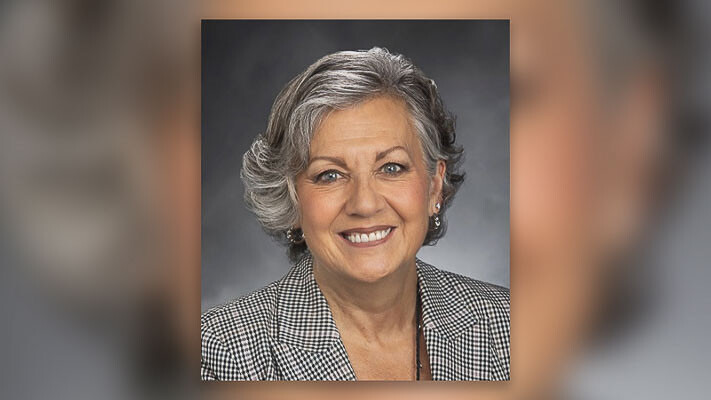

Sen. Lynda Wilson provides an assessment of state’s quarterly revenue forecast, which indicates the state government will end the 2021-23 fiscal cycle on July 1 with $335 million more than expected

VANCOUVER – The budget leader for Senate Republicans says today’s positive news about state revenue growth is offset by the continued rise in Washington gas prices and the added pain many Washington workers are about to feel from the state’s new payroll tax.

Sen. Lynda Wilson, R-Vancouver, is chair of the state Economic and Revenue Forecast Council, which met this morning to adopt the second of the state’s quarterly revenue forecasts for 2023. The forecast indicates the state government will end the 2021-23 fiscal cycle on July 1 with $335 million more than expected. The 2023-25 biennium, which begins Sunday, looks to be ahead by $287 million since the year’s first forecast in March.

Following the meeting she offered this assessment:

“While this is literally a positive forecast, I see a lot of reason to remain cautious. The predicted uptick seems to be driven more by estimated returns from the new capital-gains income tax, instead of normal economic activity. It was acknowledged today that the final capital-gains numbers may prompt a downward adjustment once they come in, a few months from now.

“Let’s remember also that revenue from income taxes is less predictable, and this tax was upheld by the court only recently. Going forward I would expect people will make more effort to reduce their exposure to it. That is especially true if members of the current majority keep looking to expand the capital-gains tax, as some have already proposed.

“My concern today is less about state government’s financial condition than the hardships being inflicted on families and employers of Washington because their state now has the highest gas prices in the nation. Anyone with the slightest grasp of economics had to know that forcing companies to buy ‘carbon allowances’ from the state would eventually hit consumers. Eight western Washington counties are averaging over $5 per gallon for unleaded regular today, according to AAA, and more are close to crossing the $5 line.

“On top of that, many Washington workers are about to lose money to a payroll deduction, for a state-run long-term care program that will benefit them relatively little if at all. After Saturday, this tax will mean even less take-home pay to put toward necessities like gasoline and other forms of energy, along with food and housing.

“Republicans keep calling attention to the affordability crisis in our state, but unfortunately we seem to be alone in wanting to offer even temporary tax relief that could ease the cost of living here. Instead, the people of Washington are getting another one-two punch courtesy of the Democrats and their government-first approach.”

Also read:

- $1B for WA broadband gets Trump administration approvalFederal approval unlocks over $1 billion to expand high-speed internet to unserved and underserved communities across Washington.

- WA passes legislation requiring no-cost insurance for state recommended vaccinesHouse Bill 2242 shifts the trigger for no-cost vaccine insurance coverage in Washington from federal recommendations to the state Department of Health.

- Opinion: WA House Finance Committee passes income tax billRyan Frost argues that ESSB 6346, which would impose a 9.9 percent income tax, advances to the House floor despite widespread opposition and ongoing budget growth.

- Journey Theater presents Mary PoppinsJourney Theater will stage six performances of Mary Poppins at Fort Vancouver High School beginning March 6, featuring a cast of local youth performers.

- Opinion: A-pillars – The safety feature that increases crashesDoug Dahl explains how wider A-pillars designed to protect occupants in rollovers may also reduce visibility and increase crash risk for other road users.

- Area cat rescue to host ‘Hisses Get Kisses’ online auctionFurry Friends will host its sixth annual online auction March 23–29 to help fund more than 900 projected spay and neuter surgeries and ongoing medical care for cats in Clark County.

- POLL: Will lawmakers’ actions at Tuesday’s State of the Union Address impact your voting in the upcoming mid-term election?Clark County Today’s latest poll asks voters whether lawmakers’ conduct during the State of the Union will influence their mid-term election decisions.