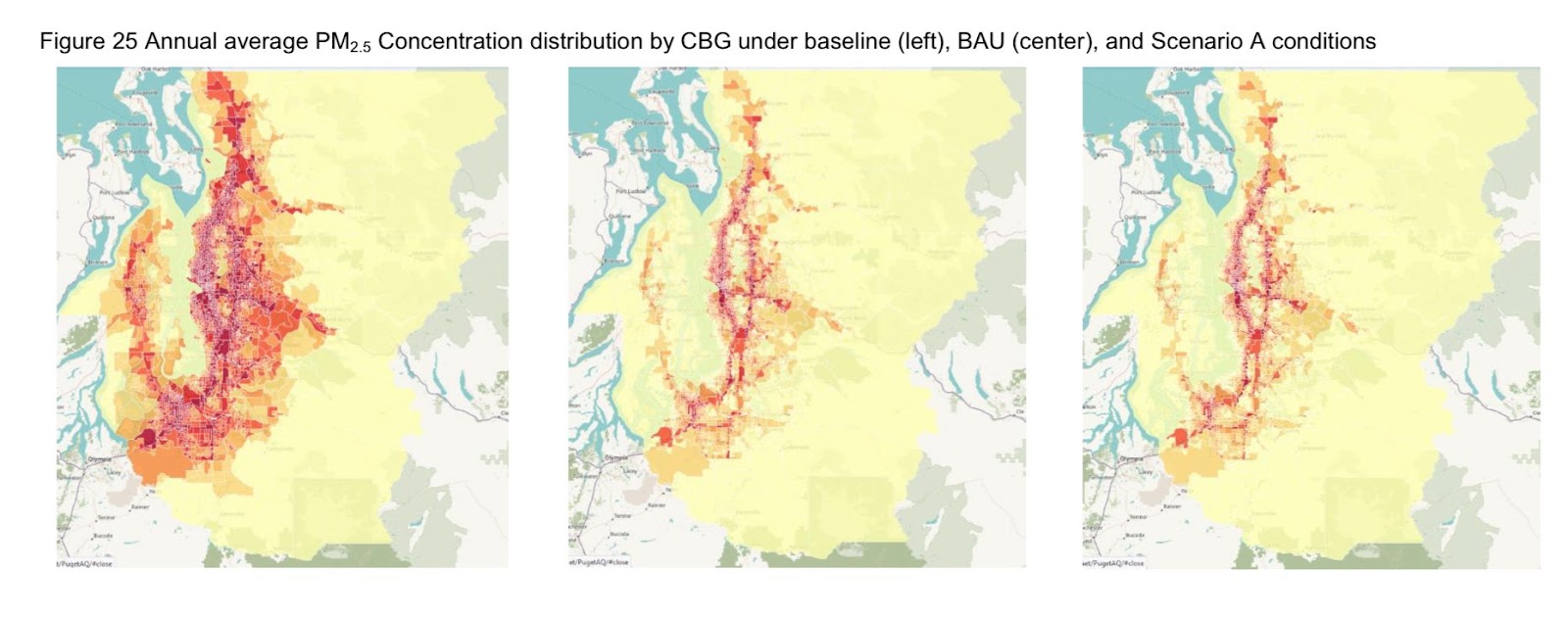

In fact, air quality will continue to improve without the CO2 tax. In 2019, the Puget Sound Clean Air Agency released a report on a proposal for a low-carbon fuel standard showing the impact of the policy on air quality. The study found that between 2019 and 2030 there would be a significant reduction in particulate matter (PM2.5) under the business as usual (BAU) scenario. This was two years before the Climate Commitment Act had been proposed.

Air quality will be better in 2030 with or without the CO2 tax.

Additionally, he says the CO2 tax would reduce the risk of smoke from catastrophic wildfire. Of the $3.2 billion from the CO2 tax, only $12 million – just 0.4% of the tax revenue – is budgeted to go to forest health. By way of comparison, more is spent on funding for government planning than forest health.

If preventing catastrophic wildfire was truly important, the legislature would have used more of the nearly $20 billion in new tax revenue the state received in the past four years.

Instead, the largest threat to projects that reduce the risk of wildfire are the very environmental groups supporting the CO2 tax. When the Colville Confederated Tribes worked with the Forest Service to thin unhealthy forests on their border, Spokane-based environmental groups immediately sued – preventing efforts to improve forest health and prevent catastrophic wildfires.

Using forest fires to justify the CO2 tax is a smokescreen.

Todd Myers is the vice president for research at the Washington Policy Center.

Also read:

- Opinion: WA House Finance Committee passes income tax billRyan Frost argues that ESSB 6346, which would impose a 9.9 percent income tax, advances to the House floor despite widespread opposition and ongoing budget growth.

- Opinion: A-pillars – The safety feature that increases crashesDoug Dahl explains how wider A-pillars designed to protect occupants in rollovers may also reduce visibility and increase crash risk for other road users.

- POLL: Will lawmakers’ actions at Tuesday’s State of the Union Address impact your voting in the upcoming mid-term election?Clark County Today’s latest poll asks voters whether lawmakers’ conduct during the State of the Union will influence their mid-term election decisions.

- Letter: Endorsement of Eileen Quiring O’Brien by retired Major General Gary MedvigyRetired Major General and former councilor Gary Medvigy outlines his reasons for endorsing Eileen Quiring O’Brien in the Clark County auditor race.

- Opinion: ‘Teachers and administrators who even SUSPECT child abuse must report to law enforcement’Lars Larson argues that school officials in Longview failed to follow mandatory reporting laws after allegations of rape at Mark Morris High School.